The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Dale/Peregrine Minerals Fund LP retained RedOaks Energy Advisors as its exclusive adviser in connection with the sale of its multibasin royalty properties.

Highlights

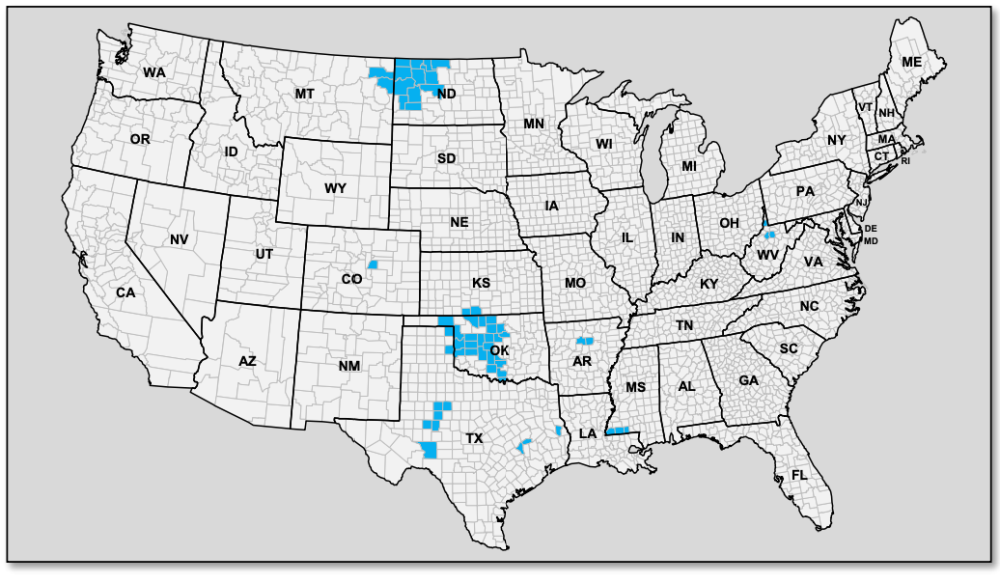

- 7,132 Net Royalty Acres across premier oil and gas basins

- Significant near-term development: 35 DUCs | 147 Permits

- Projected next 12-month cash flow: $975,000

- 2,033 Horizontal and Vertical PDPs

- Primary operators: Hess, Whiting Petroleum and Continental Resources

Bids are due Nov. 9. The transaction is expected to have a Nov. 1 effective date.

A virtual data room is available. For information visit redoaksenergyadvisors.com or contact Will McDonald, associate of RedOaks, at Will.McDonald@redoaksadvisors.com or 214-727-4996.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.