Marathon Oil’s Eagle Ford Shale operations in Karnes County, Texas, in November 2010. (Source: Tom Fox/Hart Energy)

[Editor's note: Updated at 10:12 a.m. CDT Nov. 13, 2019.]

Among its third-quarter results, Marathon Oil Corp. revealed a multimillion-dollar bolt-on acquisition in the Eagle Ford Shale plus additional shale resource expansions on Nov. 6 that analysts say will likely steal the spotlight.

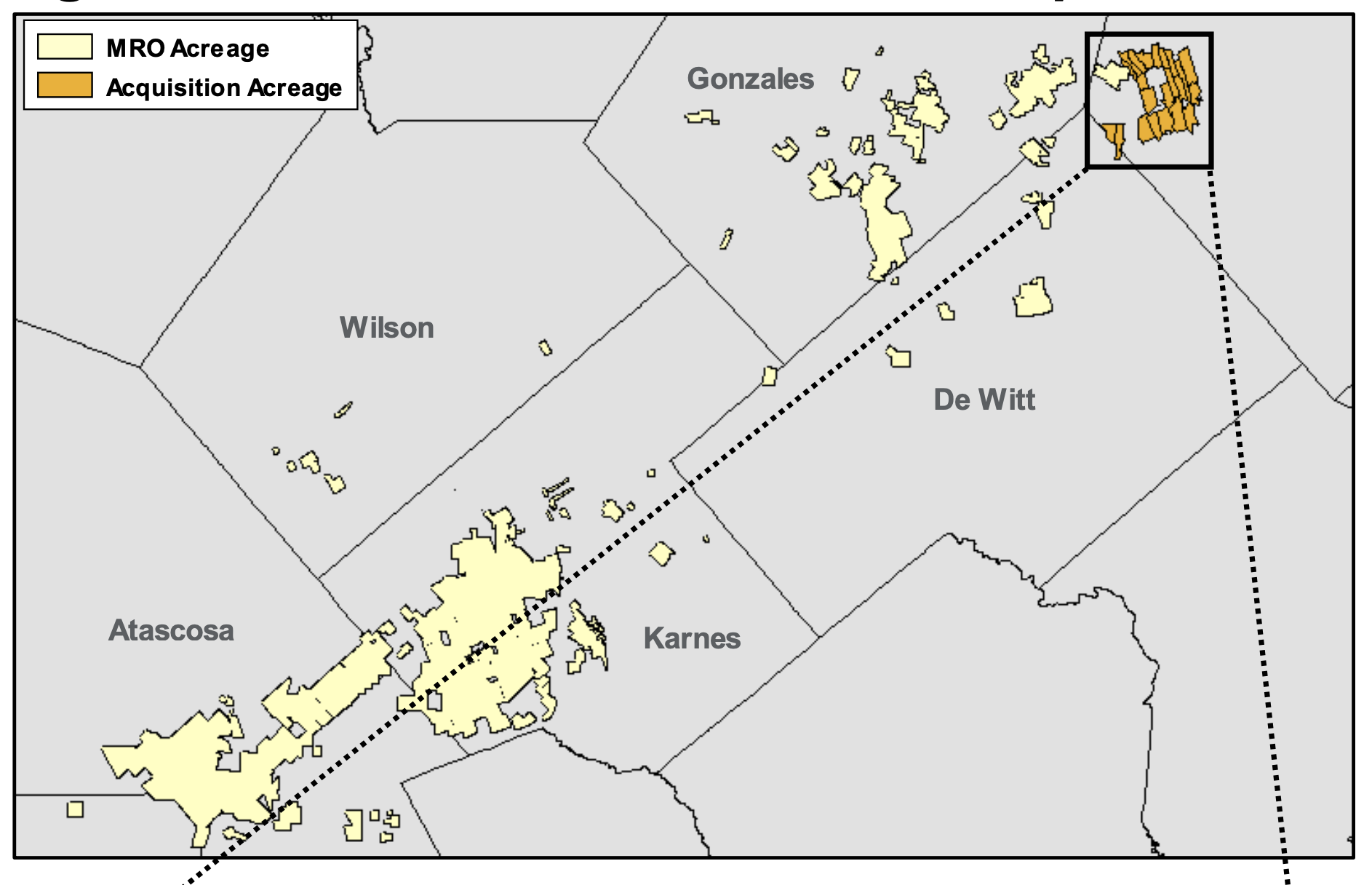

Marathon said it signed an agreement in the fourth quarter to acquire 18,000 contiguous and largely undeveloped net acres adjacent to the company's existing northeast Eagle Ford leasehold. The seller was not disclosed.

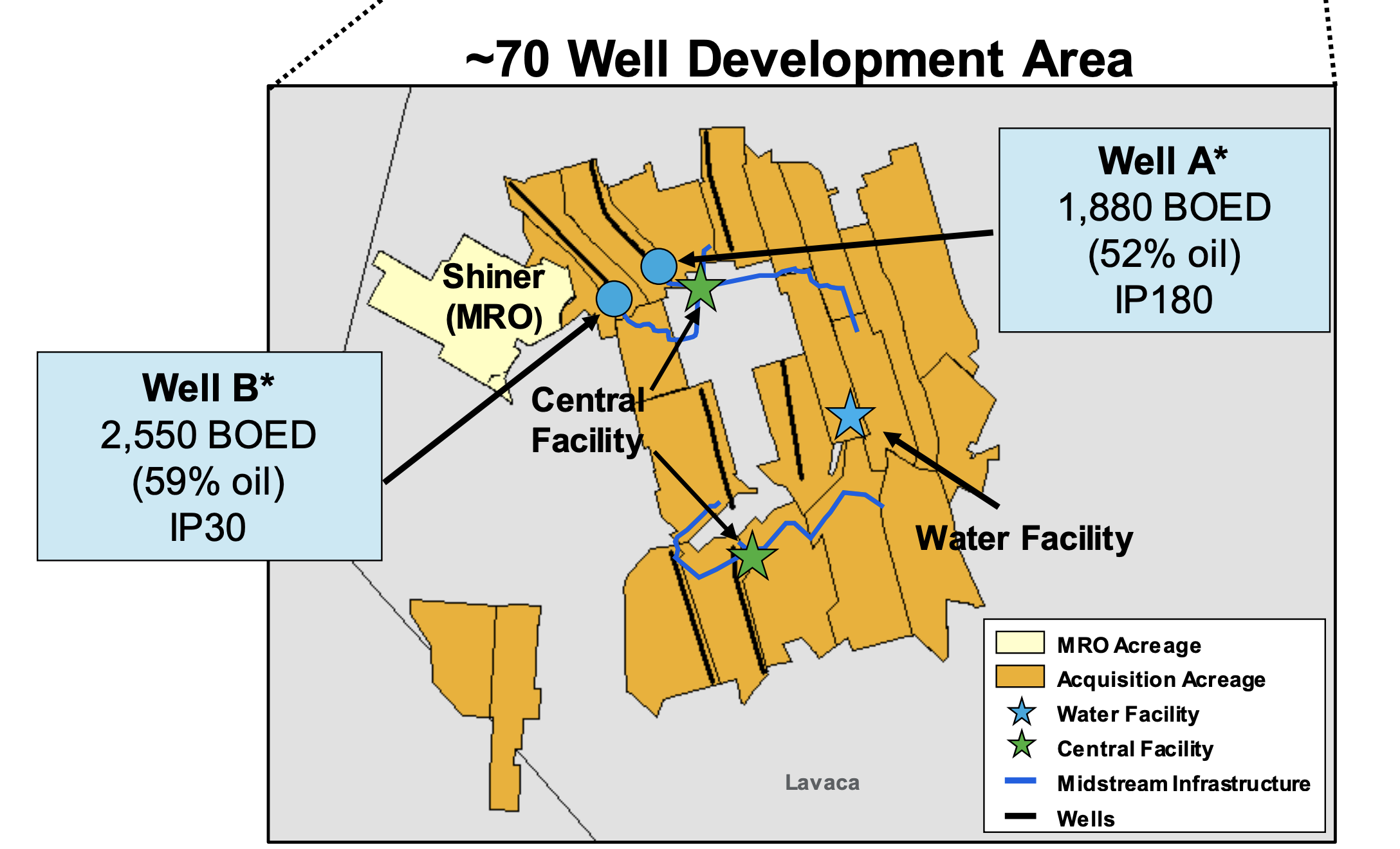

The $185 million bolt-on includes about 7,000 net barrels of oil equivalent per day (boe/d) of current production, associated midstream infrastructure, and cores up a 70-well, long-lateral development with potential upside. Laterals are greater than 8,000 feet, according to the company’s investor presentation.

“The bolt-on deal includes about 7,000 boe/d of current production, but the low 36% oil cut will likely raise some eyebrows, as it is well below [Marathon’s] current about 55%-60% oil cut in the play,” said Capital One Securities Inc. analyst Phillips Johnston in a Nov. 7 research note.

(Source: Marathon Oil Corp. November 2019 Investor Presentation)

The acquisition, which Marathon called “synergistic” and “targeted” in the company’s investor presentation, is a bolt-on to its Shiner development area primarily in Lavaca County, Texas. Current production from the assets is comprised of 36% oil and 67% liquids. Marathon also added that the acquired acreage is “responding well to modern completion designs.”

The transaction has an effective date of Nov. 1 and Marathon expects it to close by Jan. 31. The seller, according to BMO Capital Markets, was Rocky Creek Resources LLC, a joint investment between Boomtown Oil LLC, Juniper Capital Advisors LP and Delago Resources LLC.

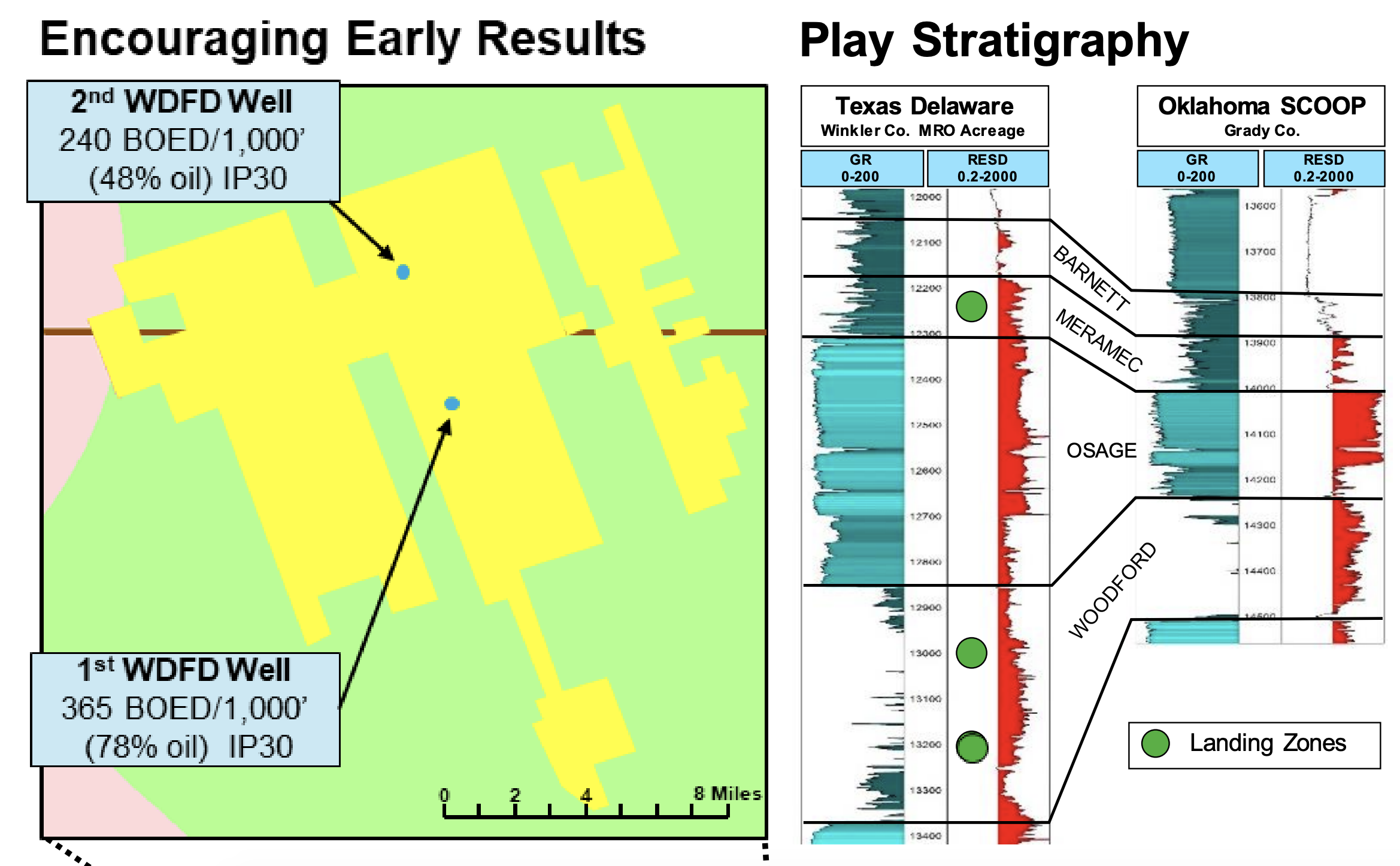

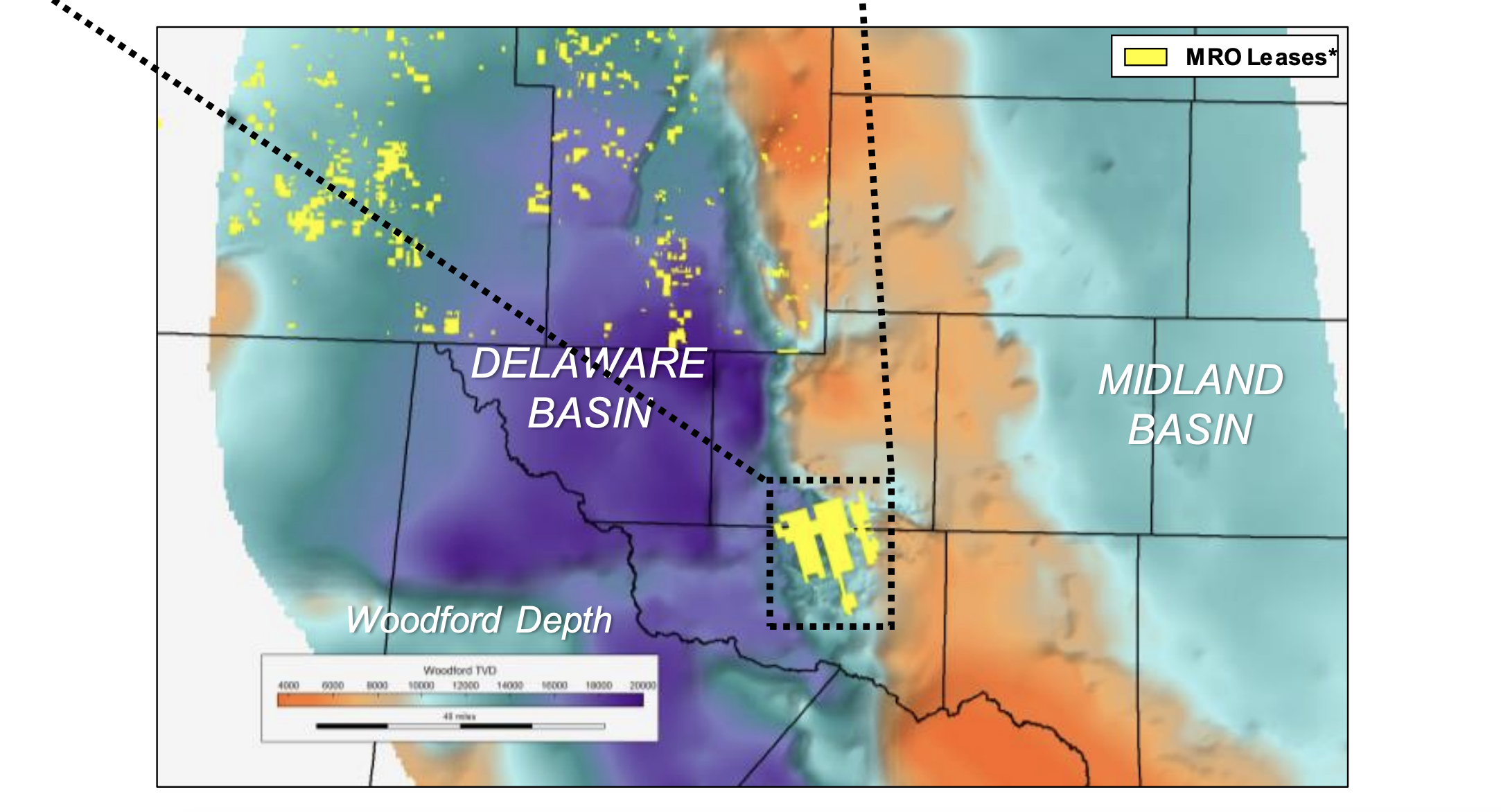

Marathon also unveiled a new Delaware Basin oil play on Nov. 6 with over 60,000 contiguous net acres in Ward and Winkler counties, Texas.

The new oil play has the potential for over 400 extended lateral locations and is located on the edge of the Central Basin Platform. The leasehold is prospective for stacked Woodford and Meramec oil targets, which Capital One’s Johnston called “interesting” target formations.

“We think investors will take a skeptical view of the effort, but management notes that two wells on the new acreage have demonstrated strong production, low water cuts and shallow decline profiles,” he said in the Capital One research note.

In the investor presentation, Marathon also noted the results support a full rig-line for appraisal and delineation in 2020. Source rocks include the Woodford and Barnett.

*Includes acquired leases expected to close during fourth-quarter 2019

(Source: Marathon Oil Corp. November 2019 Investor Presentation)

The company said it established the position at a “low entry cost” of less than $2,400 per acre through a combination of organic leasing and targeted acquisitions. Some acreage is still pending close in the fourth quarter, according to the company release.

In a filing with the U.S. Securities and Exchange Commission, Marathon said it had entered agreements in the fourth quarter to buy about 40,000 net acres in Ward and Winkler counties, Texas, for $106 million. Information on the sellers wasn’t disclosed.

Other resource expansions Marathon highlighted during its quarterly results also included more details on its Louisiana Austin Chalk position and the addition of shale drilling inventory in the Bakken and Eagle Ford through what the company calls “organic enhancement.”

As a result of the enhancement efforts, Marathon said it has added over 1,000 resource play locations since the beginning of 2018, which is equivalent to roughly three years of drilling inventory.

In particular, the company has boosted its inventory in the Bakken and Eagle Ford alone by more than 500 new drilling locations. Marathon CEO Lee Tillman said this is equivalent to replacing the last two years of inventory consumption for both the company’s Bakken and Eagle Ford assets.

“Our success starts with what we call organic enhancement or core extension through productivity uplift, enhanced recovery, cost reduction and efficiency improvement,” Tillman said on the company earnings call on Nov. 7.

For the third quarter, Marathon Oil reported a 44.5% fall in quarterly adjusted profit, results similar to those from fellow shale producers as weak crude and gas prices limit gains.

Marathon also generated $76 million free cash flow before dividends during the third quarter, which was roughly double Street and Capital One estimates, Johnston noted.

Capital One’s overall take of Marathon’s third-quarter results was positive.

“Strong [third-quarter] oil production and financials helped overshadow [third-quarter] capex that was mildly above expectations and a +3% increase to the [fiscal-year 2019] budget driven by higher [resource play exploration] spend,” Johnston said.

Marathon’s oil production averaged 216,000 net barrel per day during the third quarter, up 14% from the year-ago quarter, divestiture-adjusted, and at the top end of guidance range.

The company said it now expects full-year oil production to rise 11%, up from its previous forecast of a rise of 10%.

Recommended Reading

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

EU Expected to Sue Germany Over Gas Tariff, Sources Say

2024-04-17 - The German tariff is a legacy of the European energy crisis that peaked in 2022 after Moscow slashed gas flows to Europe and an undersea explosion shut down the Nord Stream pipeline.

Pemex to Remain Fiscally Challenged for Mexico’s Next President

2024-04-16 - S&P Global Ratings said Pemex will remain a fiscal challenge for the country’s next president, adding that continued cautious macroeconomic management was key in its ratings on both Mexico and Pemex.

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.