Sign at former landfill explains how the landfill gas collected and used for power generation. (Source: Michael Vi / Shutterstock)

Midstream player Kinder Morgan is making headway on several renewable natural gas (RNG) facilities, one of which is set to be placed in service in the coming weeks, the company said as it eyes a recovery in the cellulosic biofuel renewable identification number (D3 RIN) price.

More than 18 months after announcing the start of construction activities, Kinder Morgan said the Twin Bridges landfill RNG facility in Indiana is in the final stage of commissioning and will enter service within weeks.

The facility near the Waste Management-operated landfill will convert about 8.64 million standard cubic feed per day (MMscf/d) of landfill gas into pipeline-quality RNG.

Two more RNG projects—one of each at the Liberty and Prairie View landfills in Indiana—are expected online within the coming months, the company said April 19 in its earnings release.

When complete, the three Indiana RNG facilities together will add about 3.9 Bcf of RNG to Kinder Morgan’s total annual capacity. The facilities joined Kinder Morgan’s portfolio in 2021 with the company’s purchase of RNG developer Kinetrex Energy from an affiliate of Parallel49 Equity, adding RNG to Kinder Morgan’s Energy Transition Ventures.

RNG—biogas that has been upgraded to pipeline quality—has been attracting investment as companies see opportunity in its lower carbon profile and its decarbonization abilities. Coupled with incentives in the Inflation Reduction Act, companies—including traditional oil and gas players—are targeting RNG assets that capture naturally occurring methane from landfills, dairy farms and other such sources.

“Through our investments in renewable natural gas, renewable diesel and carbon capture and sequestration facilities, we are participating in the transition to cleaner energy,” Executive Chairman Rich Kinder said on the company’s earnings call April 19.

Through participation in the Federal Renewable Fuel Standard program, producers can generate a D3 RIN, further adding value to RNG as it pushes up the realized price to improve economics.

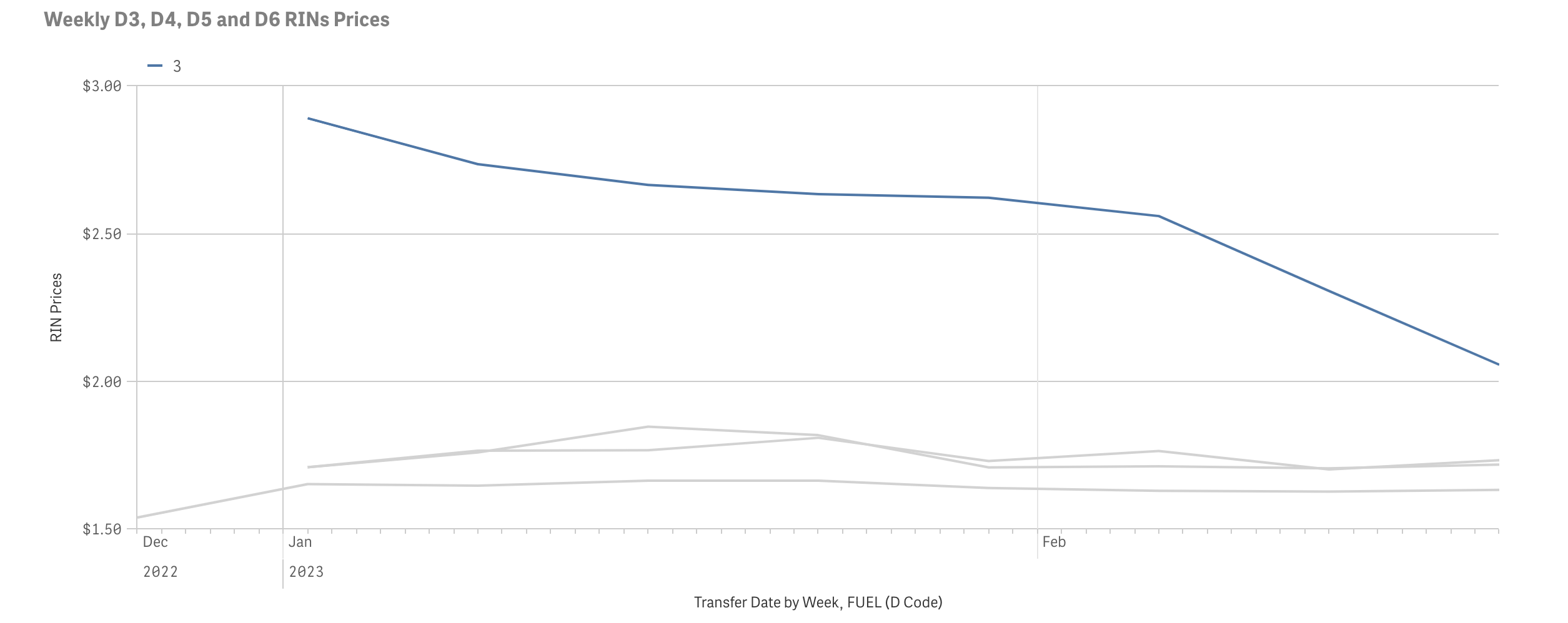

However, the price of D3 RINs has fallen recently.

Price dip

Data from the U.S. Environmental Protection Agency shows the D3 RIN price was $2.89 in early January. The price dropped to $2.06 in late February. That’s down from $3.07 in April 2022.

Anthony Ashley, Kinder Morgan’s president of CO2 and Energy Transition Ventures, addressed the potential impact on RNG projects to an analyst.

“What we’ve seen is a bit of a short-term phenomenon with—and it kind of resulted out of the EPA proposal that came out last November. They came out with proposed RVO [Renewable Volume Obligation] targets, which I think the market realizes were too low. So [that] threw the market into excess supply. The current prices today, there’s really no liquidity. I don’t think there’s necessarily any basis in those numbers.”

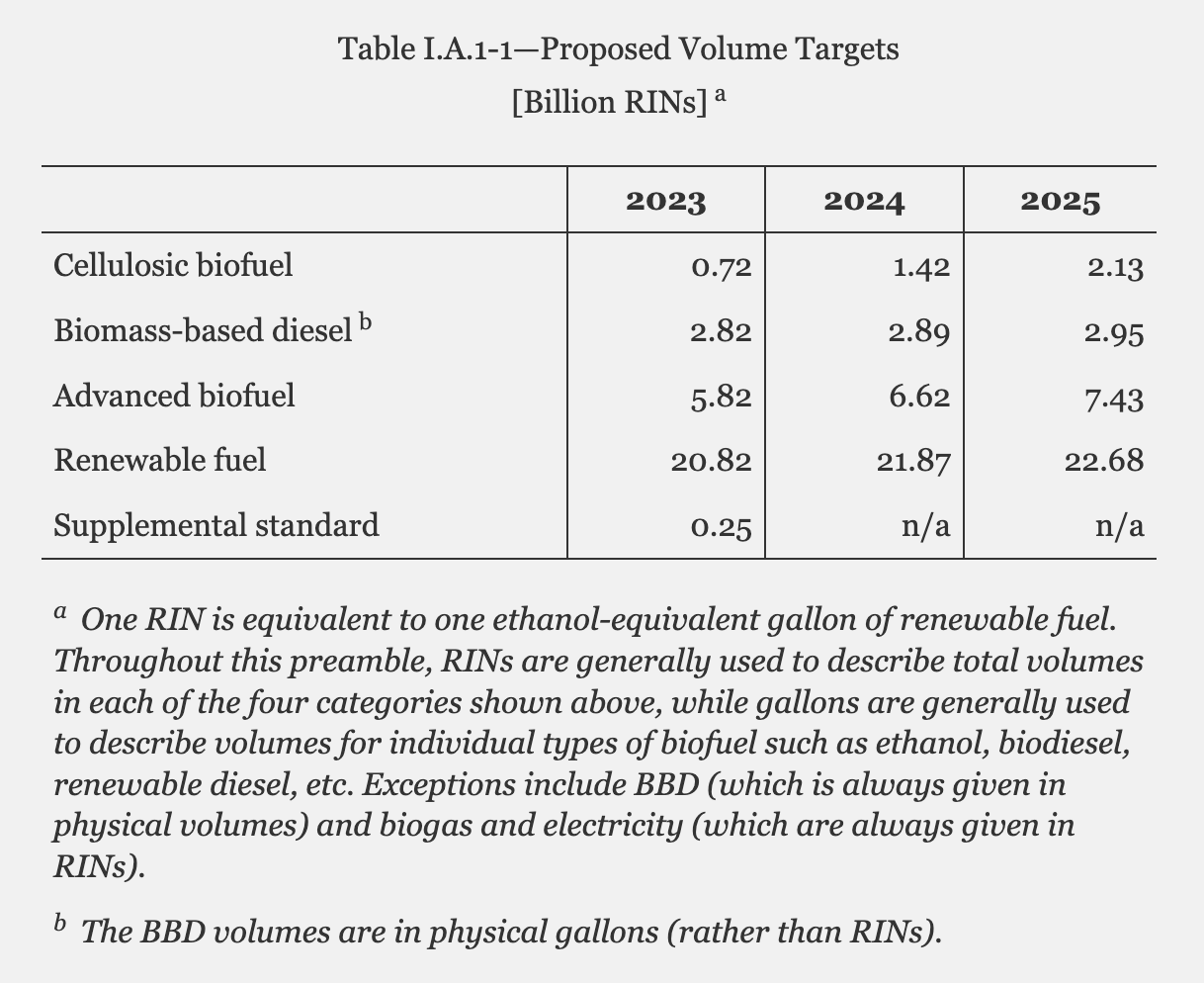

Late last year, the EPA proposed a rule that set required RVO targets and percentage standards through 2025 alongside changes to the RFS standards.

“I think there’s substantial evidence for the EPA when it comes out with its final ruling in June to increase those targets, and we fully expect RIN prices to recover in the second half of the year,” Ashley said.

Kinder Morgan is not a forced seller of D3 RINs, CEO Steve Kean added.

“We’re not forced for funding or financing or other reasons to come out into this market at this point,” Kean said. “We look to stress test our project returns to make sure there’s still good returns under different RIN pricing scenarios. The projects and the investments that we’ve made in this sector still look good.”

Kinder Morgan said it will begin monetizing RINs from Twin Bridges in the third quarter of 2023.

Weighing options

The company said it also is making progress on its Autumn Hills conversion project in Ottawa County, Michigan, where it will generate an additional 0.65 Bcf of RNG annually. Permitting and engineering design are underway, and the site is planned to enter service in second-quarter 2024.

Proposed EPA regulations that allow the creation of e-RINs from biogas to generate electricity regarding electric vehicles could usher in more changes.

“In light of those regulations, KMI is evaluating whether to keep other sites that the company initially planned to convert to RNG dedicated to producing electricity instead,” Kinder Morgan said in a statement. “Doing so could provide earnings upside opportunities with minimal additional capital investment, thus improving the net present value of the investment.”

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.