(Source: T. Schneider / Shutterstock.com)

Crestwood Equity Partners was driven by M&A last year, revealing in a Feb. 21 earnings call that the company has been transitioning away from its diversified midstream portfolio with the sale of its Tres Palacios gas storage facility for $335 million with joint partner Brookfield Infrastructure.

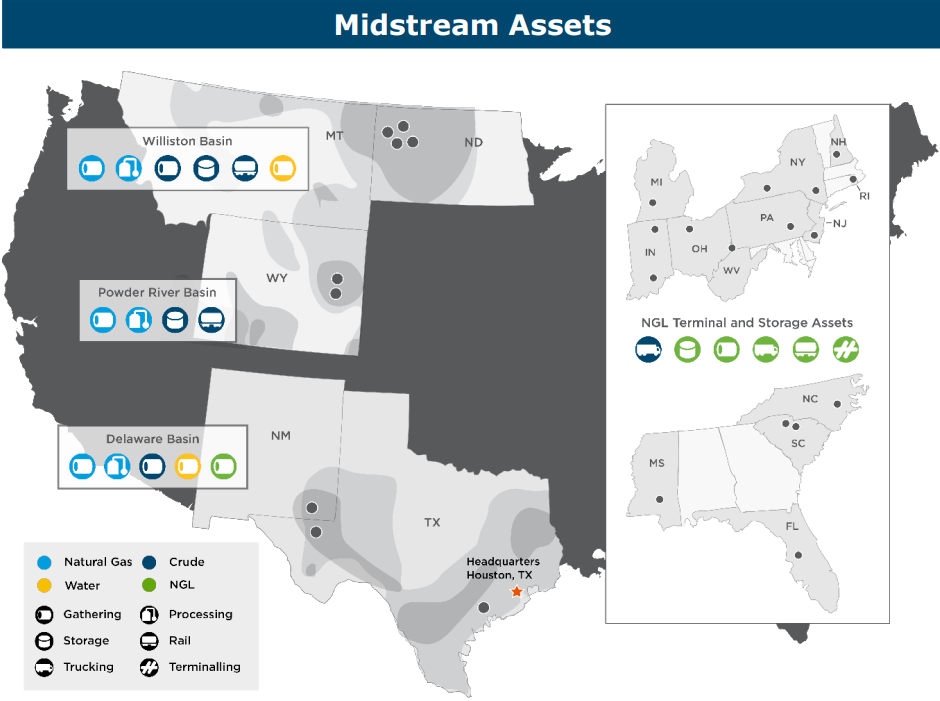

Since 2021, the company has been implementing a portfolio realignment strategy, which was created to establish Crestwood as one of the top three gas processors in the Williston, Delaware and Powder River basins.

“We’ve been transitioning away from the widely diversified midstream portfolio we put together in the first few years of Crestwood, and it served us well during the formative years to a much more concentrated gathering and processing position in the basins that offer stable long-term production profiles and more visible growth potential at what we think a realistic commodity price is going forward,” chairman and CEO Robert Phillips said.

Crestwood said it will receive approximately $168 million for its 50% interest in the Tres Palacios storage facility and plans to use all sale proceeds to reduce borrowings on its revolving credit facility. The transaction is expected to close in the second-quarter 2023 and is subject to customary regulatory approvals, according to the company.

“The sale [of Tres Palacios] represents for Crestwood our fourth noncore divestiture and a highly compelling valuation and allows Crestwood to utilize our $168 million in cash proceeds to pay down debt and further strengthen our balance sheet,” Phillips said.

But the company does not plan on M&A being a top focus in the coming year.

While Crestwood says it will remain active in the M&A market, Black told analysts during the earnings call that it is not a priority for the company this year.

“I think we’re internally focused, but the right opportunity comes along and we can finance it in a way that was accretive on a deleveraging or leverage neutral raises, those are kind of options we’re looking for,” he said.

Earnings fall short

Crestwood reported adjusted EBITDA of $200 million and distributable cash flow of $111 million in fourth-quarter 2022, year-over-year (yoy) increases of 34% and 22%, respectively, the company said during its Feb. 21 earnings call.

For the full year, the company said it generated adjusted EBITDA of $762 million and distributable cash flow of $467 million, yoy increases of 27% and 26%, respectively.

Crestwood’s full-year 2022 earnings came in short of company and market expectations, according to Phillips.

“While I’m disappointed in our actual 2022 results, which came in short of our expectations and the market’s expectations, due largely to extreme winter events and producer development delays, which were caused further by industrywide oilfield services and supply chain challenges,” he said, “I am very pleased strategically with the repositioning of our portfolio and the assimilation of these new assets and the positive growth outlook that we have in all three basins for 2023 and beyond.”

2023 outlook

For 2023, Crestwood estimates adjusted EBITDA of $780 million to $860 million and distributable cash flow in the range of $430 million to $510 million. The company is forecasting about 5% yoy EBITDA growth at the midpoint of its guidance range, which executive vice president and CFO John Black said “will be primarily driven by gathering volume growth on our system and partially offset by lower commodity prices.”

Crestwood also expects to add about 260 new well connects this year, an increase of over 15% from last year, primarily in the Williston and Delaware basins.

“We’re going to continue to carefully and efficiently spend growth capital to expand backbone infrastructure of our strategically located systems and plants and make new well connections, primarily in the Williston and Delaware basins,” Black said, adding that the company has budgeted more than 8% increase in cash flow yoy at its guidance midpoint.

On the capital side, Crestwood foresees investing between $135 million and $155 million of growth capital this year, which Black said is a step down of more than 20% yoy, with about 90% focused in the Williston and Delaware basins.

Additionally, Crestwood said it plans to allocate all excess free cash flow in divestiture proceeds this year to pay down debt.

“As we think about our capital allocation priorities for this year, we remain squarely focused on the balance sheet and reducing our debt outstanding with a long-term leverage ratio target of less than 3.5x,” Black said.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.