The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

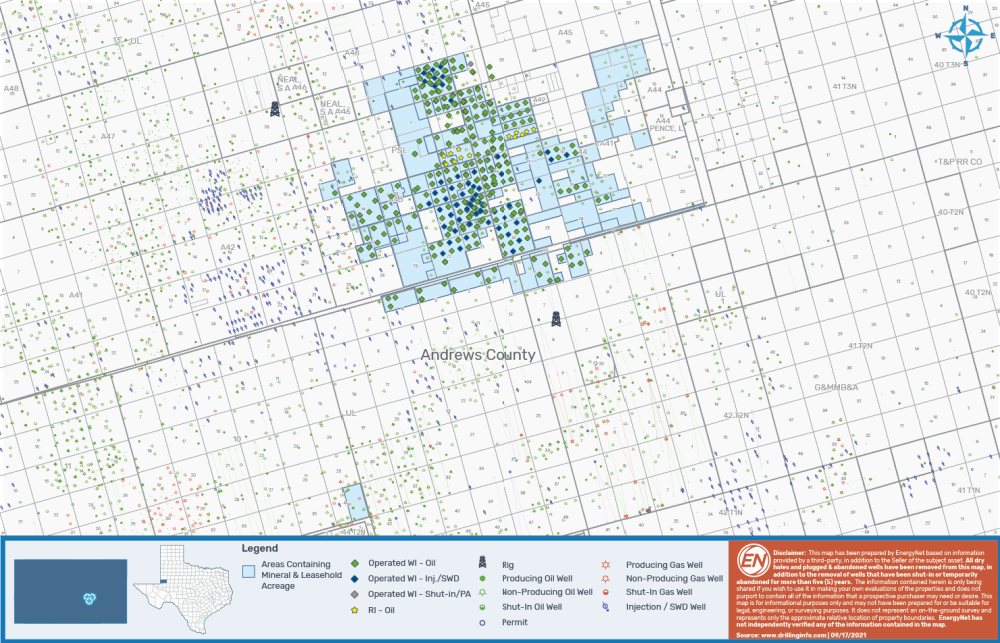

Chevron U.S.A. Inc. and Chevron MidContinent LP retained EnergyNet Indigo as the exclusive adviser for the sale of a conventional Permian oil position in Andrews County, Texas, in a sealed-bid offering closing Oct. 28.

The offering includes a legacy operated asset position covering roughly 13,705 net acres plus royalty interest, HBP leasehold and mineral fee in the Andrews/Parker Field.

Highlights:

- Legacy Operated Assets with Additional Royalty Interest within the Andrews/Parker Field in Andrews County, Texas:

- 93 Operated Producing Wells with an Average Ownership of ~98% Working Interest and ~87% Net Revenue Interest

- Producing from the Grayburg, Pennsylvanian, San Andres, and Wolfcamp Formations

- 31 Injection Wells

- Nine Royalty Wells with an Average Ownership of ~5%

- Stable Net Production of ~488 boe/d (~81% Oil) Last 12-month Average

- Field Average Annual Decline of ~3%

- Last 12-month Average Net Cash Flow of ~$168,000/month

- ~15,860 Gross (~13,705 Net) Acres

Bids are due at 4 p.m. CDT on Oct. 28. The effective date of sale is Oct. 1.

For complete due diligence information visit indigo.energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.

Sapura Acquires Exail Rovins’ Nano Inertial Navigation System

2024-02-01 - Exail Rovins’ Nano Inertial Navigation System is designed to enhance Sapura’s subsea installment capabilities.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

TGS Commences Multiclient 3D Seismic Project Offshore Malaysia

2024-04-03 - TGS said the Ramform Sovereign survey vessel was dispatched to the Penyu Basin in March.

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.