The deal to purchase Permian Basin interests from Austin-based Hatch Royalty LLC is Kimbell’s largest transaction since 2018.(Source: G B Hart/Shutterstock.com)

Kimbell Royalty Partners LP on Dec. 15 closed its acquisition of 889 net royalty acres in the Delaware and Midland basins for cash and units valued at approximately $270.7 million, the company said.

The deal to purchase Permian Basin interests from Austin-based Hatch Royalty LLC is Kimbell’s largest transaction since 2018. Kimbell closed the deal at roughly $20 million was less than the $290 million the company had announced in November.

Backed by Ridgemont Equity Partners, Hatch’s assets consist of 889 net royalty acres on 230,000 gross acres located in the Delaware Basin (90%) and Midland Basin (10%), according to Kimbell.

Kimbell paid for the Hatch assets through a combination of $150.4 million in cash and approximately 7.3 million common units of Kimbell Royalty Operating LLC valued at $120.3 million.

Under the terms of the deal, Kimbell will collect at cash flow from production attributable to the acquired assets since Oct. 1, 2022.

Kimbell estimated that, as of Oct. 1, the assets produced approximately 2,072 Boe/d (1,198 bbl/d of oil, 372 bbl/d of NGL and 3,012 Mcf/d of natural gas).

For full-year 2023, Kimbell estimates that the assets will produce approximately 2,522 Boe/d (1,439 bbl/d of oil, 461 bbl/d of NGLs and 3,730 Mcf/d of natural gas).

The deal is Kimbell’s first since it closed a $57 million multi-basin deal last December, and the company’s largest since it acquired Haymaker Minerals & Royalties LLC and Haymaker Resources LP for about $404 million in cash and stock four years ago. Since 2018, the company has made about $900 million in acquisitions.

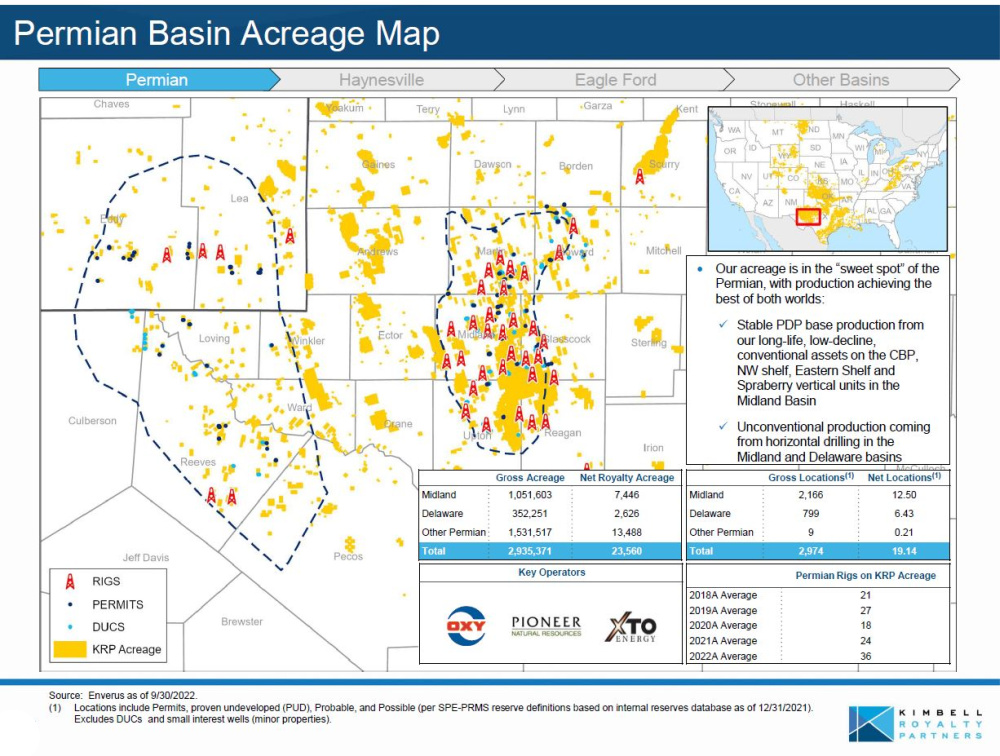

For Kimbell, the transaction reestablishes the Permian as its leading basin for production, active rig count, DUCs, permits and undrilled inventory.

About 98% of the acquired acreage is leased by public and private operators, including Occidental Petroleum Corp., ConocoPhillips Co., Devon Energy Corp., Coterra Energy Inc., Mewbourne Oil Co., Permian Resources Corp., Diamondback Energy Inc., BPX Energy, Exxon Mobil Corp. and Callon Petroleum Co.

According to Kimbell, the deal adds:

- An estimated 14.7 MMboe in total proved reserves, reflecting a purchase price of approximately $19.80 per total proved boe;

- An average net revenue interest of 0.8% per tract; and

- Line of sight on development of 1.18 net DUCs and 1.06 net permitted locations.

Kimbell, based in Fort Worth, Texas, owns mineral and royalty interests in over 16 million gross acres in 28 states and in every major onshore basin in the continental U.S., including ownership in more than 123,000 gross wells with over 47,000 wells in the Permian Basin.

Citi served as Kimbell’s exclusive financial adviser. White & Case LLP acted as legal counsel to Kimbell. TPH & Co., the energy business of Perella Weinberg Partners, served as exclusive financial adviser and Kirkland & Ellis LLP served as legal adviser to Hatch Royalty.

Recommended Reading

UK’s Union Jack Oil to Expand into the Permian

2024-01-29 - In addition to its three mineral royalty acquisitions in the Permian, Union Jack Oil is also looking to expand into Oklahoma via joint ventures with Reach Oil & Gas Inc.

Elk Range Royalties Makes Entry in Appalachia with Three-state Deal

2024-03-28 - NGP-backed Elk Range Royalties signed its first deal for mineral and royalty interests in Appalachia, including locations in Pennsylvania, Ohio and West Virginia.

Dorchester Minerals Buys Interests in Two Colorado Counties

2024-04-01 - Dorchester Minerals’ acquisition totals approximately 1,485 net royalty acres for roughly $17 million.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

Marketed: Amati Royalties Powder River Basin Opportunity

2024-03-01 - Amati Royalties has retained EnergyNet for the sale of a Powder River Basin opportunity with four wells and two pending wells in Campbell County, Wyoming.