The following information is provided by Stephens Inc. All inquiries on the following listings should be directed to Stephens. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

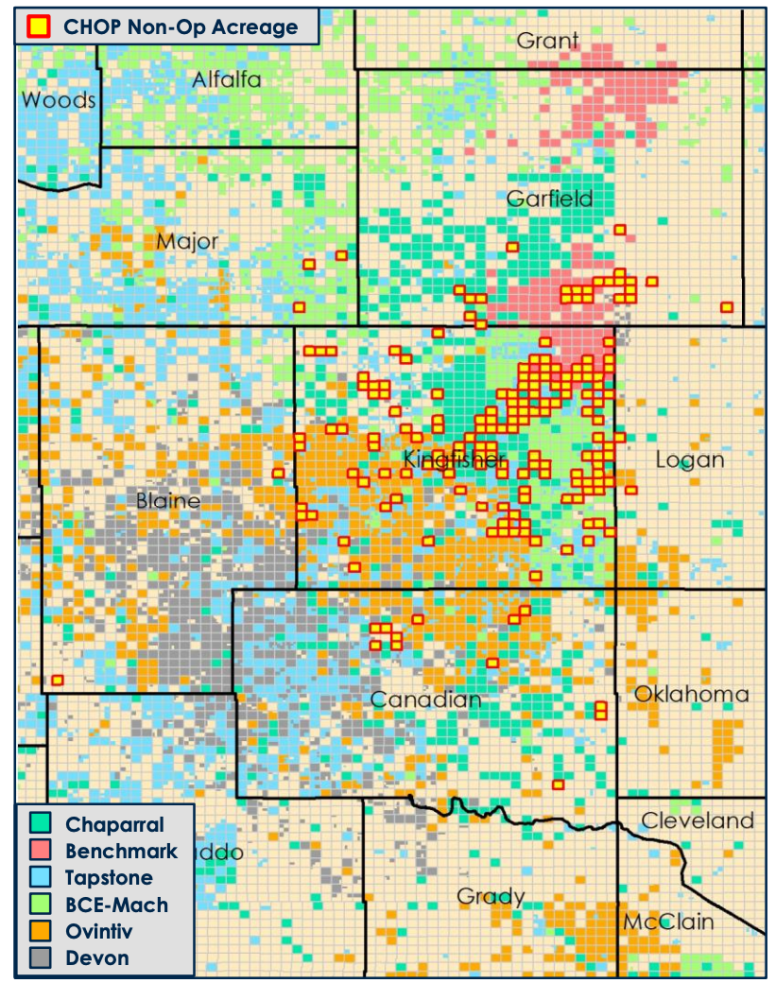

Chisholm Oil & Gas LLC retained Stephens Inc. for the sale of a nonoperated opportunity in the STACK play of Oklahoma. The offering comprises a blocky noon position across Oklahoma’s Blaine, Canadian, Garfield, Kingfisher, Logan and Major counties with predictable cash flow and strong operation partners, according to Stephens.

Highlights:

- Approximately 15,000 nonop net acres with strong operator partners focused on the region including Mach Resources, Tapstone Energy, Ovintiv and Chaparral Energy

- 100% of asset is HBP

- 83% of acreage is located in Kingfisher County, the core of the STACK play

- Net production of 1,079 boe/d (60% Liquids) as of October 2021

- Mature PDP assets with predictable cash flow (~12% average annual decline) over next 72 months

- Significant cash flow can organically fund meaningful cash yield or future AFEs; expected NTM1 PDP net cash flow of $9.4 million

- Tangible Mississippian, Woodford and Oswego upside with 168, 29 and 23 gross locations respectively with potential for over 4 million boe gross EUR

- Currently seven rigs are running offsetting the asset footprint; four in Kingfisher, Oklahoma

Purchase-offers are requested by mid-November. The proposed effective date of the transaction is Oct. 1.

A virtual data room is available. For information visit stephens.com or contact Charlie Lapeyre, Stephens managing director and co-head of A&D, at Charlie.Lapeyre@stephens.com or 214-258-2784.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

Murphy Oil Names Eric Hambly as President, COO

2024-02-08 - Murphy Oil has promoted Eric M. Hambly to president and COO and E. Ted Botner to executive vice president. Both will continue to report to CEO Roger W. Jenkins.