Kosmos CEO Andrew Inglis said he believes a huge opportunity has opened in the U.S. Gulf of Mexico as many competitors leave the region for onshore shale. (Source: Shutterstock.com)

[Editor's note: This story was updated at 1:02 p.m. CST Aug. 6.]

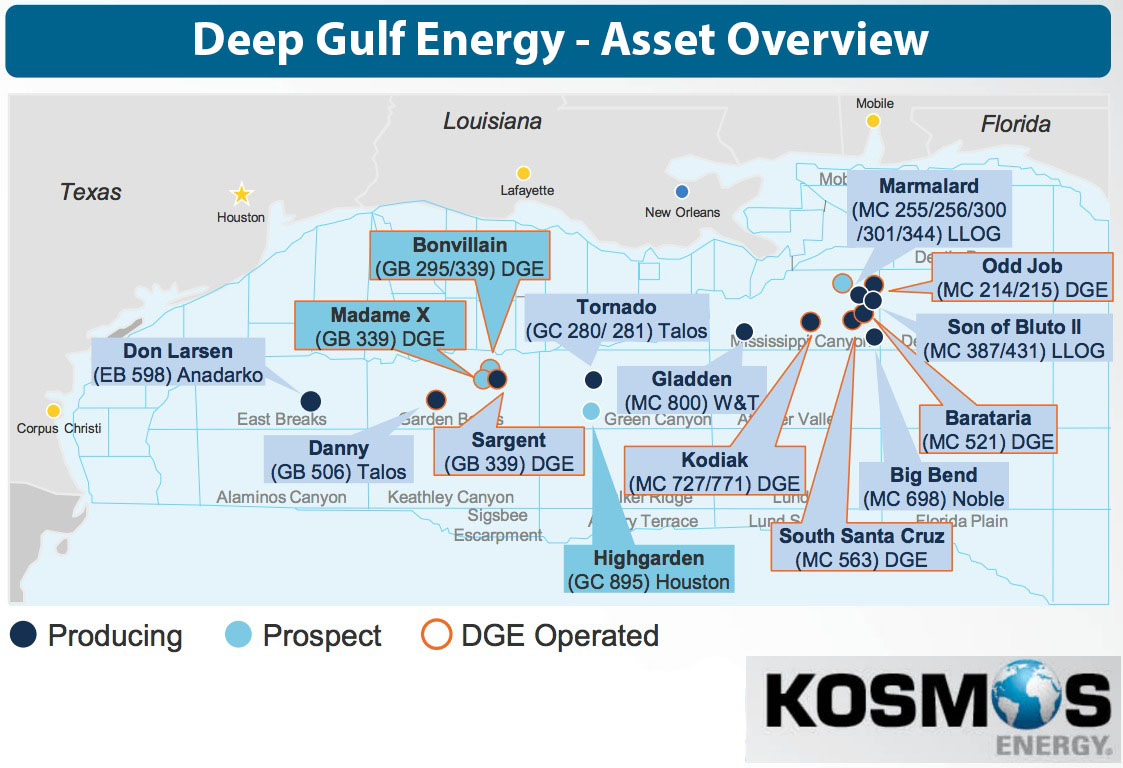

Kosmos Energy Ltd. (NYSE: KOS) said Aug. 6 it will acquire Deep Gulf Energy Cos., a portfolio company of First Reserve with deepwater assets in the U.S. Gulf of Mexico (GoM), for about $1.23 billion in cash and stock.

The purchase of Deep Gulf is Kosmos’ largest acquisition and gives the company an entryway into the U.S. GoM. Currently, Kosmos’ assets are focused offshore West Africa and South America.

Kosmos Chairman and CEO Andrew G. Inglis said the company’s entry into the U.S. GoM is perfectly timed.

“With many competitors leaving the Gulf of Mexico to chase onshore shale plays, a huge opportunity has opened in the basin,” Inglis said in a statement. “The best deepwater assets can compete with the best of shale, and now is a good time to enter the Gulf of Mexico.”

Based in Dallas, Kosmos is a pure-play deepwater oil and gas company with assets focused on frontier and emerging areas along the Atlantic Margin, including offshore Ghana and Equatorial Guinea as well as Cote d'Ivoire, Mauritania, Morocco, Sao Tome and Principe, Senegal and Suriname.

On Aug. 6, the company also reported a net loss of $103.3 million, or $0.26 per diluted share, for the second quarter as higher costs and expenses offset increased revenues.

Still, Inglis said the Deep Gulf acquisition will create a platform for Kosmos to double production in the next four years.

“With this acquisition, Kosmos continues to grow into a larger, more balanced exploration and production company, with increasingly diversified production, a pipeline of world-class development projects, and a portfolio of short- and longer-cycle exploration opportunities,” he said.

Inglis is no stranger to the U.S. GoM, having spent 30 years of his career with BP Plc (NYSE: BP). He left BP in 2010 as head of its E&P business. He later joined Kosmos in March 2014 from Petrofac, after leading the firm’s integrated energy services division.

The acquisition of Deep Gulf will add roughly 25,000 barrels of oil equivalent per day (boe/d) of production (about 85% oil), with an estimated reserves-to-production ratio of 8.8, growing 2018 pro forma production by 50% to 70,000 boe/d from about 45,000 boe/d.

Under the terms of the transaction, Kosmos agreed to acquire Deep Gulf from First Reserve for $925 million cash and $300 million in Kosmos common shares.

First Reserve first backed the Deep Gulf Energy team in 2005 as part of its focus on supporting experience management teams. During that time, the private equity firm has backed the Deep Gulf team in three separate vehicles.

Deep Gulf Energy's management team is made up of a core group of mostly ex-Mariner Energy founders and personnel with a total of more than 300 years of E&P experience including over 175 years in the deepwater Gulf of Mexico, according to a First Reserve press release.

Richard Clark, president of Deep Gulf, said in a statement: “We look forward to becoming a part of the Kosmos team which, we believe, will not only enhance our exploration focus in the deepwater Gulf of Mexico but will add overall value and skills to the Kosmos group.”

Kosmos intends to fund the cash portion of the purchase price with borrowings under its existing credit facilities. In connection with the transaction, the company has also received $200 million of additional firm commitments to increase its reserves-based loan facility capacity.

The transaction is expected to close around the end of third-quarter 2018.

Law firm Gibson, Dunn & Crutcher LLP represented First Reserve in its sale of Deep Gulf Energy to Kosmos. Vinson & Elkins represented Deep Gulf and Kosmos was represented by Davis Polk.

Evercore Inc. and Goldman Sachs & Co. LLC were financial advisers to Kosmos. Barclays was an adviser for First Reserve and Deep Gulf Energy. Lazard Freres & Co. LLC and Moelis & Co. provided fairness opinions to the special committees of the Deep Gulf Energy vehicles in the transaction.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.

Canada’s First FLNG Project Gets Underway

2024-04-12 - Black & Veatch and Samsung Heavy Industries have been given notice to proceed with a floating LNG facility near Kitimat, British Columbia, Canada.

Biden Administration Argues Against Enbridge Pipeline Shutdown Order

2024-04-11 - The U.S. argues that shutting down the pipeline could interrupt service and violate a 1977 treaty between the U.S. and Canada to keep oil flowing.