The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Carr Resources Inc. retained Detring Energy Advisors to market for sale its operated oil and gas leasehold located in the Eastern Shelf of the Permian Basin in Scurry County, Texas.

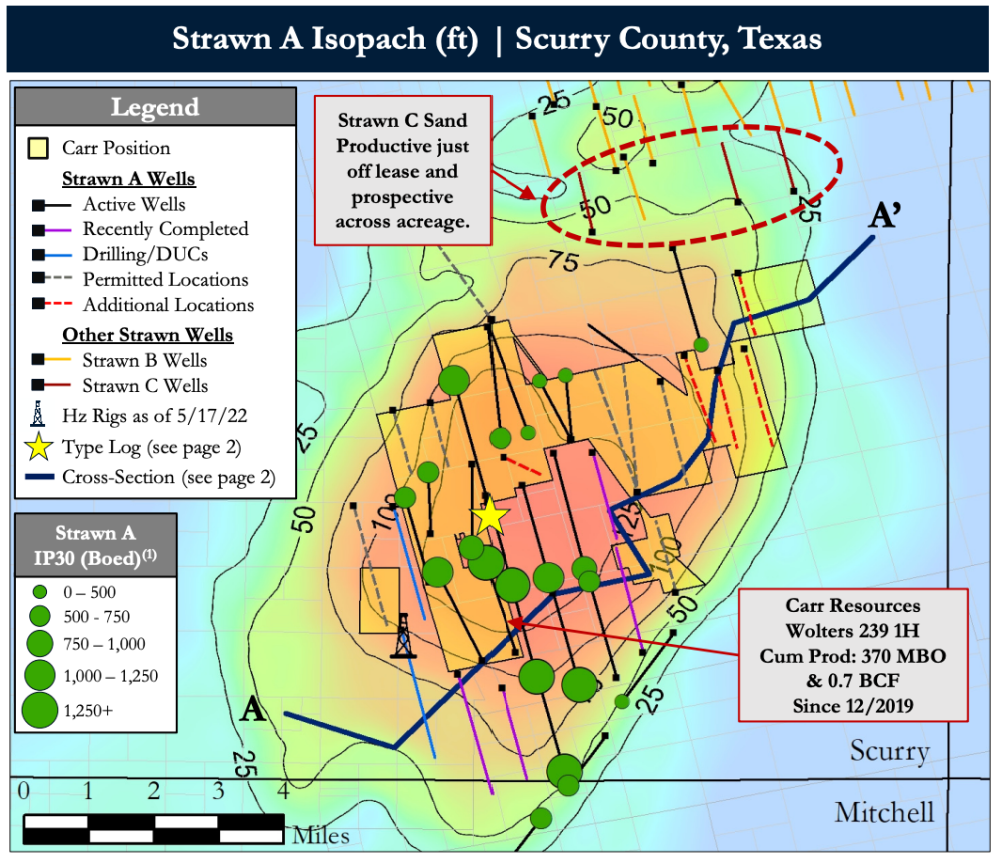

The assets offer an attractive opportunity to acquire a concentrated roughly 7,600 net acre position and 100% working interest in 10 horizontal wells producing from the Strawn formation, according to Detring. Current liquids-rich production is about 2,100 boe/d with significant, high-margin net cash flow of $33 million next 12-month (PDP-only) and 12 highly economic development locations including seven permits self-funded through operating cash flow, the firm added.

Highlights:

- Robust Production and Cash Flow | 2,100 boe/d | $33 million next 12-month cash flow

- Substantial liquids-rich PDP production and cash flow from 10 horizontal Strawn wells

- PDP Net Reserves: 3.1 MMboe (85% liquids)

- PDP PV-10: ~$75 million

- Blended hydrocarbon production profile comprised of ~60% oil, ~25% NGL and ~15% gas

- Rich gas stream generates an NGL yield >170 Bbl/MMcf

- Low cost, high-margin production

- Last 12-month lifting cost ~$6/boe

- Substantial liquids-rich PDP production and cash flow from 10 horizontal Strawn wells

- Large Operated, Contiguous, Land Position

- 7,600 net acres concentrated in southeast Scurry County on the Eastern Shelf of the Permian Basin

- 100% working interest | 75% net revenue interest

- Implementing field-wide saltwater disposal system

- Actively permitting new saltwater disposal well and ROW for gathering lines

- Projecting 75% reduction to current saltwater disposal costs

- 7,600 net acres concentrated in southeast Scurry County on the Eastern Shelf of the Permian Basin

- De-Risked Horizontal Strawn Development Locations

- 12 low-risk PUDs identified including seven current permits

- Three operated wells planned for second-half 2022

- Highly economic type curve at only $5.7 million D&C (7,500 ft)

- IP30: 625 boe/d | EUR: 625 Mboe

- ROI: 2.5x+ | Payout: 0.75 years

- Material upside value:

- 3P Net Reserves: 6.5 MMboe (85% liquids)

- 3P PV-10: ~$120 million

- 12 low-risk PUDs identified including seven current permits

- Highly Active Horizontal Development Play

- The assets are ideally positioned across the thickest portions of the prolific Strawn A

- The Lower Strawn C sand is productive just to the north of the properties and is prospective across the acreage, providing additional upside

- Carr and multiple offsetting operators continue to devote substantial capital to the region, with annual spuds increasing from ~10-20/year in 2018-2020 to ~60/year currently

Process Summary:

- Evaluation materials available via the Virtual Data Room on June 6

- Bids are due on July 13

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.

Shipping Traffic Freezes Up in Port Waters After Baltimore Bridge Collapse

2024-03-26 - U.S. port of Baltimore traffic was suspended until further notice following a bridge collapse. At least 13 vessels expected to load coal were anchored near the port at the time of the incident.

NextDecade Targets Second Half of 2024 for Phase 2 FID at Rio Grande LNG

2024-03-13 - NextDecade updated its progress on Phase 1 of the Rio Grande LNG facility and said it is targeting a final investment decision on two additional trains in the second half of 2024.

New Fortress Starts Barcarena LNG Terminal Operations in Brazil

2024-03-01 - New Fortress’ facility consists of an offshore terminal and an FSRU that will supply LNG to several customers.