Gas-directed rig activity was led by the Marcellus Shale, where drillers added five gas rigs over the past week – the most gas rigs added in the region since March 2015. (Source: Shutterstock)

Rig activity in key U.S. basins is up, despite volatility in commodity prices, according to data from Baker Hughes.

The oil and gas rig count, a barometer for the drilling sector and industry suppliers, grew by eight to 754 total rigs during the week ended on March 17.

While the number of net oil rigs fell by one to 589, U.S. drillers added nine natural gas rigs over the week. It was the largest single-week increase in gas rigs since December 2018, Baker Hughes data shows.

Faced with warmer weather and weaker-than-expected demand so far this year, U.S. gas demand has struggled to keep up with supply, Rystad Energy Analyst Ade Allen said.

“Last week was a relatively tepid week for the U.S. gas markets as prompt-month Henry Hub prices traded sideways and end[ed] up settling relatively flat for the week at $2.33/MMBtu [million Btu],” Allen said in a March 21 research note. “As winter draws to a close and the market moves into the shoulder season, limp demand is not enough to keep up with growing supply, and the chances of that balance finding equilibrium is minimal at best.”

Gas rigs on the move

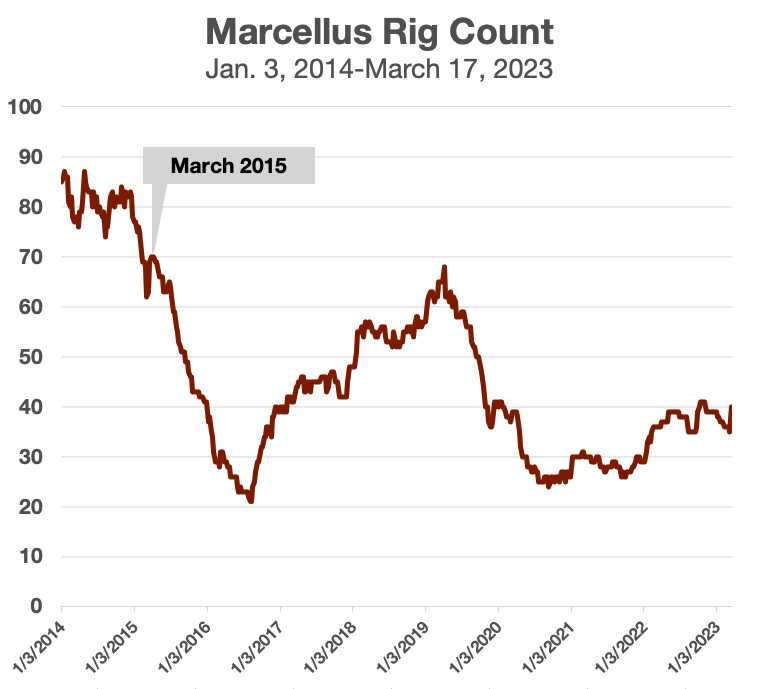

Gas-directed rig activity was led by the Marcellus Shale, where drillers added five gas rigs over the past week – the most gas rigs added in the region since March 2015, according to Baker Hughes data.

A total of 40 rigs were deployed in the Marcellus as of March 17.

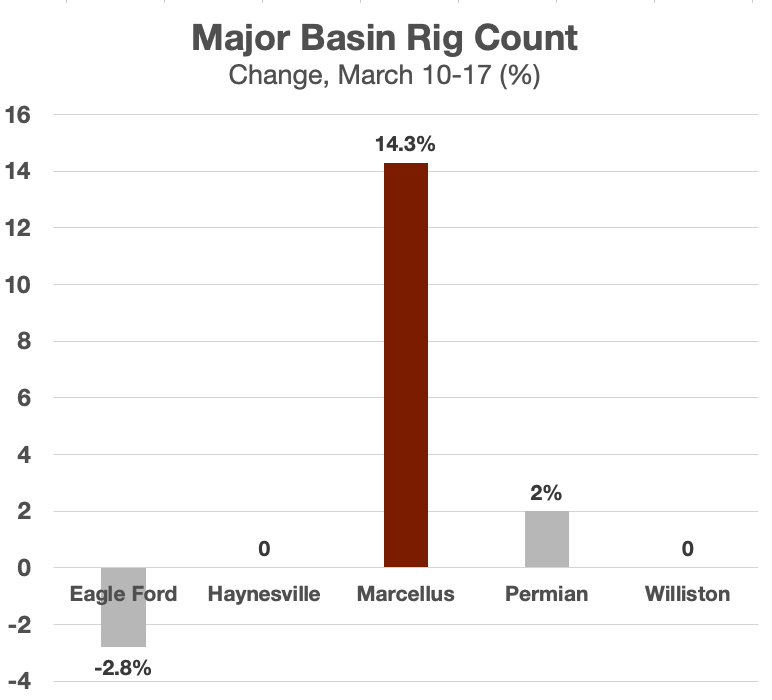

Operators in the Eagle Ford Shale in South Texas added four gas rigs during the week, while the Permian Basin in West Texas and New Mexico added a single gas rig.

Meanwhile, four gas rigs exited the Utica Shale play over the past week.

Rig activity in the gassy Haynesville Shale region held steady at 67.

RELATED

Haynesville, Permian to Lead Natural Gas Production Growth in April

As the natural gas sector continues to face price pressure, analysts at Tudor, Pickering, Holt & Co. (TPH) expect gas rigs will be cut in the Haynesville, the Eagle Ford and the Anadarko Basin during the second quarter and in the second half of 2023.

However, TPH analysts said it is time to begin accumulating gas stock exposure for eventual upside recovery in 2025 and beyond, with possible estimates ranging between $6/MMBtu and $7/MMBtu during tighter years.

RELATED

U.S. NatGas Price Volatility? ‘No Sympathy’ From Europe, Says Tellurian’s Simões

After averaging $6.42/MMBtu in 2022, Henry Hub gas prices are expected to average around $3/MMBtu this year before rising to an average of $3.89/MMBtu in 2024, according to the latest U.S. Energy Information Administration forecasts.

Oil rigs trend down

The total oil rig count decreased, continuing a downward trend seen for the past five weeks.

Energy companies in the prolific Permian region added six oil rigs during the week ended March 17.

The Denver-Julesburg Basin (D-J Basin) and Niobrara Basin in Colorado and Wyoming added a single oil rig.

The oil rig count in the Eagle Ford fell by six over the week.

Bank failures in the U.S. and uncertainty about a broader banking contagion have pushed down commodity futures and energy stocks in recent days.

On March 17, WTI's spot price closed out trading at $66.61/bbl while Brent ended the day at $71.03/bbl. It was WTI’s lowest point since December 2021, per EIA data.

Oil prices have rebounded some this week: WTI rose to $69.53/bbl and Brent rose to $75.25/bbl on March 21.

Recommended Reading

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.