The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

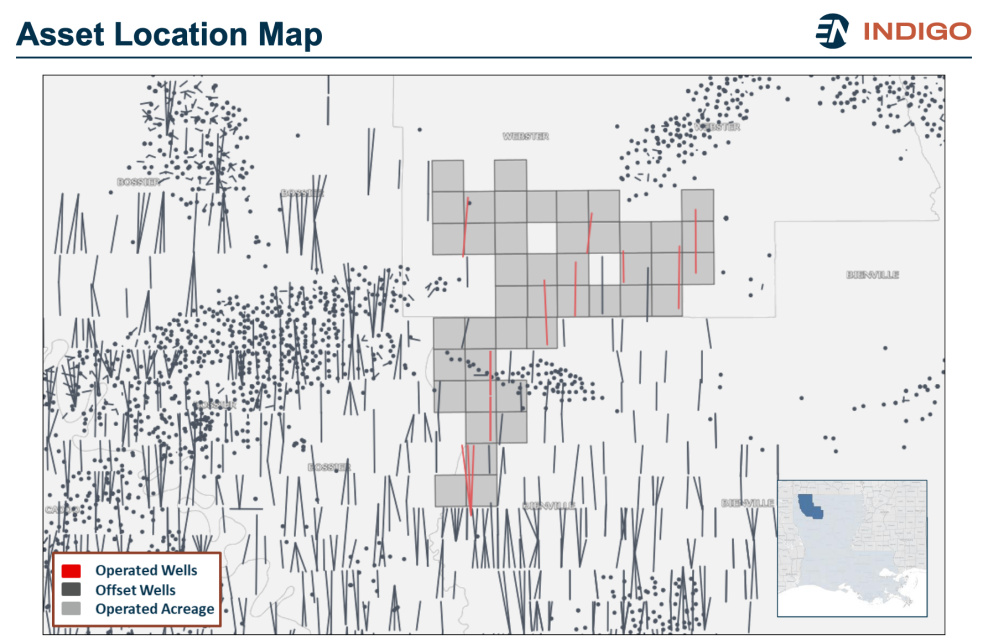

Arkoma Drilling II LP and its affiliates are offering for sale its portfolio of northeastern Haynesville assets in the Ark-La-Tex Basin located in Bienville, Bossier and Webster parishes Louisiana. The company retained EnergyNet Indigo as the exclusive financial and technical adviser for this transaction.

Key Investment Highlights:

Excellent Haynesville Shale Acreage

- Unique opportunity to acquire high contiguous undeveloped Haynesville acreage

- Nine attractive, stable producing wells; producing ~51 MMcef/d; PDP PV-10 at $120.2 million

- Operated production with 92.4% working interest and 73.0% net revenue interest

- Full control of operations and future development planning

- Established production profile leading to long term cashflow predictability

- Active development continuing to take place across Bossier and Webster Parish

Stacked Resource Upside Potential

- Repeatable drilling inventory, with de-risked future development as a result of Arkoma development

- Extensive upside inventory due to stacked resource formations on Arkoma’s acreage

- Unevaluated potential value in development of Pettet for expansion of Lake Bistineau gas storage facility

Contiguous Development Opportunity & Stable Cash Flow

- Highly contiguous and consolidated operated position within Bossier and Webster parish

- Well delineated asset with drill-ready development locations, strategically located near Gulf Coast demand centers

- Average monthly cash flow ~$7.5 million/month

Delineated, Premium Inventory Potential

- Upside location development timing is consistent with typical pad development

- 25 pads with 83 upside locations

- Haynesville Formation is main target for future development

- Assuming 10,000’ laterals spaced at 4 wells per section

- Bossier shale and Cotton Valley present within Arkoma’s acreage

- Upside cases haven’t been modeled

- Gross Bossier thickness of 250 ft-350 ft

Bids for Lot# 101385 are due Dec. 1. The transaction effective date is Oct. 1.

A virtual data room is available. For complete due diligence information visit energynet.com or email Zach Muroff, managing director, at Zach.Muroff@energynet.com, or Denna Arias, executive director of acquisitions and divestments, at Denna.Arias@energynet.com.

Recommended Reading

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.

Scathing Court Ruling Hits Energy Transfer’s Louisiana Legal Disputes

2024-04-17 - A recent Energy Transfer filing with FERC may signal a change in strategy, an analyst says.

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.