In a statement, Ryan Watts, president and CEO of Springbok Investment Management and manager of the Springbok entities, called Kimbell “the natural acquiror” of the company’s acreage. (Source: Shutterstock.com)

Kimbell Royalty Partners LP added to its coffers on Jan. 9 with the multimillion-dollar acquisition of private equity backed Springbok Energy Partners LLC

Kimbell has agreed to acquire the mineral and royalty interests held by the Dallas-based company and its affiliates in a cash and stock transaction valued at $175 million.

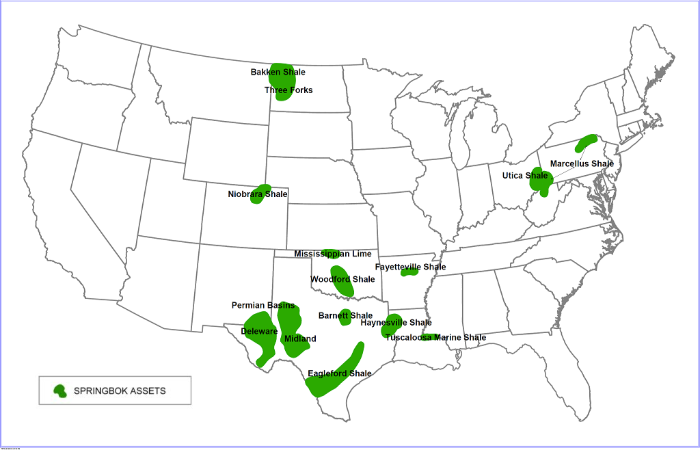

Backed by NGP Energy Capital Management LLC, Springbok has assembled a position of more than 13,000 mineral interests across 15 unconventional resource plays in 10 states. In total, the company and its affiliated predecessor entities have invested over $200 million of investors’ capital over the past 10 years.

In the Jan. 9 news release, Ryan Watts, president and CEO of Springbok Investment Management LP and manager of the Springbok entities, called Kimbell “the natural acquiror” of the company’s acreage.

Since its IPO in 2017, Kimbell has become a major consolidator within the oil and gas mineral and royalty space, completing over $700 million worth of transactions.

“We believe strongly in the continued future success of Kimbell as a leading consolidator in the highly fragmented national minerals market,” Watts said in a statement.

Nearly half of the purchase price of the Springbok transaction is comprised of equity in Kimbell and its affiliate Kimbell Royalty Operating LLC valued at $80 million. Kimbell intends to pay for the $95 million cash portion of the purchase price through a combination of an underwritten public offering of common units and borrowings under its revolving credit facility.

The Springbok acquisition is expected to further solidify Kimbell’s position in the Permian Basin by adding mineral interests in the Delaware Basin and further bolster its Eagle Ford Shale, Bakken Shale, Haynesville, Stack and Denver-Julesburg Basin positions.

In particular, the Delaware Basin represents 29% of the rig activity included in the acquisition.

“Included with this acquisition is our first meaningful addition from the Delaware Basin since our initial public offering, which is an area where we are finally seeing opportunities that we believe have the right balance of existing and future drilling locations,” Bob Ravnaas, chairman and CEO of Kimbell’s general partner, said in a statement.

Kimbell estimates that, as of Oct. 1, the Springbok assets produced 2,533 barrels of oil equivalent per day (6:1) and included 2,160 net royalty acres.

Ravnaas added in his statement that he is optimistic about the future development of the assets for many years to come.

Upon closing, Kimbell expects to have over 13 million gross acres, 145,917 net royalty acres and a total of 93 active rigs on its properties, which represents about 12% of the total active land rigs drilling in the continental U.S., according to the company news release.

The companies anticipate to close the transaction in the second quarter. The effective date of the acquisition is Oct. 1.

Baker Botts LLP and Kelly Hart & Hallman LLP provided legal counsel to Kimbell for the transaction. Willkie Farr & Gallagher LLP served as legal counsel to the Springbok entities with TenOaks Energy Advisors LLC acting as financial adviser.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.