The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

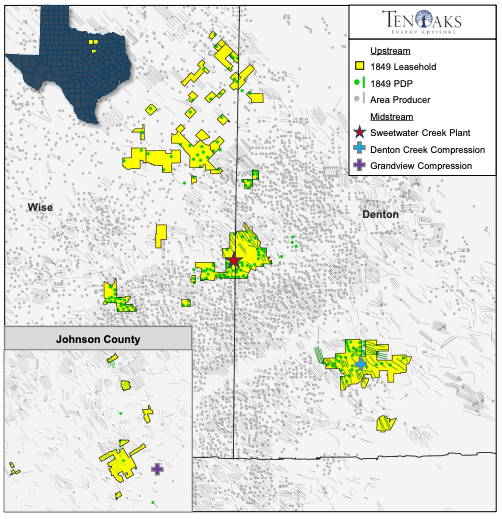

1849 Energy Partners LLC retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of its upstream and midstream Barnett Shale assets.

Highlights:

- Vertically integrated, operated footprint in the Barnett Shale

- Enhanced operating margins from company-owned midstream infrastructure

- PDP PV-10: $37 million | Next 12-month PDP cash flow: $9 million

- Low-decline production base

- Net production: 12,200 Mcfe/d (75% Gas)

- Inventory of 115 low-cost, high-impact development opportunities

- Re-entry drilling, refracs, recompletions and production optimization projects

Bids are due at noon CST on Aug. 4. The transaction is expected to have an Aug. 1 effective date.

A virtual data room is available. For information visit tenoaksenergyadvisors.com or contact Jason Webb at TenOaks Energy Advisors at 214-420-2322 or Jason.Webb@tenoaksadvisors.com.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.