The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

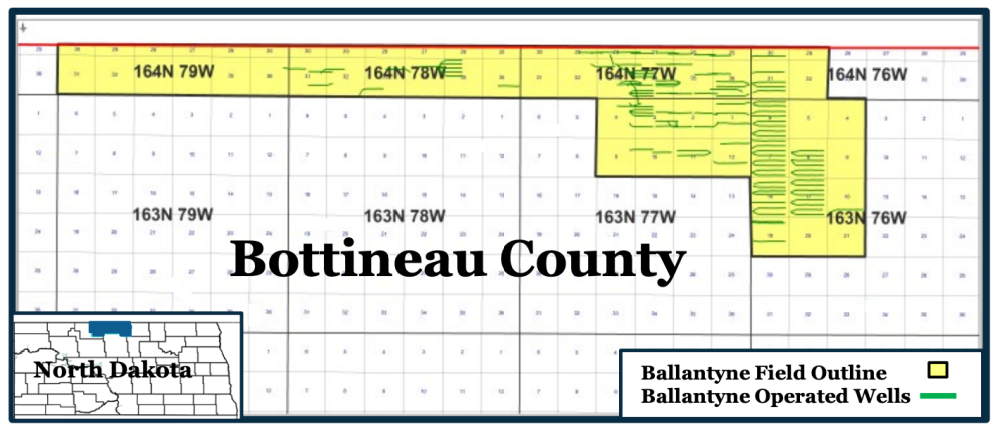

Eagle River Energy Advisors LLC has been exclusively retained by Ballantyne Oil LLC to divest certain operated working interest assets in Bottineau County, North Dakota.

The assets provide the opportunity to acquire a 100% oil-weighted production stream of 428 net boe/d. Additionally, this package has stable production with an average well age of 9.7 years over 103 PDP wells, with over 100 potential PUD locations being economic in current price environment. Lastly, this asset has a PDP PV-10 Value of $23.6 million as well as a next 12-month (June 2022-May 2023) net cash flow of $8.7 million.

Highlights:

- Diversified Shallow Decline Oil Production

- Production of 428 net boe/d (100% oil)

- Well seasoned production with avg. well age of 9.7 years

- High operational control asset with 94.0% Average Working Interest

- 103 PDP wells (102 HZ Spearfish)

- Shallow forecasted decline rate of ~14%

- Highly Profitable Asset

- Low operating costs of $25.95/BO (2021 Average)

- Last 12-month net cash flow = $5.4 million

- Next 12-month net cash flow = $8.7 million

- PDP PV-10 = $23.6 million; PDP PV-20 = $19.3 million

- Potential Upside

- Cleanouts and stimulations have shown consistent production uplift of 2X+, seven other candidate wells identified

- Waterflood injection pilot has shown promising results and potential for upscaling

- as high as 2X incremental production uplift observed in offset wells

- Over 100 potential PUD locations are highly economic in current price environment

Bids for the Ballantyne Oil acquisition opportunity on July 13. The transaction effective date is June 1. A virtual data room will be available starting May 16 For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Genesis Energy Declares Quarterly Dividend

2024-04-11 - Genesis Energy declared a quarterly distribution for the quarter ended March 31 for both common and preferred units.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.