Linn Energy has sold more than $1.8 billion in assets as it prepares to divide into three companies, including one in the Oklahoma Stack. (Image: Hart Energy)

Linn Energy Inc.’s (OTC: LNGG) U.S. asset selling tour most recently rolled into West Texas, where the company said Feb. 14 it agreed to divest conventional assets and production for $119.5 million.

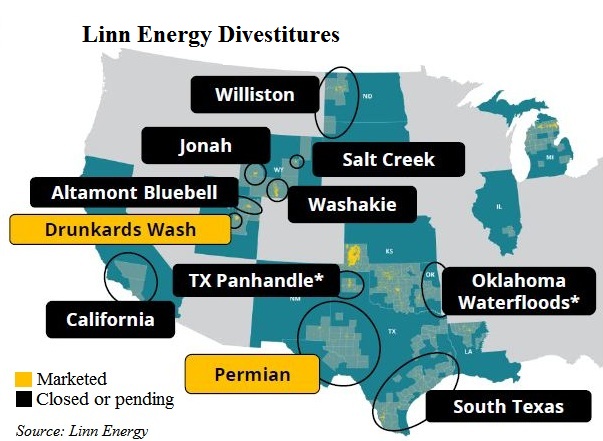

The playlist for the Houston-based company has essentially remained at one song for more than a year: sell out of any asset area that doesn’t fit into its strategy of dividing the company into three new components.

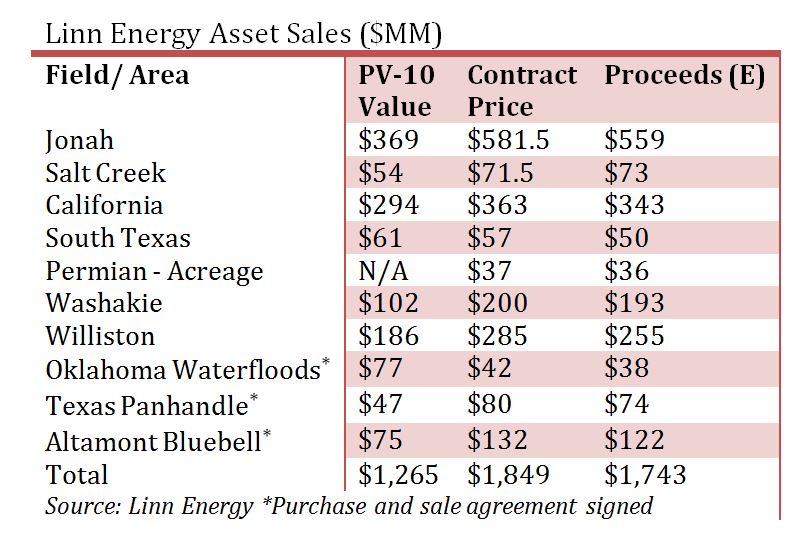

So far, Linn’s contract prices for its assets have eclipsed $1.85 billion.

In its recent divestiture, Linn said it sold about 28,000 net acres in West Texas with average production in 2017 of about 6,300 barrels of oil equivalent per day (boe/d).

Annualized field level cash flow on the properties is about $32 million, Linn said. The company will save an estimated $3 million annually on related general and administrative expenses after the sale closes.

The assets’ proved developed reserves include about 14.4 million boe and a proved developed PV-10 value of about $106 million, continuing Linn’s largely successful divestitures at prices exceeding PV-10 value.

The transaction follows Linn’s announcement in January that it had sold interests in the Altamont Bluebell Field in Utah to an undisclosed buyer for $132 million. The company is also actively marketing its Permian Basin assets in Texas and New Mexico and the Drunkards Wash coalbed methane development in Utah.

Linn’s divestitures are part of a plan to further separate into three companies this year, including Roan Resources LLC, which will operate as a pure-play in the Merge, Scoop and Stack. Linn also has a 105,000 net-acre position in the northwest Stack.

As of Feb. 12, Roan’s net production averaged 40,800 boe/d. Linn holds a 50% equity interest in the company with partner Citizen Energy II. The company has also formed a midstream company in the Midcontinent called Blue Mountain Midstream LLC. A third company with assets in several states has yet to be named.

Linn’s West Texas sale is expected to close first-quarter 2018 with an effective date of Jan. 1. RBC Richardson Barr and Jefferies LLC were Linn’s co-financial advisers and Kirkland & Ellis LLP was its legal counsel for the transaction.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.