Record levels of U.S. LNG exports helped save the natgas market from collapse in 2020. At year-end, all U.S. export terminals were operating at or near capacity. (Source: Shutterstock.com)

Presented by:

[Editor's note: A version of this story appears in the February 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

A warmer-than-usual U.S. winter has dragged on natural gas futures, but sub-$3 won’t last, according to forecasters. Asian demand has rebounded. Industrial demand has rebounded. And supply remains reduced by less oil-well associated gas production.

Near term, however, there’s still too much natgas, according to Rusty Braziel, executive chairman of energy-markets consulting firm RBN Energy LLC.

“U.S. natural gas is now totally dependent on exports to balance supply and demand,” he wrote shortly after New Year’s Day.

As LNG exports “have recovered with a vengeance” and natgas prices “clawed their way back” to more than $2 in the second half of 2020, “the lesson was learned,” he wrote.

“With Lower 48 production in the 90-plus Bcf/d range where it is today, without exports the U.S. market is vastly oversupplied and, if exports are curtailed, prices will respond accordingly.”

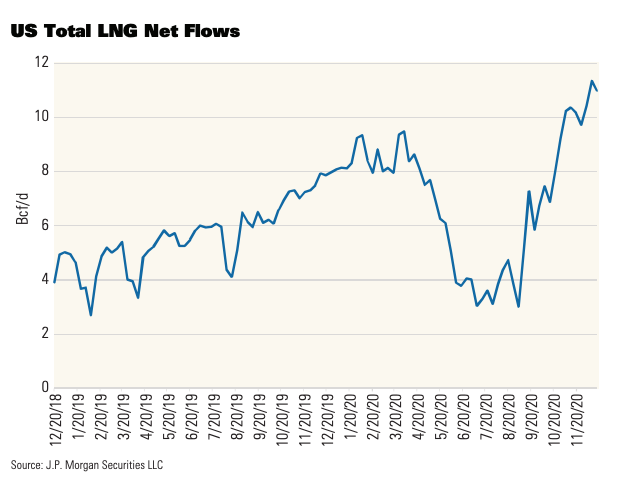

U.S. LNG shipments began 2020 at 8 Bcf/d, grew to 9.5 Bcf/d in early April and slid to 3 Bcf/d in July, according to J.P. Morgan Securities LLC energy analyst Arun Jayaram. They more than recovered by December, setting a new high of 11.6 Bcf/d.

Tankers loaded an average of 11 Bcf/d during the first half of December. Of that, 4.02 Bcf/d was loaded at Sabine Pass, which is the largest U.S. export terminal. The balance of orders was filled at Freeport, 2.03; Corpus Christi, 1.98; Cameron, 1.94; Cove Point, 0.79; and Elba Island, 0.22.

Sheetal Nasta, fundamentals analyst for RBN, wrote at year-end, “Talk about whiplash! Not that long ago, the global LNG market was reeling from the effects of the pandemic: stunted demand, severe oversupply, brimming storage and record low prices—all of which led to a squeeze on offtaker margins and mass cancellations of U.S. cargoes.

“Within a matter of months, however, the market has done a 180.”

All U.S. export terminals were operating at or near capacity approaching year-end. The smallest among them—the Kinder Morgan Inc. 51%-owned Elba Island, Ga., terminal—entered full operation in August. Its capacity is 350 MMcf/d, of which 100% is contracted by Royal Dutch Shell Plc.

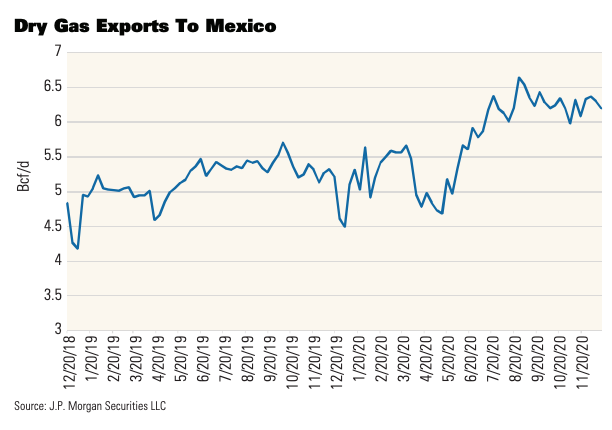

Meanwhile, a meaningful amount of improved demand came from Mexico. Exports were 4.6 Bcf/d exiting 2019; in December, they were 6.3 Bcf/d, and the 2020 average was 5.7 Bcf/d, according to J.P. Morgan.

Winter

But the record exports, even amid reduced production, weren’t showing up in a higher Henry Hub price. Ed Morse, global head of commodity research for Citigroup, said it’s because the U.S. has had a relatively mild winter.

“U.S. [natgas] prices are weaker than they otherwise might have been, largely because of weather-related issues,” he said.

In December, for example, U.S. weather was 4% colder than during December of 2019, but it was “8.5% warmer than normal,” according to an American Gas Association report in early January.

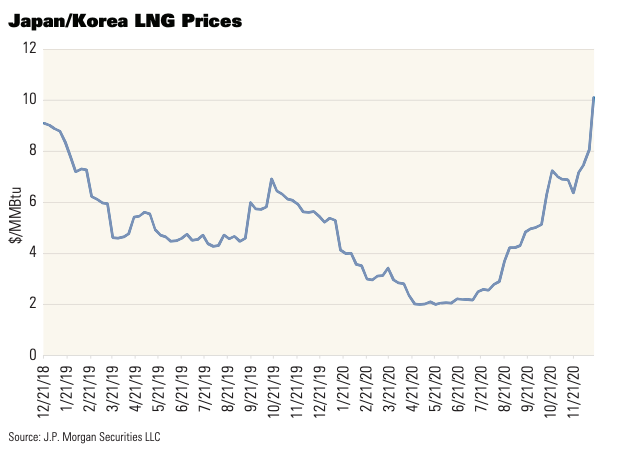

Meanwhile, Asia has had an extraordinarily cold winter, Morse said. Compared with $2 in May 2020, the JKM/Asia LNG price improved 500% to more than $10 in December, which also was the highest price in two years, according to J.P. Morgan’s Jayaram.

The Dutch TTF/Europe price, which was sliding to nearly $1 in May, improved to $5.73 in December.

“The JKM is going to come down,” though, Morse said. “The Chinese government put out an orange alert yesterday [Jan. 4], which said, because the cold spell is so awful, they have to ration gas for commercial and industrial reasons and keep it for power and heating.”

Except for the weather, the JKM didn’t have much reason to be as high as it became. “The JKM is twice as high as we reckoned it would be and that’s all weather-related,” Morse said. “It’s going to come down fairly sharply over the course of 2021.”

As the Dutch TTF improved at year-end, is the economy there rebounding? Morse said the European price improved because the Asian price improved, for the most part.

“Asian prices had lifted European prices. The European market is actually weaker than the price would otherwise indicate.”

It was fortunate for Asia, then, that the U.S. was experiencing a mild winter and had excess supply, it seems. Morse said, “You might say ‘fortunate for Europe’ as well.”

Another factor is in play too, according to J.P. Morgan: An unplanned outage in Qatar “has led to 18% of Qatari vessels that are anchored or at less than 25% of capacity, including 10 vessels anchored off the coast of Ras Laffan, per Platts,” the firm reported.

Dodging ‘a complete meltdown’

The U.S. sub-$3 natgas this winter is certainly better than sub-$2 natgas, but it could be so much worse as “the U.S. gas market this injection season just barely managed to avoid a complete meltdown,” RBN’s Nasta wrote.

As summer was waning, U.S. natural gas was looking at topping off storage capacity—despite a 5 Bcf decline in production.

“It wasn’t until [September and October] that the market tightened enough to escape a major storage crunch,” she wrote in December.

While Asia and Europe were helped this winter by a mild U.S. winter, resulting in access to excess U.S. natgas supply, the U.S. gas-storage situation was helped by other weather: hurricanes.

“In reality,” Nasta wrote, “it took the multipronged effects of production cutbacks—in part from hurricane-related disruptions—higher LNG and pipeline exports, and cooler fall weather to make that happen.”

Gulf of Mexico production entered 2020 at 2.55 Bcf/d and exited at 1.72 Bcf/d—and thrice fell to nearly zero during storm shut-ins, according to J.P. Morgan. Five named storms struck the Louisiana coast in 2020, and all nine of 2020’s Gulf storms traveled through production fairways, according to National Weather Service tracking.

Appalachian and Louisiana onshore (Haynesville, mostly) production grew by about 2 Bcf/d combined in 2020, according to J.P. Morgan. In particular, Appalachia reached 33.8 Bcf/d.

Meanwhile, Permian, Oklahoma, D-J Basin and Gulf production declined from a combined 25 Bcf/d in January 2020 to 22 Bcf/d in December. In the Bakken, production entered and exited 2020 at mostly the same level: about 2.2 Bcf/d.

Overall, U.S. natgas output, which was a record high of 97 Bcf/d in December 2019, according to the Energy Information Administration (EIA), was 90 Bcf/d this past December, according to J.P. Morgan. And it was as little as 87 Bcf/d in June.

“The production decline reversed a three-year trend of consistent growth in U.S. natural gas production,” Kristen Tsai, a “Today in Energy” coordinator for the EIA, reported. The full-year average was 89.8 Bcf/d.

The ‘Amazon effect’

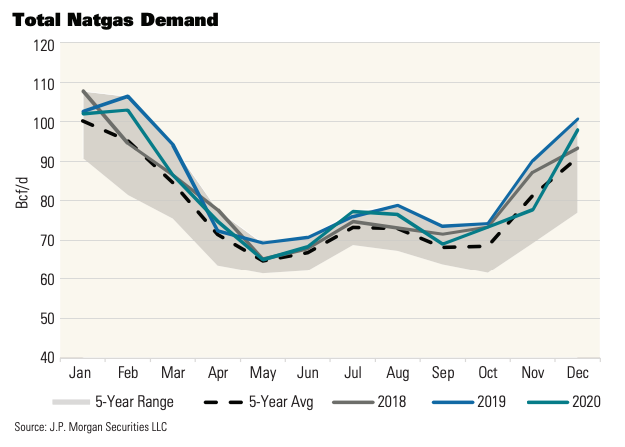

The natgas-demand side hasn’t been as whipped as crude oil demand—in fact, natgas demand grew in some sectors in 2020, instead. J.P. Morgan shows demand exiting 2020—and lacking much of a winter, still—was 6.5 Bcf/d greater (102.7 Bcf/d) than when exiting 2019 (96.2 Bcf/d).

For plant fuel, that was unchanged at about 5 Bcf/d, and pipeline losses were mostly unchanged.

On the power side, demand was about 1.5 Bcf/d less. But a bright spot there is continued growth in natgas share of the powergen market: It reached 31.6 Bcf/d in 2020, up 2% from the 2019 average, according to the EIA’s Tsai.

“This increase occurred despite slightly lower total U.S. electricity consumption this year,” she wrote. In July, power plants set a new oneday record of 47.2 Bcf, she added.

According to the U.S. Bureau of Labor Statistics (BLS), 23.7% of the U.S. workforce was teleworking in December. (The labor subsector that includes dry cleaning lost 12,000 jobs.)

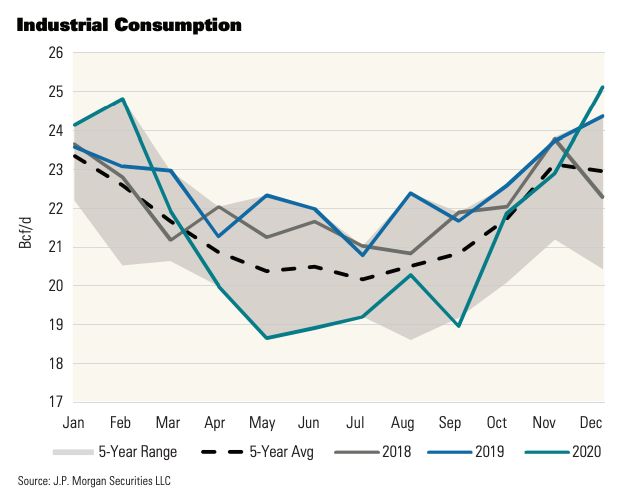

Greater demand was from the industrial sector: up 5.2 Bcf/d. Morse said, “We had December U.S. manufacturing growing at the fastest rate in basically two and a half years.

“It’s the fastest production growth in factory numbers in a decade, which is the real rebound in the COVID-19 slump.”

What is all of this industrial demand while a sizable share of U.S. incomes remained diminished by shuttered or pared in-person jobs? The BLS reported on Jan. 8 that unemployed in December was 10.7 million—that is, 6.7% of the labor force.

“Although both measures are much lower than their April highs,” the BLS added, “they are nearly twice their pre-pandemic levels in February—3.5% and 5.7 million.”

The growth in industrial demand—for goods, that is—reflects what Morse said is a K-shaped recovery: A part of the broad U.S. industry is curtailed, such as in-person retail, while part of it is growing.

It’s an Alexa thing. “So we have an economy that is confusing,” Morse said.

“You can see the confusion in what happened to [physical store] retail sales, which were down in the fourth quarter. On the other hand, deliveries to households were at a record level.

“That’s the Amazon phenomenon: People were spending money, buying things; they just were not doing it out of retail shops.”

Compared with February 2019, employment in leisure and hospitality was down in December by 3.9 million, or 23.2%, according to the BLS. Meanwhile, professional and business services gained 161,000 jobs, with 68,000 of these being temp.

Tech jobs, including gig-industry hardware, gained 20,000. Courier and messenger jobs grew 222,000.

$3-plus gas

J.P. Morgan’s Jayaram forecasts natgas prices averaging more than $3 this and next quarter, “given the lack of weather-related demand in November and the larger-than-anticipated increase in production in the fourth quarter,” he reported.

For the second half, he expects more than $3—of course all of this being “at the mercy of Mother Nature.” For 2022, he also expects an average of more than $3.

Citi’s Morse is seeing $3-plus too. “We think natural gas in the U.S. is going to be decent and strong through 2021,” he said, with this quarter being the poorest performer of the year.

Coming out of that, “We think Henry Hub will be over $3 most of the year after the winter is over,” Morse said.

To just put more and more and more U.S. natgas into LNG tankers is less of an option going forward, he added. “On the gas side, new development of LNG projects is coming to an end.”

But an upside to that is less new competition for LNG-cargo buyers, if more plants aren’t coming on worldwide: “The global gas market could be settling in at higher prices in 2022 and 2023,” Morse said.

New supply?

On the supply side, rigs drilling for natgas reached a record low of 68 in July, and the count remained “relatively low throughout the rest of 2020,” the EIA’s Tsai reported.

Bernstein Research senior analyst, natural gas, Jean Ann Salisbury looked at gas-well performance in December and found that “gas wells have almost stopped improving. Will this eventually translate into higher prices?”

On a percentage basis, new wells in 2019 had averaged a 5% larger IP but minus 1% on a per-lateral-foot basis—an ongoing trend of “all gains in well productivity tied to drilling longer wells,” she wrote.

Producers may have found the edge of the envelope: “This may be as good as it gets in gas basins.”

That—along with continued lower associated gas production and ongoing Appalachian bottlenecks—is good news for generating a higher gas price going forward, she added. But that’s “only if capital discipline holds—that is, behavior will matter more than efficiency.”

When doing natgas math today, how Appalachian and Haynesville economics are faring is still the most crucial factor in the equation. “The gassiness of gas wells versus oil wells can’t be overstated,” she wrote.

“Appalachia and Haynesville accounted for only 13% of total horizontal wells in 2019 but some 50% of new gas.”

She concluded that, with gas wells’ productivity not improving per lateral foot any longer, it’s “a bullish signal for long-term gas price. One lever—improving wells—is effectively gone.”

RBN’s Braziel wrote in early January that there is one drag. In 2019, 80% of the growth in U.S. natgas production was coming from oil wells. While new oil wells were far fewer in 2020, Braziel found that “natural gas has another problem: As shale wells age, they tend to get gassier.”

And the outlook for significantly more new oil wells in the near term? Morse said, “The oil market is either going to hold steady or collapse, and it’s very hard to figure out which of those things is going to happen.

“I happen to think Iran will not be putting 2 MMbbl/day of oil back in the market anytime soon, but other people are thinking it will. So, it’s an issue of a lack of consensus globally.”

Recommended Reading

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

Stena Evolution Upgrade Planned for Sparta Ops

2024-03-27 - The seventh-gen drillship will be upgraded with a 20,000-psi equipment package starting in 2026.

Shell Taps TechnipFMC for 20K System for Sparta

2024-02-19 - The deepwater greenfield project in the Gulf of Mexico targets reserves in the high-pressure Paleogene reservoir.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.