The following information is provided by PetroDivest Advisors. All inquiries on the following listings should be directed to PetroDivest Advisors. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

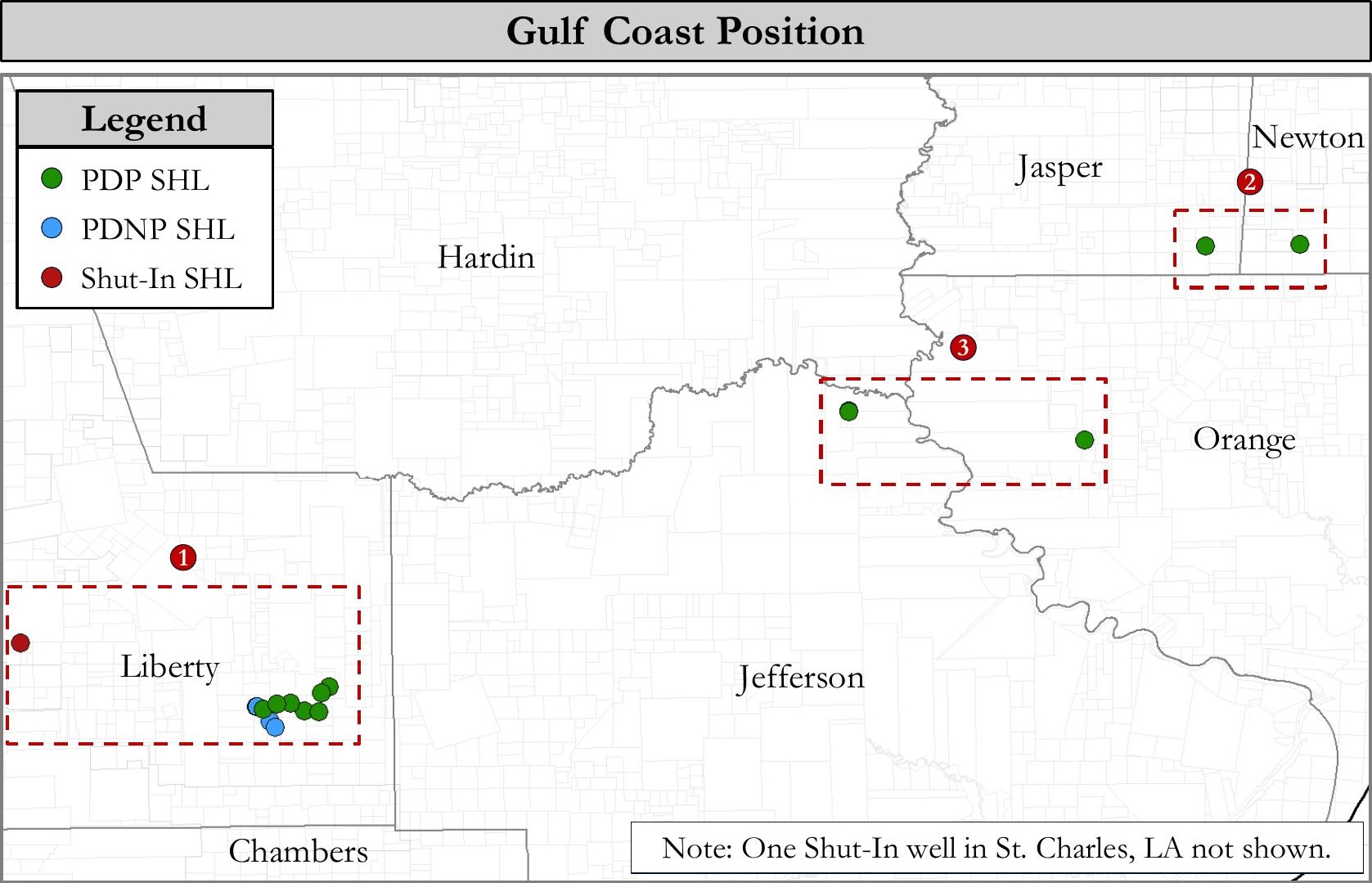

Costa Energy (Costa) is offering for sale its operated oil and gas leasehold, producing properties and related assets located primarily along the Texas Gulf Coast. The lot includes a conventional Gulf Coast gas-weighted production offer of $1.5 million in the next 12 months, in addition to approximately 2,500 net acres as well as low-cost behind-pipe and other conventional opportunities. Costa Energy has retained PetroDivest Advisors as its exclusive advisor relating to the transaction.

Asset Highlights:

- Gas Weighted Net Production (1.1 MMcfed | 79% Gas)

- Conventional Gulf Coast gas-weighted production offers $1.5 million in next-twelve-month operating cash flow

- Produces from multiple intervals of Yegua, Cook Mountain, and other conventional targets

- Current contango gas strip pricing sustains cash flow over 5 years

- $7.4MM PDP PV10

- Low lifting costs ensures positive cash flow and asset resiliency in any price environment

- LTM Average Lifting Cost: $0.78/Mcfe

- Conventional Gulf Coast gas-weighted production offers $1.5 million in next-twelve-month operating cash flow

- ~2,500 Net Acres | 100% Held By Production

- Legacy assets, fully HBP with well-established production histories, offer long-term optionality on future development

- 14 active producing wells

- 24 total wellbores

- 68.7% average WI & 51.4% average NRI

- Premium differentials for Gulf Coast assets with optionality and access to coastal LNG and marketing

- Legacy assets, fully HBP with well-established production histories, offer long-term optionality on future development

- Low-Cost Behind-Pipe & Conventional Opportunities

- Two highly economic Liberty County vertical infill locations

- 4.4 Bcfe of additional net reserves (94% gas)

- Low D&C cost of $2.3MM/well

- Seven stacked-pay behind-pipe opportunities provide additional reserves and asset production maintenance

- PDNP+PUD PV10: $17.3MM

- Grand Total PV10: $24.7MM

- Two highly economic Liberty County vertical infill locations

Bids are due on June 7. For complete due diligence information on this property, please visit http://www.petrodivest.com/ or contact Linda Fair.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.