The acquisition of Howard County acreage will shift Laredo Petroleum’s production mix toward oil, says analyst Gabriele Sorbara. (Source: Hart Energy)

Laredo Petroleum Inc. recently tacked on more Permian Basin acreage through a $130 million cash acquisition as the company’s new CEO implements his strategic vision.

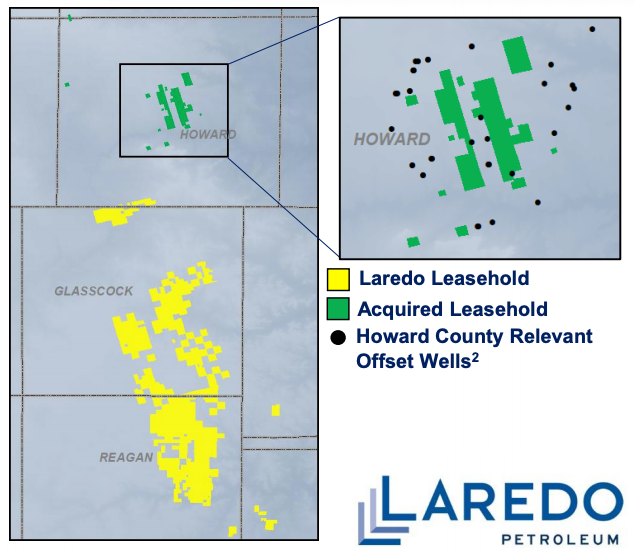

In its third-quarter earnings release, Laredo revealed it had signed a purchase and sale agreement with Cordero Energy Resources LLC on Nov. 4 to acquire 7,360 net acres (96% operated) and 750 net royalty acres in Howard County, Texas. The largely undeveloped acreage is in an area of high oil productivity with offsetting wells indicating first-year production that is 80% oil, according to the company release.

Jason Pigott, who took over as Laredo CEO last month, called the Howard County acreage acquisition Laredo’s next strategic step to maximize and create additional value for its stakeholders.

The Tulsa, Okla.-based independent oil and gas company has worked to answer calls by investors to transform itself into a returns focused company rather than one driven on net asset value accretion.

So far this year, the company has generated almost $40 million of free cash flow by high-grading its existing acreage and additional cost saving initiatives, which included a 20% reduction to its staff plus a total overhaul of its leadership team. Though on Nov. 5, Pigott said this is only the first step for Laredo.

“To implement the second pillar of our strategy, further improving our capital efficiency in corporate returns, we intend to opportunistically pursue transactions ... to target high margin inventory that will move to the front of our development queue,” Pigott said during the company earnings call, according to a Seeking Alpha transcript of the call.

Pigott joined Laredo in May, initially as its president, having previously worked at Anadarko Petroleum Corp. and, more recently, Chesapeake Energy Corp. He was eventually named as successor to Randy A. Foutch, Laredo’s CEO who had founded the company in 2006, effective Oct. 1.

According to Foutch, Pigott has a “positive, profound impact” in a short period of time.

“Since joining Laredo as president in May, his focus on increasing oil productivity and minimizing risk has refocused the company on the Cline formation and improved our Wolfcamp development plan,” Foutch said in a statement in late September.

The Howard County acreage acquisition, expected to close in December, will continue Laredo’s pivot toward oil, said senior equity analyst, Gabriele Sorbara.

“We believe this is a pivotal transaction that shifts its production mix towards oil,” Sorbara, principal at Siebert Williams Shank & Co. LLC, wrote in a research note on Nov. 6. He estimated Laredo is buying the acreage for about $16,000 per net acre. The company plans to finance through its senior secured credit facility.

(Source: Laredo Petroleum Inc. Investor Presentation November 5, 2019)

The transaction is expected to add 120 gross (100 net) primary locations in the Lower Spraberry and Upper and Middle Wolfcamp formations, which Pigott said Laredo will begin drilling in first-quarter 2020.

“This is not acreage that is being acquired to languish our development queue as we expect to begin drilling our first package in the first quarter of 2020 and that the majority of our completions will be on this acreage in the 2020 to 2022 timeframe,” he said on the earnings call.

He also added that Laredo currently expects to develop the locations in 16 well packages targeting primary zones to limit future parent/child interactions.

Recommended Reading

Enterprise Buys Assets from Occidental’s Western Midstream

2024-02-22 - Enterprise bought Western’s 20% interest in Whitethorn and Western’s 25% interest in two NGL fractionators located in Mont Belvieu, Texas.

Report: Occidental Eyes Sale of Western Midstream to Reduce Debt

2024-02-20 - Occidental is reportedly considering a sale of pipeline operator Western Midstream Partners as the E&P works to close a $12 billion deal in the Permian Basin.

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

2024-02-29 - Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

2024-02-12 - The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.

E&P Highlights: Feb. 12, 2024

2024-02-12 - Here’s a roundup of the latest E&P headlines, including more hydrocarbons found offshore Namibia near the Venus discovery and a host of new contract awards.