Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

President Joe Biden signed the landmark Inflation Reduction Act (IRA) into law on Aug. 15, which contains several renewable energy tax breaks to help companies and U.S. consumers transition to clean energy.

While the legislation includes several incentives for traditional forms of renewable energy like wind and solar, it also contains more robust incentives and tax credits for producers, developers, and investors seeking to build new carbon capture, utilization, and storage (CCUS) facilities.

How Do The New Provisions In The IRA Impact CCUS?

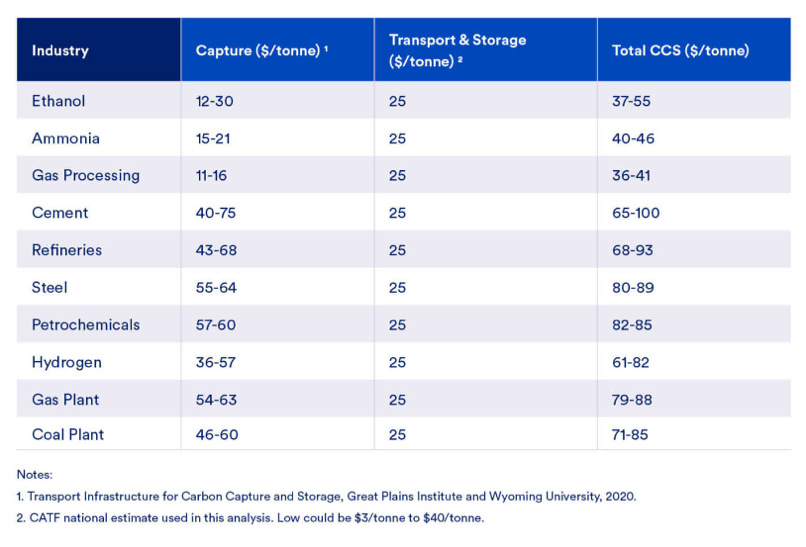

The passage of the IRA means that carbon capture technologies are within closer reach for industries whose greenhouse-gas emissions are more costly to capture and sequester. Previously, only those sources whose emissions contained a very high concentration of CO₂, like ethanol plants, were viable candidates for carbon capture deployment. With the increased credits in the IRA, other industries, like steel, cement, refineries, and chemicals may be able to reduce their carbon emissions using CCUS.

The IRA includes about $369 billion in incentives for clean energy and climate-related program spending, including carbon capture projects. Specifically, the IRA:

- Substantially increases the availability of the federal income tax credits available for domestic CCUS projects (often referred to as “45Q credits”) to $85 per ton (/ton) for sequestering CO₂ produced by industrial activity, up from $50/ton;

- 45Q incentives increase from $35/ton to $60/ton for utilization from industrial and power generation carbon capture;

- 45Q incentives increase from $50/ton to $180/ton for storage in saline geologic formations from direct air capture (DAC)

- 45Q incentives increase from $50/ton to $130/ton for utilization from DAC;

- The 45Q credit can be realized for 12 years after the carbon capture equipment is placed in service and will be inflation-adjusted beginning in 2027 and indexed to base year 2025; and

- 45Q’s “commence construction” window is extended seven years to January 1, 2033. This means that projects must begin physical work by then to qualify for the credit.

Another major change in the IRA is the inclusion of a direct payment option for receiving the credit, which will allow the owners of carbon capture equipment to receive their credits as if they were overpayment of taxes. This is significant because under previous legislation the credit could only be taken to the extent it offset current taxes; this limitation would often require the creation of complex “tax equity” financial structures to monetize the credits.

While this is an important change, unfortunately, for-profit, tax-paying entities can only use the direct payment option for five years after the carbon capture equipment is placed in service. Tax-exempt entities such as states, municipalities, Tribes, and cooperatives can realize the direct payment option for the full 12 years after the carbon capture equipment is placed in service. Another related provision in the IRA is a one-time option to sell future credits to a third party, but there are unresolved questions regarding the implementation of this aspect.

Additionally, the IRA broadens the definition of “qualified facilities”; that is, those facilities that are eligible to claim the credit:

- The capture threshold for credit-eligible power generation facilities will decrease from 500,000 tons of CO₂ emitted per year to 18,750 tons;

- For industrial facilities, it will decrease from 100,000 tons of CO₂ emitted per year to 12,500 tons;

- For DAC facilities, it will decrease the amount of CO₂ capture requirements from 100,000 tons captured per year to 1,000 tons per year; and

- Power generation facilities seeking to qualify for the credit must meet a capture design capacity requirement of not less than 75% of the CO₂ from an electricity-generating unit that will install capture equipment.

Taken together, these changes are anticipated to significantly increase the number of carbon capture projects that will enter service over the coming years.

How Much Carbon Can Be Economically Captured and Stored?

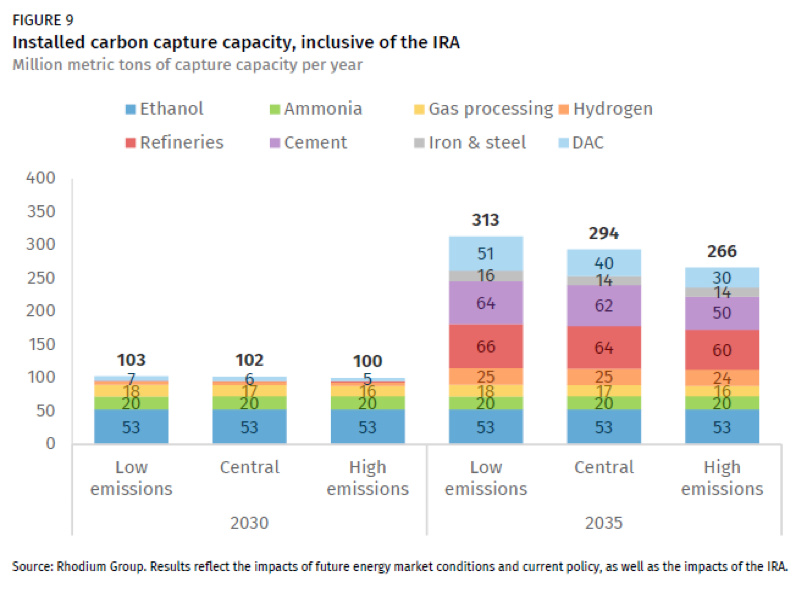

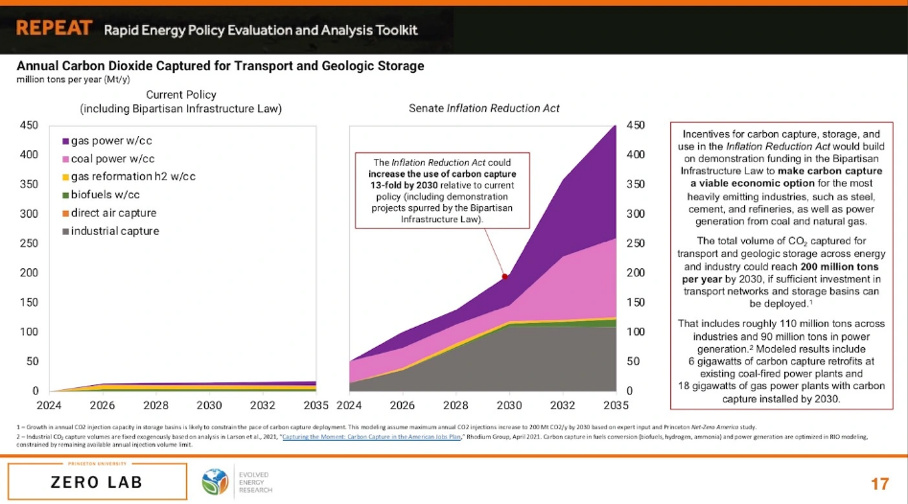

The IRA is expected to help the U.S. reduce overall emissions by about 40% below 2005 levels by 2030, compared with the 24%-40% cuts we’re on track for today. But estimates of the role carbon capture will play in achieving this target vary, depending on its application. A widely-cited analysis of the IRA by consulting outfit Rhodium Group concluded that carbon capture could deliver between 4% and 6% of that progress and more in future years. A separate analysis by Princeton University’s REPEAT Project found that the IRA could result in the sequestration of nearly 1 billion metric tons of CO₂ by 2030.

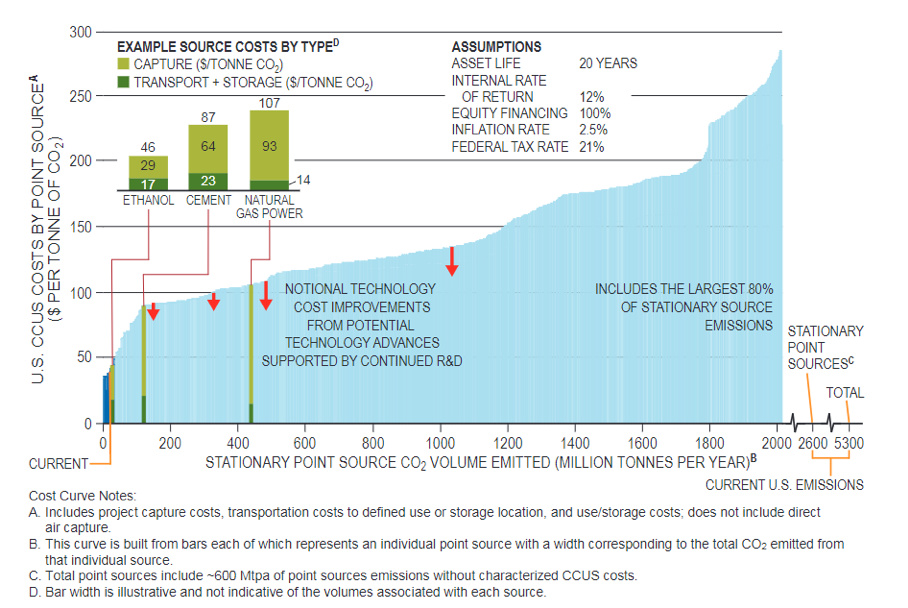

The cost of capturing CO₂ is strongly influenced by its concentration in the emissions stream. For example, fermentation processes at ethanol plants produce a highly pure CO₂ stream that’s relatively inexpensive to capture compared to CO₂ from a gas- or coal-fired power plant. In the power generation cases, the fuels are burned in the air, which is mostly non-combustible nitrogen, so the flue gas is also mostly nitrogen. Removing the dilute CO₂ from the flue gas requires more equipment and higher operating costs.

Underground storage of CO₂ is generally considered to have three stages: capture, transportation, and storage. According to a recent National Petroleum Council report, titled “Meeting The Duel Challenge – A Roadmap to At-Scale Deployment of Carbon Capture, Use, And Storage”, the costs associated with each stage of the CCUS process are dependent on site-specific circumstances that vary with each project. For example, capture costs vary with CO₂ concentrations as noted above, while transport costs vary based on the value, distance, and terrain over which CO₂ is transported. Storage costs also vary depending on the location, depth, and nature of the storage formation.

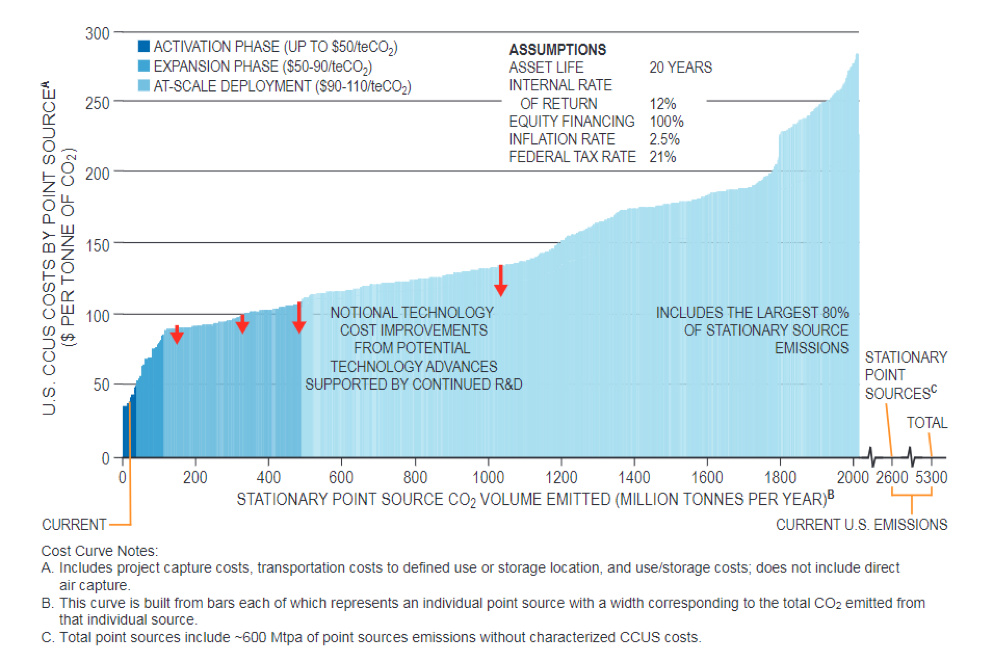

In its analysis, the NPC assessed the costs of capturing, transporting, and storing CO₂ emissions from 80% of the largest U.S. stationary sources (see below). As of 2019, there are currently 10 large-scale CCUS projects operating in the U.S. and have captured and stored about 160 million metric tons of CO₂ up to that time, according to the NPC citing data from the Global CCS Institute.

The NPC presented its results as a CO₂ cost curve where the total cost to capture, transport, and store one metric ton of CO₂ from stationary sources is plotted against the volume of CO₂ abatement it could provide (see below). As explained by the NPC report, the costs for individual projects “will vary based on location factors and the economic assumptions specific to each project.”

Using the NPC study as a guide, it seems likely that the increased level of tax credits in the IRA will lead to a significant increase in CCUS deployment. Nevertheless, the NPC cost curve also shows that credits of $85/ton still leave the vast majority of stationary source CO₂ emissions out of reach. If CCUS is to mitigate these emissions, its costs will need to decline, or the credits will need to be increased. It may be that the government’s logic is to provide enough incentives to address the lowest-cost emissions reduction opportunities first, rather than waste money by setting the credit at a level that is much greater than needed to incentivize carbon capture deployment. As these low-cost sources are addressed, we may see the credits increased in future years for new CCUS installations that capture the high-cost emissions.

Summary

The tax credits contained in the IRA are a significant step forward in the deployment of carbon capture and sequestration technologies as a means to reduce CO₂ emissions. Previous tax credit levels were sufficient to have only incentivized a handful of domestic carbon capture projects, but the new credit amounts and the reduction in the qualifying facility size should open several new, economically viable installations.

About The Authors:

Steve Hendrickson is president of Ralph E. Davis Associates (RED), an Opportune LLP company. Hendrickson has over 35 years of professional leadership experience in the energy industry with a proven track record of adding value through acquisitions, development, and operations. Before joining Opportune, he was the principal of Hendrickson Engineering LLC, a licensed petroleum engineering firm focused on reserves assessment and property valuation supporting property acquisitions and divestitures. Hendrickson began his career at Shell Oil as an engineer in Permian Basin waterfloods and CO₂ floods. After 16 years at Shell, he focused on leading upstream oil and gas reserves evaluation/engineering projects serving in management or as an executive at several E&P companies, including El Paso Production Co., Montierra Minerals & Production LP and Eagle Rock Energy Partners LP. Steve is a licensed professional engineer Texas and Pennsylvania and holds an M.S. in Finance from the University of Houston and a B.S. in Chemical Engineering from The University of Texas at Austin. He recently served as a board member of the Society of Petroleum Evaluation Engineers (SPEE) and is a registered FINRA representative.

Steve Hendrickson is president of Ralph E. Davis Associates (RED), an Opportune LLP company. Hendrickson has over 35 years of professional leadership experience in the energy industry with a proven track record of adding value through acquisitions, development, and operations. Before joining Opportune, he was the principal of Hendrickson Engineering LLC, a licensed petroleum engineering firm focused on reserves assessment and property valuation supporting property acquisitions and divestitures. Hendrickson began his career at Shell Oil as an engineer in Permian Basin waterfloods and CO₂ floods. After 16 years at Shell, he focused on leading upstream oil and gas reserves evaluation/engineering projects serving in management or as an executive at several E&P companies, including El Paso Production Co., Montierra Minerals & Production LP and Eagle Rock Energy Partners LP. Steve is a licensed professional engineer Texas and Pennsylvania and holds an M.S. in Finance from the University of Houston and a B.S. in Chemical Engineering from The University of Texas at Austin. He recently served as a board member of the Society of Petroleum Evaluation Engineers (SPEE) and is a registered FINRA representative.

Bryan Sims is the content director with the marketing team at Opportune LLP based in Fargo, N.D. A native of Grand Forks, N.D, Sims is an accomplished content writer, storyteller, and editor with over 10 years of experience as a journalist covering the energy industry. Before Opportune, Sims was a reporter with Thomson Reuters where he covered the cash crude oil market, regularly interfacing with traders, brokers, and shippers to gain market insight for articles, as well as reporting on oil import/export trends and the midstream oil and gas sector. Before Reuters, Sims served as executive editor at Hart Energy where he produced and managed content covering key oil and gas industry trends for the company’s website and publication titles such as Downstream Business (formerly FUEL magazine), Oil & Gas Investor and Midstream Business. He holds a B.A. in Communication from The University of North Dakota and is a 20-year veteran of the Army National Guard.

Bryan Sims is the content director with the marketing team at Opportune LLP based in Fargo, N.D. A native of Grand Forks, N.D, Sims is an accomplished content writer, storyteller, and editor with over 10 years of experience as a journalist covering the energy industry. Before Opportune, Sims was a reporter with Thomson Reuters where he covered the cash crude oil market, regularly interfacing with traders, brokers, and shippers to gain market insight for articles, as well as reporting on oil import/export trends and the midstream oil and gas sector. Before Reuters, Sims served as executive editor at Hart Energy where he produced and managed content covering key oil and gas industry trends for the company’s website and publication titles such as Downstream Business (formerly FUEL magazine), Oil & Gas Investor and Midstream Business. He holds a B.A. in Communication from The University of North Dakota and is a 20-year veteran of the Army National Guard.

Recommended Reading

New BOEM Regulations Raise Industry Decommissioning Obligations by $6.9B

2024-04-15 - Under new regulations, the Bureau of Ocean Energy Management estimates the oil and gas industry will be required to provide an additional $6.9 billion in new financial assurances to cover industry decommissioning costs.

US Finalizes Big Reforms to Federal Oil, Gas Drilling

2024-04-12 - Under the new policy, drilling is limited in wildlife and cultural areas and oil and gas companies will pay higher bonding rates to cover the cost of plugging abandoned oil and gas wells, among other higher rates and costs.

Exclusive: ‘Reality Has Hit,’ NatGas Not Just a Bridge Fuel, Landrieu Says

2024-04-11 - The Biden administration's LNG pause is "disappointing" and natural gas is a "solution to energy woes," co-chairs for Natural Allies for a Clean Energy Future Senator Mary Landrieu and Congressman Kendrick Meek told Hart Energy's Jordan Blum at CERAWeek by S&P Global.