The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

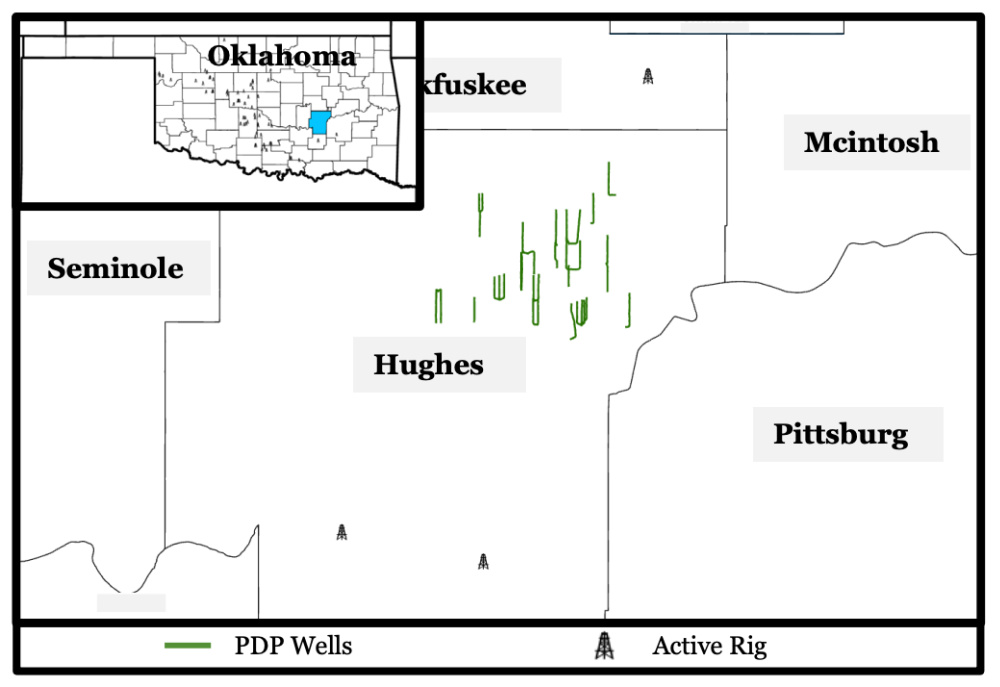

Eagle River Energy Advisors LLC has been exclusively retained by a private seller to divest certain nonoperated working interest, overriding royalty interest (ORRI) and mineral assets in the Arkoma Basin in Oklahoma.

The assets provide the opportunity, according to Eagle River, to acquire a gas-weighted production stream of 436 Mcfe/d diversified with 40 PDP wells across Hughes County, Oklahoma. Additionally, the package has stable production with an average well age of 4.5 years and is projected to make $814,000 in net cash flow over the next 12 months. Lastly, the asset provides a shallow decline of 10% with low operating costs of $0.35/Mcfe.

Highlights:

- Diversified Asset Base

- Production of 436 Net Mcfe/d is 49% gas (January 2023)

- Well seasoned production with average well age of 4.5 years

- Operators include Blackbeard, Trinity and Calyx

- Well Count by Interest – 9 mineral interest/40 ORRI/28 working interest

- Shallow forecasted decline rate of ~10%

- Highly Profitable Asset

- Production primarily from Woodford formation

- Operating costs of $0.35/Mcfe (last 12-month average)

- Last 12-month net cash flow = $597,000

- PDP PV-10 = $4.0 million; PDP PV-20 = $2.7 million

Bids are due at 4 p.m. MT on Dec. 14. The transaction effective date is Jan. 1.

A virtual data room will be available starting Nov. 16. For information contact Chris Martina, technical director at Eagle River, at 720-726-6092 or cmartina@eagleriverea.com.

Recommended Reading

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.