The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

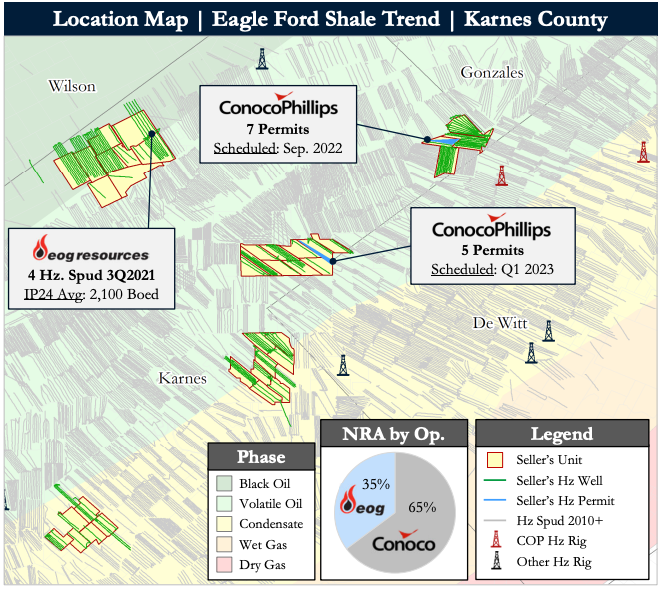

FKO Enterprises, FRJK Legacy Family and RMK Trust have retained Detring Energy Advisors to market for sale certain of their oil and gas fee mineral interests in the Karnes Trough of the Eagle Ford Shale.

The assets offer an attractive opportunity to acquire about 1,475 net royalty acres (100% minerals) consolidated under top regional operators ConocoPhillips and EOG Resources with an interest in 160-plus horizontal PDP wells and 19 near-term development wells generating $8.6 million in next 12-month cash flow, according to Detring. The firm added that the package includes an additional 220-plus undeveloped locations across the highly economic Lower Eagle Ford, Upper Eagle Ford and Austin Chalk formations, which are actively being developed by ConocoPhillips, EOG and other regional operators.

Highlights:

- High-Royalty Interest Mineral Position | ~1,475 Net Royalty Acres | 1.2% Average Royalty Interest

- Unique opportunity to acquire a multi-generational, family-owned asset (fee simple mineral estate) in the prolific core of the Karnes Trough

- Footprint spans ~40 drilling units

- 100% operated by two well capitalized, top in-basin operators who continue to dedicate substantial capital to the region

- Net Royalty Acres split 65% ConocoPhillips and 35% EOG

- Unique opportunity to acquire a multi-generational, family-owned asset (fee simple mineral estate) in the prolific core of the Karnes Trough

- Significant Cash Flow | $8.6 Million Next 12 Months

- Strong PDP cash flow generated from liquids-rich production (210 boe/d) across 160-plus horizontal wells ($4 million NTM)

- Meaningful additional cash flow generated by 19 near-term development wells ($4 million-plus NTM)

- 12 permits plus seven operator-planned wells

- Cumulative five-year and total undiscounted cash flow of roughly $40 million and $120 million, respectively (3P)

- Highly Economic Inventory | Eagle Ford and Austin Chalk

- Over 220 remaining horizontal undeveloped locations across the Lower Eagle Ford, Upper Eagle Ford and Austin Chalk

- Performance: All zones generate initial rates >2,000 boe/d and payout in about three months (net to operator)

- Net 3P Reserves: 2.6 MMboe (83% liquids)

- Net 3P PV-10: ~$60 million

- ConocoPhillips and EOG are each currently operating 5 rigs in the Eagle Ford

- Over 220 remaining horizontal undeveloped locations across the Lower Eagle Ford, Upper Eagle Ford and Austin Chalk

Process Summary:

- Evaluation materials available via the Virtual Data Room on May 23

- Bids are due on June 22

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.