The U.S. Geological Survey updated its estimate in 2019 to 84-200 Tcf of potentially developable undeveloped resources in the Appalachia region. “Production growth is on trend to meet that projection,” Randall Wright, president of Wright & Co. Inc., said on June 14. (Source: Chesapeake Energy Corp. / Hart Energy)

PITTSBURGH—The Marcellus Shale play has produced 80 Tcf of gas to date, according to Randall Wright, president of Wright & Co. Inc., and it is likely that production will reach 38 Bcf/d in some areas by 2025.

Wright told attendees of Hart Energy’s DUG East Conference and Exhibition that his company did its first evaluation of the play in 2008, at a time when the Marcellus was the “play du jour.” The prediction was: “If you could get 1 Bcf/1,000 ft of lateral, it might be a viable play.”

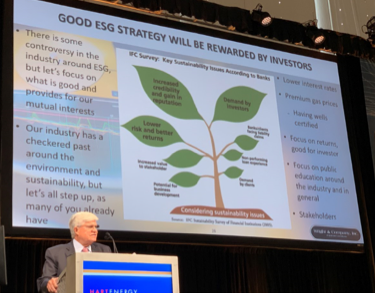

“[ESG] a problem for those who ignore it and an opportunity for those who embrace it.”—D. Randall Wright, president, Wright & Co. Inc.

Four years earlier, the U.S. Geological Survey (USGS) estimated production in the region would top out around 1.9 Tcf. This estimate, Wright explained, “was pre-hydraulic fracturing, pre-horizontal drilling and pre-technology that has emerged in the last 20 years.” By 2014—after five years of drilling—the USGS increased its estimate to 15 Tcf, and in 2019, updated its estimate to 84-200 Tcf of potentially developable undeveloped resources in this region.

“Production growth is on trend to meet that projection,” Wright said on June 14, with areas of eastern Ohio, western Pennsylvania and West Virginia in excess of 3 Bcf/1,000 ft of effective lateral.

Although some potential investors are asking, ‘Aren’t all the better areas drilled up?’ in Wright’s estimation, the Marcellus remains a good play.

“Lots of companies have great inventory even in highly developed areas,” he said, suggesting that Tier 2 areas will become economic at higher oil prices. Even areas that appear to be full of developments have considerable space for more drilling activity.

Wright pointed out that much of the current production is responsibly sourced gas (RSG), which delivers slightly better profits. While it pays only pennies more on the dollar, “the volume is tremendous, and the pennies add up.”

Responsible development will be critical for operators in the region because there are some formidable challenges, Wright said. There is political opposition to drilling, and more financial institutions are making investments based on a company’s ESG performance.

“With the current philosophies about oil and gas and the target on its back, how are we going to proceed with sustainable and responsible development drilling?” Wright asked.

The answer, he said, is to embrace ESG even when there is a lack of clarity about what investors want to see.

Wright pointed out that new regulations from the U.S. Securities and Exchange Commission are out in draft form today, and responses are anticipated in the next month or so. New guidelines have been proposed for ESG investing, and new disclosures will be required for publicly reporting companies.

“The effect on private companies is just a matter of time,” he added. “You can’t have an IPO without having ESG”

Wright said that even though some companies in the oil and gas industry are still coming to grips with what ESG means for them, they need to develop a written ESG policy. This plan should explain how the company is handling anything it is doing in terms of ESG issues.

“Explain what you’re doing with focus on continuous improvement and growth,” he. “Look for the low-hanging fruit. Report community activities and scholarship donations.” Make sure ESG achievements have visibility, he said. “Put it on your web page.”

Wright suggested companies develop metrics by asking themselves questions about operations. “Do you plan to reduce emissions over next 24 months? Do you plan to increase recycled water usage over next 24 months? Are you actively monitoring gas emissions? Do you have a written spill response plan?” These questions have little to do with reserves numbers and future production, he said, but the answers will be vitally important to investors.

Also important, he said, is engaging shareholders and stakeholders because the perception of a company’s performance is in the arena of public opinion.

For companies that do not have a strong ESG story, Wright advised, “Tell it anyway.” If a company is at the bottom in terms of ESG performance, “the only way is up.”

There is good news to share, he said. “The Marcellus and Utica operators are leading the nation in trying to implement these things, and the U.S. is leading the way in reductions globally.”

In the past, it was, “Drill, baby, drill,” he said, but going forward, the industry will have to take a different approach, developing shale gas responsibly from an ESG perspective. “It’s a problem for those who ignore it and an opportunity for those who embrace it,” he said.

“In some cases, sustainability reporting and implementation for these projects will be costly initially, but there will be a higher cost if they are not implemented properly,” he said.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.