Liberty Energy enjoyed a solid quarter of earnings, but weakness in the natural gas market will likely result in its frac crews migrating to oil basins later in the year. (Source: Shutterstock.com)

A weakening natural gas market will likely prompt Liberty Energy to move some fleets to oily basins in the second half of the year, company executives told analysts during the company’s recent earnings call.

The magnitude of such a shift would be relatively modest for Liberty because gas only accounts for 20% of the oilfield service firm’s business, CEO Chris Wright said.

As an industry trend, however, it sends a signal.

“Since we do have a meaningful oversupply of natural gas, the prices have collapsed dramatically,” Wright said. “It’s macro. This is significant.”

While such a move would not affect the company’s financial results, it would mitigate demand in a tight services market.

“The vast majority of frac services are weighted toward oilier basins and are working to simply maintain today’s production levels,” he said. “Today, our calendar remains strong with some expected movement from gas to oilier basins during this transient period. The fundamental outlook for North American hydrocarbons is strong, as constrained global oil supply is confronted by rising demand in emerging markets and a gradual recovery in China.”

Market indifference

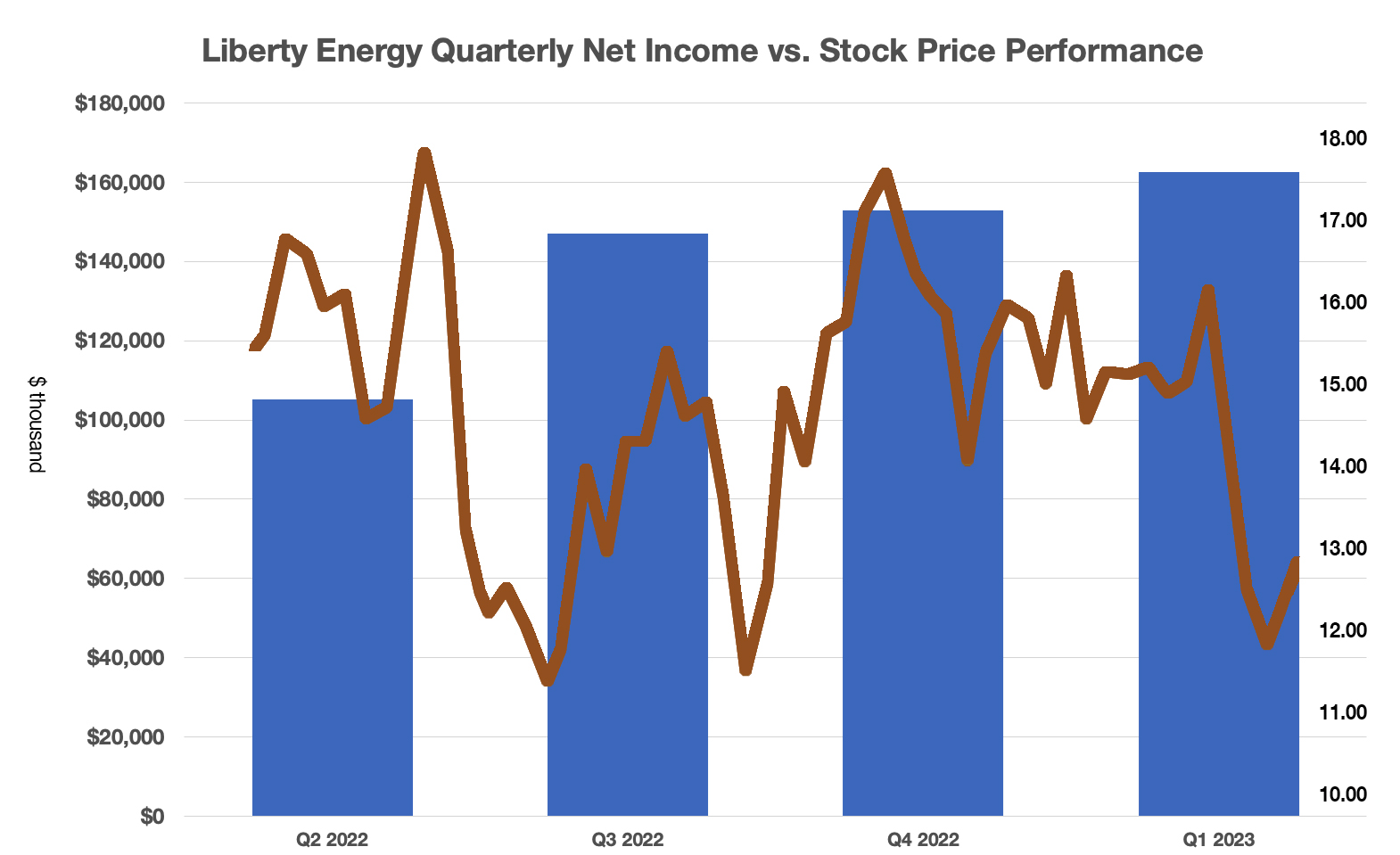

Liberty reported its fourth consecutive quarter of record profitability, with net income of $163 million or $0.90/share, beating the Zacks Equity Research estimate of $0.80 /share. First-quarter revenues of $1.26 billion beat the analyst consensus estimate of $1.25 billion. EBITDA of $330 million beat the consensus expectation of $299 million.

The earnings release, however impressive, was greeted by a collective shrug from Wall Street.

Liberty’s stock languished at $12.16 on the afternoon of May 2, down 36% from its 52-week high. The company repurchased 2.9% of its outstanding shares in the quarter and is authorized to spend another $300 million on stock buybacks. It paid a dividend of $0.05 /share.

“Expectations for LBRT were low and market sentiment has been negative; however, it beat and raised 2Q expectations,” Piper Sandler said in a review of the first week of oilfield service company earnings. The problem, the analysts said, is perception of the sector.

“Even though LBRT beat 1Q EBITDA by 10% and guided 2Q above the Street, it’s hard for North American OFS stocks to re-rate just yet as the negative [North American] OFS thesis can’t be disproved at this point,” Piper Sandler said. “We do believe the market is too negative for what might be another 20-30 rig drop at current commodity prices, but valuation isn’t a catalyst. If earnings don’t fall materially with the anticipated upcoming activity dip, we still believe there could be a multiple re-rating in the back part of the year.”

Liberty is counting on it.

“As we look ahead, early-year strength continues into the second quarter, where we are seeing stable pricing and normal seasonality,” Wright said.

Recommended Reading

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

TotalEnergies Cements Oman Partnership with Marsa LNG Project

2024-04-22 - Marsa LNG is expected to start production by first quarter 2028 with TotalEnergies holding 80% interest in the project and Oman National Oil Co. holding 20%.

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

2024-04-22 - Double Eagle IV is quietly adding leases and drilling new oil wells in core parts of the Midland Basin. After a historic run of corporate consolidation, is it the most attractive private equity-backed E&P still standing in the Permian Basin?