A pivotal shift that began decades ago in cultural values toward sustainable business practices now directs massive flows of investment capital, affects public perception of brands and influences employee recruiting and retention. Its impact is now being felt across all types of enterprise and, increasingly, in the oil and gas sector.

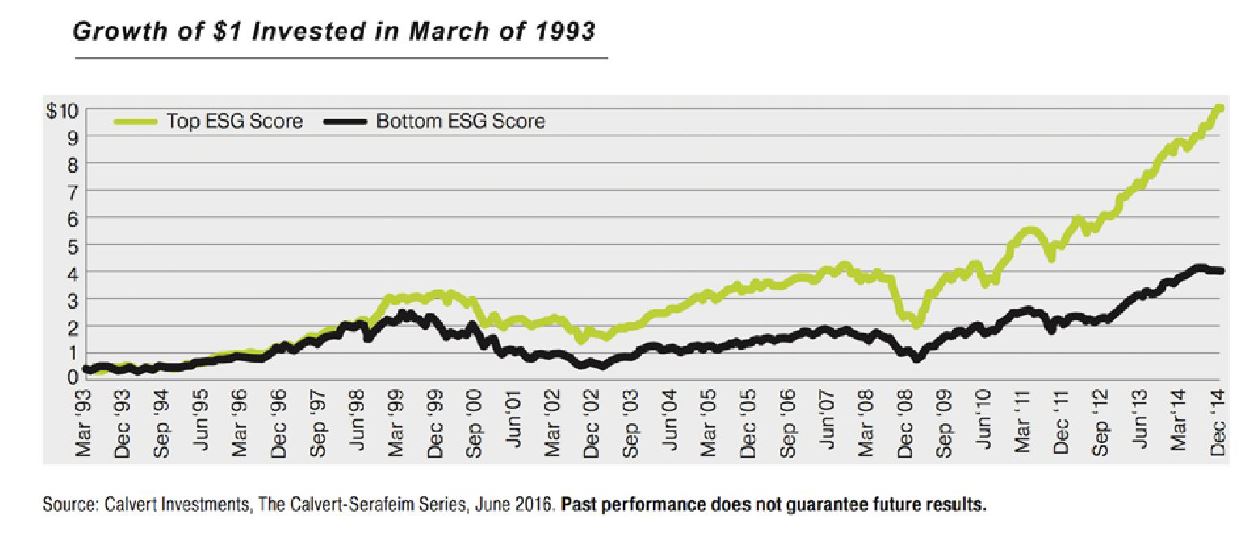

Labeled as “ESG”—environmental, social and governance—this deceptively simple tag contains within it an all-encompassing approach to managing a company’s risk, while supporting its ongoing economic success. Whether or not the correlation is one of direct cause and effect, share prices of companies performing in the top third on ESG metrics compared with their industry peers have appreciated 250% better during the last 25 years, according to Calvert Investment Management Inc.

For oil and gas companies with complex footprints and, in some cases, high-profile brands, scoring high on ESG factors represents a big data and analytics challenge in some critical ways. There are many potential metrics to be considered—from health and safety to human resources policy to environmental stewardship— it’s difficult to prioritize which data should be tracked and how.

“These companies have so much data, it’s almost as much a curse as a blessing,” said David Parham, an oil and gas industry analyst for the Sustainable Accounting and Standards Board (SASB). “It’s often difficult to know which are the key pieces needed to begin implementing a successful ESG strategy.”

Share prices for companies in the top third for ESG scores vs. their peers have appreciated by 250% during the last 25 years.

Founded in 2011 and currently chaired by Michael Bloomberg, the SASB seeks to provide a framework of ESG metrics for every major industry sector. Within oil and gas, the SASB offers separate matrices of critical factors for upstream, midstream and downstream businesses. Provisional drafts of the organization’s voluntary standards were submitted for public comment by key stakeholders in October, and final review by the SASB’s standards board began in December.

Ultimately, the organization’s goal is to provide a mechanism for investors to compare industry peers with one another, apples to apples, based on the same ESG standards, as well as a way for companies to measure their own performance.

“The value of consistent, independent, reliable data for senior management can hardly be overstated,” said Darren Olagues, the former CEO of Cleco Corp., an energy services company in Louisiana, and who serves as a consultant to major banks active in the energy sector. “Understanding how you can gather the right data to understand how a company is viewed through the lens of ESG is critical now.”

Among his personal investments with early-stage renewable and other energy industry-related technologies, Olagues recently made a bet on 3BL Media, a start-up developing automated tools for helping C-suite executives and board directors to optimize ESG performance. “I expect that establishing good ESG data-gathering and analytics is going to be something required as a standard, senior-management reporting mechanism, just like monthly profit and loss, key operating performance indicators, employee and diversity reports, and safety statistics,” Olagues said.

That perspective about the inevitability of ESG reporting as a core component of a management team’s ability to benchmark performance resonates with recent work done by Jeffrey W. Hales, an accounting professor at the Georgia Institute of Technology. Hales was on an advisory council of the Financial Accounting Standards Board (FASB), whose standards—unlike SASB, as yet—are enforced by the U.S. Securities and Exchange Commission.

Hales is also an advisor to SASB, which he says is work that has altered his thinking about what information investors need to make good decisions, but also what individual companies need to be doing to improve their ESG performance. “From a perspective of good management, having the right information at your fingertips is key,” Hales said. “With regard to ESG, it’s critical to track and respond to emerging issues, which are not necessarily related directly to quarterly earnings.”

Approach to intelligence

In 2002, Donald Rumsfeld, as U.S. Secretary of Defense at the time, offered this brief theory about the nature of intelligence during a press briefing, responding to a question about the lack of evidence linking Saddam Hussein to the supply of weapons of mass destruction to terrorist groups.

“… As we know,” Rumsfeld said, “there are known knowns; there are things we know we know. We also know there are known unknowns. That is to say, we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know.”

Coming from the former chairman and CEO of General Instruments Corp. and Gilead Sciences Inc., Rumsfeld’s description of the nature of intelligence and risk applies not just to the realm of national security. It also accurately describes the challenges faced by leaders of large commercial enterprises, managing risks to their organizations across the spectrum of ESG issues.

In today’s world of complex supply chains and tumultuous political environments, threats to business operations and brand reputations—and ultimately share price—can emerge at fiber-optic speed. With the brief time it takes for an oppositional Facebook or Twitter campaign criticizing corporate operations or policies to go viral, serious damage can occur to a company’s long-term prospects.

“Fake news” and activism via social media in the digital age represent a constantly shifting threat matrix, full of Rumsfeld’s “known unknowns” and “unknown unknowns,” which can cause lasting damage to a company’s bottom line. An aggressive social-media campaign opposed to a company’s plan to drill for resources could result in failure to obtain necessary permits. Although conducted several years ago, a Goldman Sachs survey of the largest 190 oil and gas projects at the time found that 73% of their 19 major delays resulted from sustainability issues raised by stakeholders and local communities.

Efforts by businesses to manually identify, monitor and prioritize risks associated with social media campaigns and fake news spinners to date have been limited by their capacity to keep up with the proliferation and viral spread of real threats from activist groups. On the bright side, technologies that were innovated by the U.S. Intelligence Community to identify and track national security threats are now coming online for private enterprises.

John Davis II, founder and CEO of N&C Inc. and a developer of artificial intelligence solutions that help companies manage political and regulatory risk, believes the day has arrived for business executives and boards of directors to take advantage of similar technologies used by national intelligence agencies.

N&C’s first commercially available product, Regendus, leverages an

“It’s essential for enterprises that want to optimize their ESG performance to establish systems and best practices for continually gathering and analyzing data throughout the organization as soon as it’s available,” said Davis, a former federal prosecutor. “Then the key becomes applying sound NLP and machine-learning technology that notifies senior management immediately when there’s a potential problem and allows them to rapidly drill down on the source.”

A model for success

As a neatly packaged model for complex oil and gas infrastructures, the world record-breaking speedboat built by San Diego-based artificial intelligence firm DataSkill offers a useful case study. Sponsored by Lucas Oil Products Inc. and piloted by DataSkill founder and CEO Nigel Hook, the 48-foot-long, twin-engine, rocket-ship-of-a-boat blasted from Key West to Havana and back again in August in record-smashing time of 1:18:03 with a top speed of 127 mph.

Strapped into the driver’s seat, Hook listened in his headset for instructions spoken by the boat’s “brain,” an artificial intelligence system with myriad sensors monitoring everything from engine temperature to emissions to the height and frequency of ocean waves. Computing all these variables nearly instantly—far faster than a human could—the system advised Hook when to back off or rev up a 1,000-rpm on the engines or when to make small course adjustments.

Prior to Hook’s attempt at breaking the world record, the boat’s intelligence system was trained by feeding it large amounts of data from numerous open-water races and test runs. In this way, the computer learned what worked best under certain conditions so it could advise Hook on actions required to optimize the boat’s performance on the fly.

The open-ocean race was an expression of Hook’s lifelong passion for speedboats, but, more importantly, it demonstrated DataSkill’s core capabilities in developing machine-learning applications. The company has created artificial intelligence systems for major corporations ranging from telecommunications to oil and gas. In the latter, DataSkill has implemented strategies predicting the failure of drilling components to avoid costly repairs and project delays.

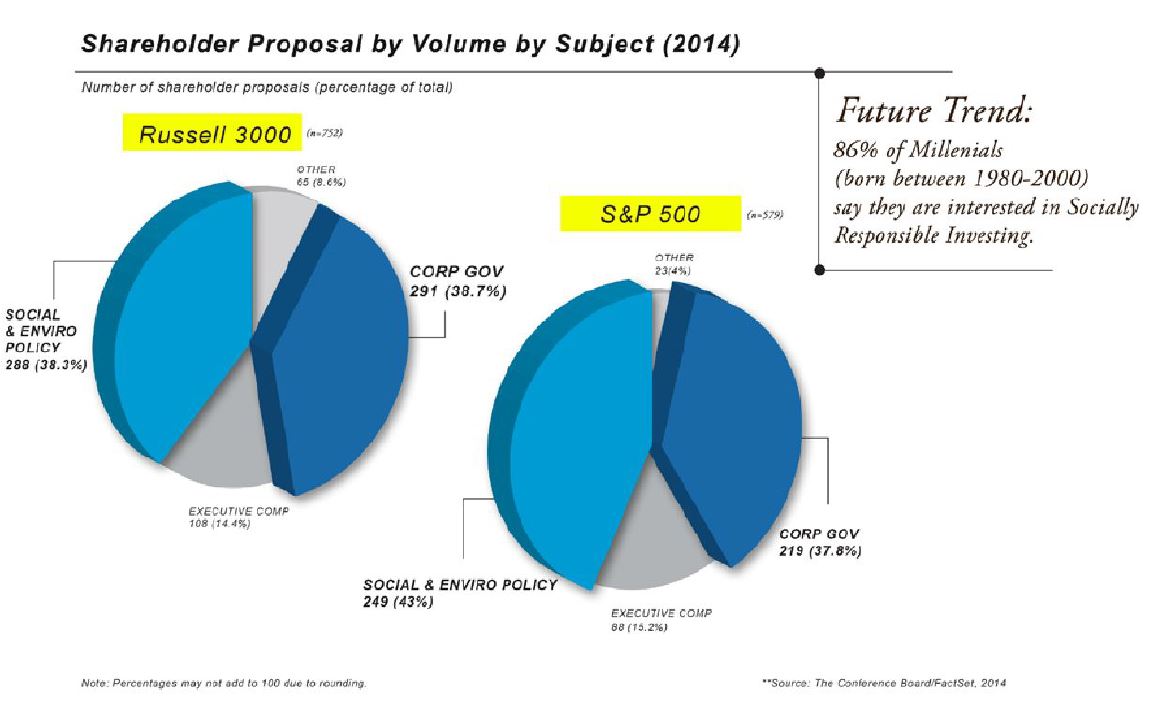

Shareholder activism and proxy votes based on ESG-related issues are on the rise. The trend promises to accelerate as the socially minded millennial generation matures and inherits/acquires wealth.

One can easily see how additional applications of artificial intelligence technology to oil and gas infrastructure, such as, say, drilling platforms on the sea, could help prevent incidents that might otherwise have major negative effects on an exploration company’s ESG score. A purposeful program to implement advanced technologies like this, demonstrating a company’s commitment to ESG principles, provides greater credibility than mere boilerplate platitudes about a company’s “love of the earth.”

“In the end, it’s about taking responsibility for your infrastructure,” said Ed Evans,

A gathering force

When it comes to predicting market trends, demographics are king. And the cultural drivers for ESG as determinant factors for long-term financial success show no sign of abating.

According to a recent survey by Morgan Stanley Smith Barney LLC, 86% of millennials say they are interested in “socially responsible” investing and twice as likely to invest in a stock or a fund where it’s part of the value-creation thesis. With millennials becoming the largest demographic in America by 2020, accounting for a third of American adults, companies failing to address this emerging generation of investors’ core values will do so at their own peril.

ESG Factors: Survey of 320 Institutional Buyside Decision Makers

Institutional investors increasingly base their decisions about where to commit funds on how well companies perform with respect to ESG-related metrics.

While most sustainable investing opportunities still cater to mature individuals with significant wealth, Morgan Stanley recently launched its Impact Access Model Portfolios with reduced account minimums to catch customers early in their investing lives.

Meanwhile, shareholder activism and proxy votes based on ESG-related issues accounted for 77% of the total for Russell 3000 and 80% for S&P 500 companies in 2014, according to The Conference Board/FactSet—a growing trend that promises to accelerate as the socially minded millennials acquire more wealth.

Institutional investors around the globe increasingly base their decisions about where to commit funds on how well companies perform with respect to ESG-related metrics, according to a recent survey by EY of 320 buyside fund managers. A majority also expressed a desire for greater transparency among their portfolio companies, with 60% saying they don’t think companies currently disclose enough about ESG risks, which could materially affect their businesses.

Companies in Europe are typically further along in their attempts to provide greater data transparency on their ESG performance than businesses in America, said Jason Gold, S&P Global Inc. vice president of strategic relationships and partnerships. “Although there are companies in the U.S. that are aware of and thinking about the implications, the data bears out that ones taking a more aggressive stance are seeing commensurately positive results,” he said.

“ESG is an evolving market force, a cultural shift—a conversation that is quickly penetrating every level,” And it’s one that is having an ever-important effect on the oil and gas industry.

Publicly traded energy companies are becoming increasingly aware of their ESG performance and how effective it is to a growing number of investment groups, said Jack Belcher, executive vice president of Houston-based energy consulting firm HBW Resources LLC, whose clients include energy companies large and small across the hydrocarbon chain. The firm is now advising clients on how to improve their ESG metrics. “Solid ESG performance is important to a growing number of investors. Ranking high in your peer group creates more value and attracts investment capital,” Belcher said. “This is the wave of the future.”

Ray Bolger was a writer and editor with the Aspen Institute’s Energy and Environment program. He is currently an editor for Tech Wire Media Group.

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.