The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

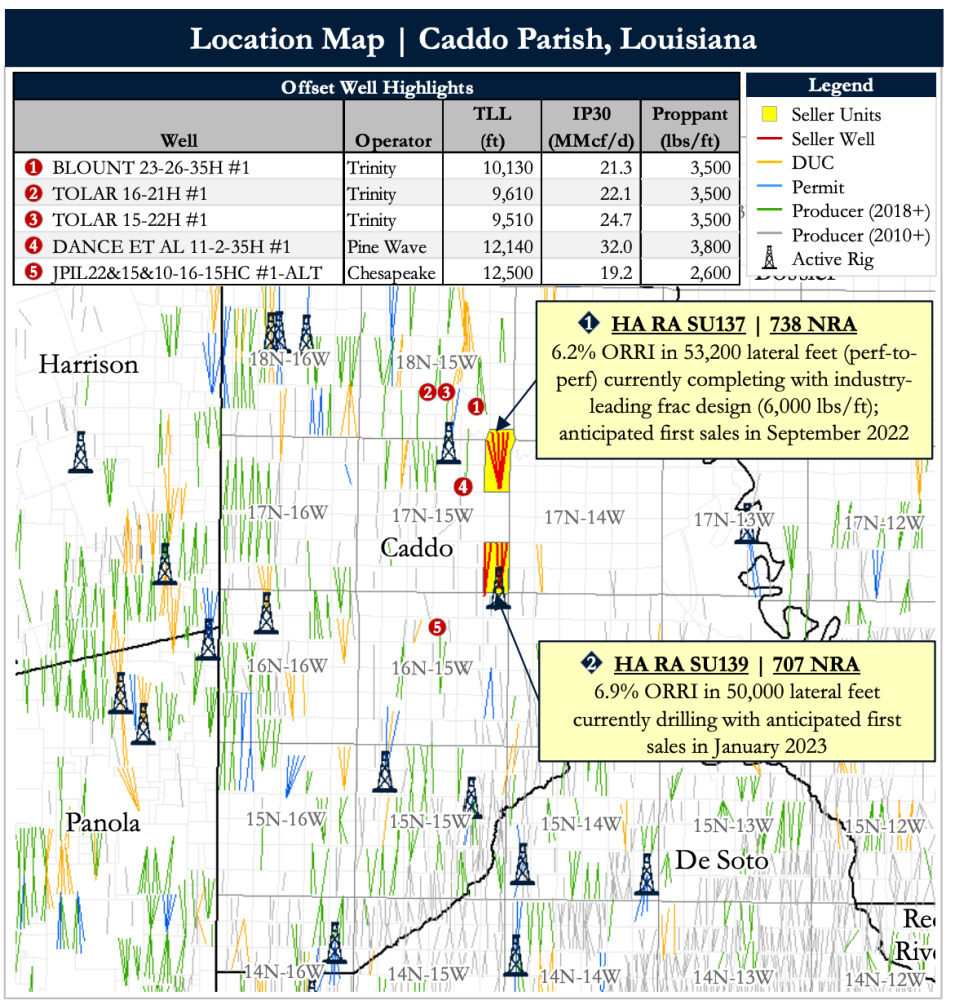

A private seller retained Detring Energy Advisors to market for sale its overriding royalty interests (ORRI) located in Caddo Parish, Louisiana.

The assets include 1,445 net royalty acres concentrated in two units under active development in the core of the Haynesville. Operated by Paloma Natural Gas (PNG), the assets deliver $18 million in next 12-month cash flow from 10 high-interest locations, including five DUCs in various stages of completion and five wells currently being drilled.

Asset Highlights:

- High-Interest Royalty Units

- Unique opportunity to acquire concentrated ORRI in two core units with imminent production

- 1,445 NRA

- 6.6% average ORRI

- 100% operated by PNG

- Unique opportunity to acquire concentrated ORRI in two core units with imminent production

- Rapid Return on Investment

- $18 million next 12-month Cash Flow

- ~103,000 ft gross treated lateral (~7,000 ft net) with anticipated first sales in September 2022; fully online by January 2023

- PV-10: $40 million

- Net Reserves: 14.7 Bcf

- Cumulative three-year and total undiscounted cash flow of $33 million and $47 million, respectively

- World-Class Resource and Leading-Edge Completions

- Prolific type curve supported by recent offset completions with 2.2+ Bcf/1,000 ft gross EURs

- PNG is an experienced Haynesville operator with a track record of top-tier well performance

- Currently running four rigs and completing wells with 100+ stages and 6,000 lb/ft

- Proximity to Gulf Coast / LNG export ensures premium pricing

Process Summary:

- Evaluation materials are available via the Virtual Data Room on July 25

- Proposals are due on Aug. 24

For information visit detring.com or contact Matt Loewenstein at matt@detring.com or 713-595-1003.

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.