The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

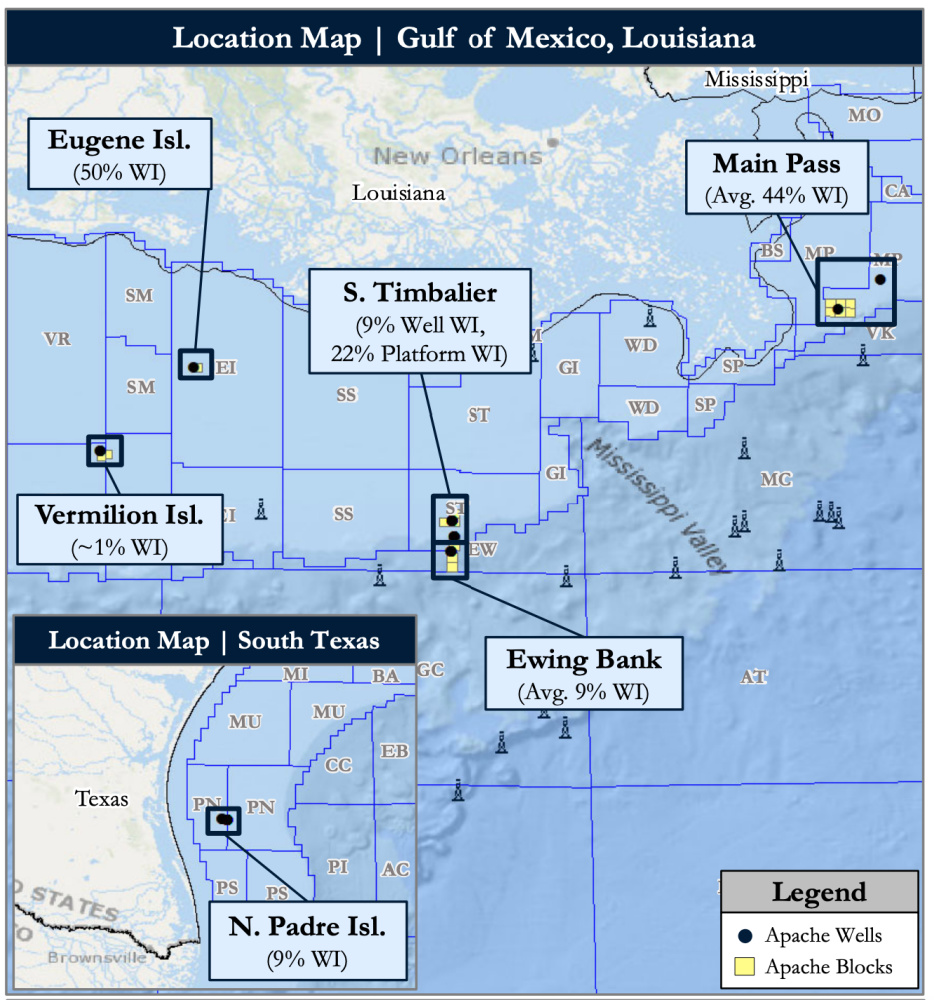

Apache Corp. retained Detring Energy Advisors to market for sale certain of its nonoperated Gulf of Mexico shelf assets located across six platforms in Louisiana and Texas federal waters.

The assets comprise nonoperated working interest in legacy production underpinned by meaningful liquids-weighted production generating $24 million of cash flow. Planned development opportunities include low-risk behind-pipe locations, which boast attractive economics supported by high-margin realizations of $50 or more of boe netback, according to Detring.

Asset Highlights:

- Legacy and liquids-weighted net production of 1,400 boe/d (65% liquid by revenue)

- High netback of $52/boe supported by low operating expenses and production handling income

- 18 active wells across six platforms

- Substantial $24 million next 12-month PDP Cash Flow

- PDP PV-10 and reserves of $42MM and 1.2 MMboe, respectively

- Ability to fund development out of cash flow, with 2P PV-10 and reserves of $49 million and 1.9 MMboe, respectively

- Assets operated by established, well-capitalized Gulf of Mexico operators including W&T and Walter Oil and Gas

- History of topsides and subsurface maintenance provides for a reliable production base across all assets

Process Summary:

- Evaluation materials available via the Virtual Data Room on Sept. 21

- Bids are due on Oct. 26

For information visit detring.com or contact Melinda Faust at mel@detring.com or 512-296-4653.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers.

Novo II Reloads, Aims for Delaware Deals After $1.5B Exit Last Year

2024-04-24 - After Novo I sold its Delaware Basin position for $1.5 billion last year, Novo Oil & Gas II is reloading with EnCap backing and aiming for more Delaware deals.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.