Apache anticipates producing between 94,000-98,000 boe/d in the third quarter and between 100,000-105,000 boe/d in the Permian Basin. (Source: Hart Energy)

Beleaguered by low natural gas and NGL prices that prompted the temporary halt of production earlier this year, the Permian Basin’s Alpine High field must compete for capital with the rest of Apache Corp.’s assets, the company’s CEO said.

Lean gas and part of the field’s rich gas production will continue to be deferred until Kinder Morgan’s Gulf Coast Express pipeline begins service in September, Apache CEO John Christmann said on a call with analysts Aug. 1.

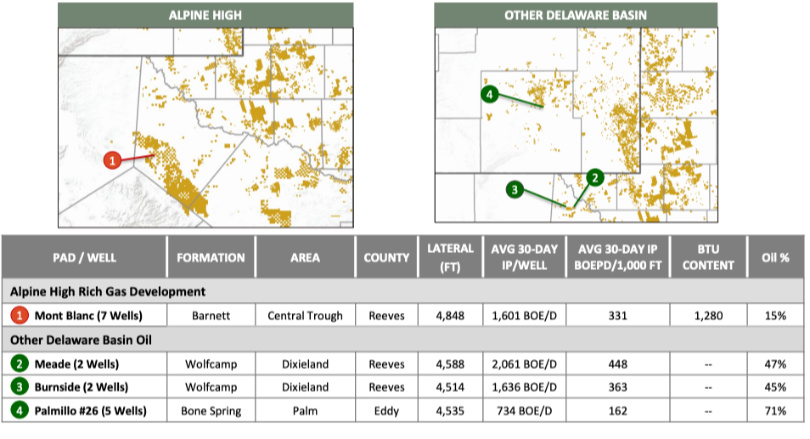

“From a cash flow and returns perspective, it is far more valuable to wait a few weeks and produce into an improved price environment. At current gas and NGL prices some portions of Alpine High are less competitive than other opportunities in our portfolio,” Christmann said. “If this pricing situation does not improve some capital will be reallocated to areas with more leverage to oil price most likely elsewhere in the Permian Basin.”

Fields that predominately produce gas have been hit especially hard this year as natural gas prices have plummeted. The average natural gas price per thousand cubic feet in the Permian was 26 cents for second-quarter 2019, compared to $1.85 the same quarter a year earlier.

The average NGL price per barrel didn’t fare any better—down to $13.12, compared to $26.97 a year ago.

“When we began 2019 the commodity price environment was volatile but planning based on a $50 to $55 [West Texas Intermediate (WTI)] and a $2.50 to $2.80 Henry Hub for the long term felt prudent if not slightly conservative,” Christmann said. “Oil prices so far are delivering on that expectation. But gas prices are significantly weaker. Additionally, NGL prices took a material downturn in the second quarter and are now trading near historic lows around 35% of WTI.”

But having a high quality, diverse portfolio and flexibility to redirect capital is an advantage in times of commodity price volatility, he added.

“As we progress our longer-term planning process we are closely monitoring macro commodity fundamentals and evaluating many capital allocation scenarios for 2020 and beyond under a number of different pricing decks,” he said.

Quarterly Update

Apache reported its second-quarter adjusted earnings fell to $41 million, compared to $195 million a year ago.

Total adjusted production rose to about 395,616 barrels of oil equivalent per day (boe/d), up from 389,734 boe/d. Contributing to higher production was the North Sea and Permian Basin, where oil production increased to 92,176 barrels per day (bbl/d), from 89,928 bbl/d.

The company, however, lowered its second-half production guidance for the Permian, reflecting delays in the Midland and Delaware sub-basins along with continued gas production deferrals at Alpine High due to weak Waha gas prices.

The longer-than-expected commissioning and late arrival of a new electric-powered frac fleet caused some timing delays but once online resulted in more than $250,000 in diesel savings and cut emissions by an estimated 90%, said Tim Sullivan, executive vice president of operations support for Apache. In the Midland Basin, a sidetrack and flowback limitations caused delays while mechanical issues held up completions in the Delaware Basin.

“The impact of these production delays has affected second-quarter results and will linger into the third and fourth quarters,” Sullivan said. “We expect to be caught up with all this year's planned completions by year-end.”

Apache anticipates producing between 94,000-98,000 boe/d in the third quarter and between 100,000-105,000 boe/d in the Permian, where the company remains in full development mode.

Third-quarter production at Alpine High is expected to be between 70,000-75,000 boe/d with fourth-quarter guidance unchanged at more than 100,000 boe/d, assuming “all deferred gas production is returned to sales by the beginning of October in conjunction with the [Gulf Coast Express] pipeline startup,” Apache said.

Christmann added that: “It also assumes that Altus Midstream cryo[genic] units are operating in full ethane recovery mode. We will prioritize value over production volumes and depending on the prevailing gas and NGL prices may choose to reject ethane at Alpine High, which would impact our reported fourth-quarter volumes.”

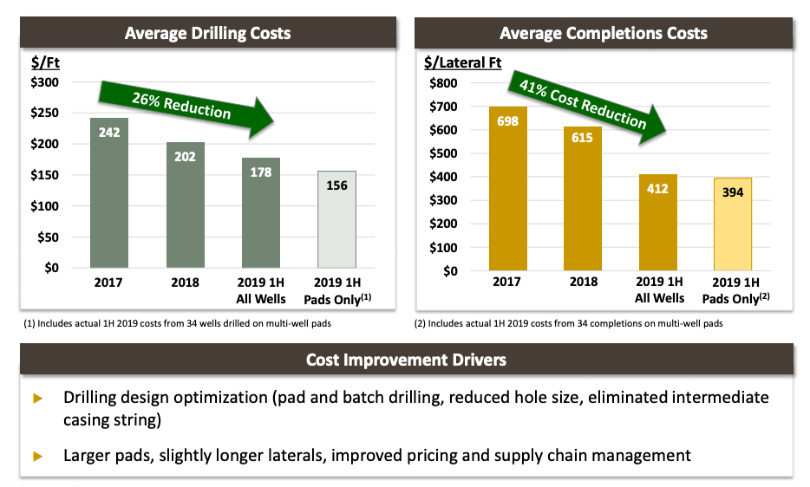

Cost Improvements

As the company continues to cope with commodity prices, improvements are being made on costs at Alpine. Sullivan noted that drilling and completions have improved on a cost-per-foot basis amid more development activity and pad developments are moving costs into projected range. Drilling, completing and equipping costs for one-mile laterals are nearing $5.5 million per well, he said.

Executives also said midstream work is shaping up well with two cryogenic processing facilities—in partnership with Altus Midstream—on and another set for fourth-quarter.

But the company is still keeping a close eye on the market, with a long-term picture in mind, to inform any needed shifts in its capital program.

Given Apache’s singling out of Alpine High’s need to compete, Bank of America/Merrill Lynch analyst Doug Leggate said on the call “philosophically, it sounds like you’re kind of rationalizing a pivot toward the more oil part of the basin.” He wanted to know more about Apache’s depth of inventory on the Midland side and the trajectory for Alpine, specifically whether its purpose would become aimed at filling the cryogenic plants.

Christmann answered by pointing out Alpine High’s large acreage and its prospectivity for rich gas, NGL and gas production plus other factors such as Apache’s 79% ownership interest in Altus Midstream.

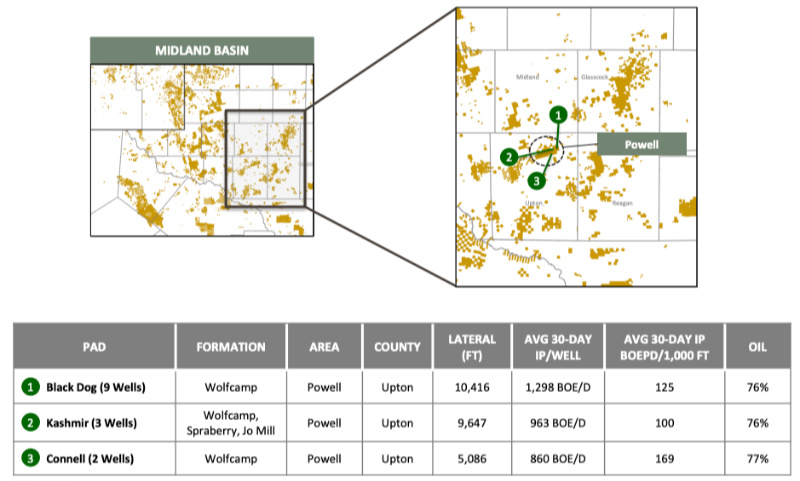

“As far as the depth of inventory in the Midland Basin we feel very good about that,” he said, noting Apache has been running more rigs in the Powell, Wildfire and Azalea areas, which is only about 20% of its acreage footprint. Test wells drilled in other parts of the Midland Basin have had “fantastic results,” he added.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.