The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

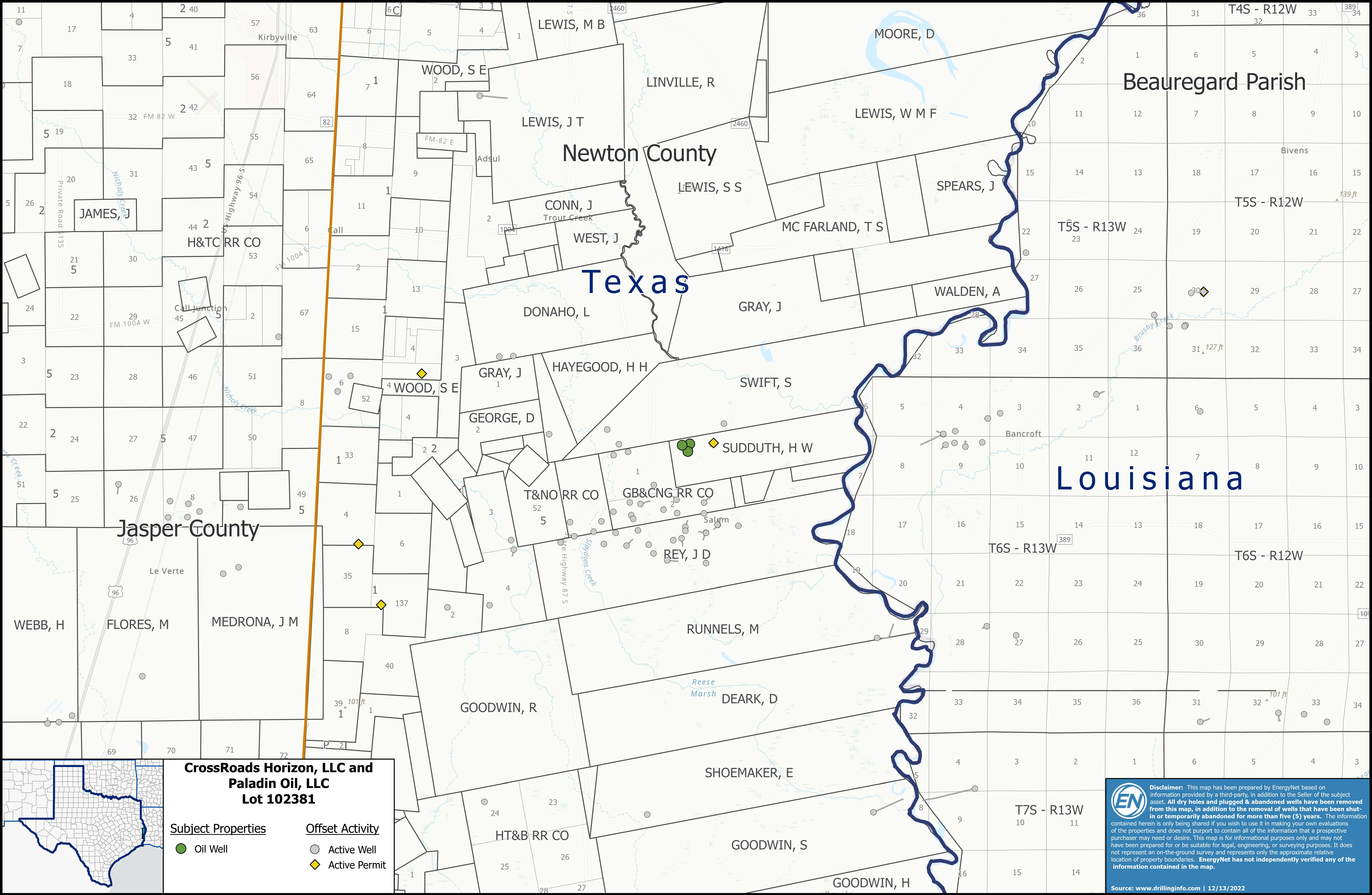

CrossRoads Horizon LLC and Paladin Oil LLC retained EnergyNet for the sale of a non-operated working interest in the J. H. Kurth Jr. B-lease wells located in Newton County, Texas. The Lot# 102381 includes six-month average net production of 4 bbl/d and 542 MMcf/d operated by Foundation Energy Management LLC.

Opportunity highlights:

- Non-Operated Working Interest in the J. H. Kurth Jr. -B- Lease (3 Wells):

- 0.50% WI / 0.36% NRI

- 6-Month Average Net Income: $9,985/Month

- 6-Month Average 8/8ths Production: 977 BOPD and 541 MCFPD

- 6-Month Average Net Production: 4 BOPD and 2 MCFPD

- Operator: Foundation Energy Management, LLC

Bids are due at 2:05 p.m. CDT on Feb. 15. For complete due diligence information, please visit energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com.

Recommended Reading

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Chevron Adds to Carbon Capture Tech Portfolio with ION Investment

2024-04-04 - Chevron New Energies led a funding round that raised $45 million in Series A financing for ION Clean Energy, according to a news release.

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.