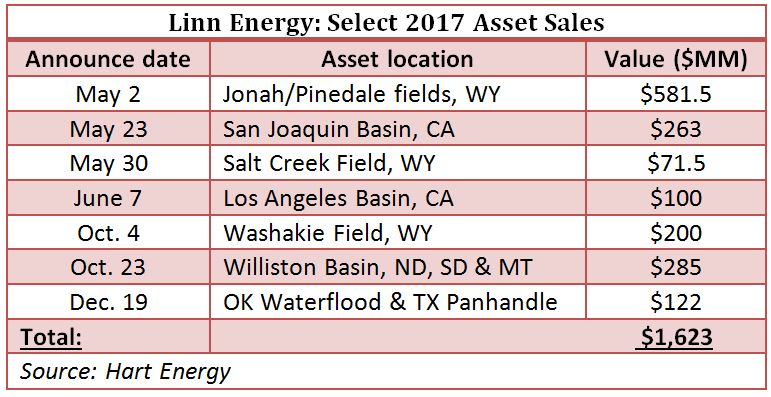

The divestiture of Linn’s mature Oklahoma and Texas assets brings the company’s total asset sales for 2017 to more than $1.6 billion. (Image source: Hart Energy)

Linn Energy Inc. (OTC: LNGG) said Dec. 19 it will close out an already blockbuster 2017 of A&D activity with yet another asset sale as it continues the transformation it embarked on earlier this year.

The Houston-based company agreed to sell its Oklahoma waterflood and Texas Panhandle properties to an undisclosed buyer for $122 million. Combined the assets cover roughly 179,000 net acres with net production of about 5,200 barrels of oil equivalent per day (boe/d) for third-quarter 2017.

Since exiting bankruptcy reorganization in February 2017, Linn has focused on transforming itself from an MLP with assets scattered across the Lower 48 to a streamlined, growth-oriented E&P. As a result, the company has divested or agreed to sell more than $1.6 billion in noncore assets so far this year.

Additionally, Linn said Dec. 14 that it intends to streamline itself further with a proposal to separate into three standalone companies by mid-2018: an E&P focused on Oklahoma shale plays; a midstream business in the same area; and a company made up of Linn’s leftovers.

“The proposed separation is intended to further maximize shareholder returns by unlocking the significant sum of the parts value of Linn’s asset base that we believe is still being significantly discounted by the market,” Mark E. Ellis, Linn’s president and CEO, said in a statement. “Pro forma following the proposed separation, Linn’s shareholders will have focused exposure to three unique companies: a pure-play, high-growth company focused in the prolific Merge/Scoop/Stack play, a rapidly expanding and highly economic midstream business centered in the core of that basin, and, subject to ongoing asset divestitures, a collection of unlevered, low decline and low cost assets that generate significant free cash flow that we believe are currently undervalued when embedded within Linn’s current structure.”

As part of its separation plans, Linn said it is in talks with Citizen Energy II LLC to consolidate ownership in Roan Resources LLC.

Roan, which Linn and Citizen each own a 50% stake in, was formed in August to focus on accelerated development of more than 150,000 net acres in the Scoop/Stack/Merge shale play. Ultimately, Linn is aiming to list Roan on either the New York Stock Exchange or Nasdaq in 2018.

Until the effective date of the separation, Linn plans to continue its current strategy of selling noncore assets.

As of Nov. 14, Linn was marketing its remaining assets in the Permian Basin along with its interest in the Altamont Bluebell Field in Utah. The company also planned to sell its interest in the Drunkards Wash Field in Utah.

Linn said it expects the sale of its mature Oklahoma and Texas assets to substantially reduce its future abandonment liabilities and operating expenses. The annualized field level cash flow of the assets was roughly $21 million, which doesn’t include estimated annual general and administrative expenses of $4 million to $6 million, according to the company.

The combined assets had proved developed reserves of roughly 22.8 million boe and a proved developed PV-10 value of about $124 million.

Linn said it expects the sale of its Oklahoma waterflood and Texas Panhandle assets to close during first-quarter 2018. The transaction will have an Oct. 1 effective date and is subject to satisfactory completion of title and environmental due diligence, as well as the satisfaction of closing conditions.

Jefferies LLC was Linn’s financial adviser for the Texas Panhandle properties and Kirkland & Ellis LLP provided the company with legal counsel for both transactions.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

Sunoco’s $7B Acquisition of NuStar Evades Further FTC Scrutiny

2024-04-09 - The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for Sunoco’s pending acquisition of NuStar Energy has expired, bringing the deal one step closer to completion.