Oil and gas exploration in the Permian. (Source: Shutterstock)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Kimbell Royalty Partners LP continues to shore up interests in the Permian Basin following a December deal to buy Hatch Royalty LLC in December, the company said in an April 12 press release.

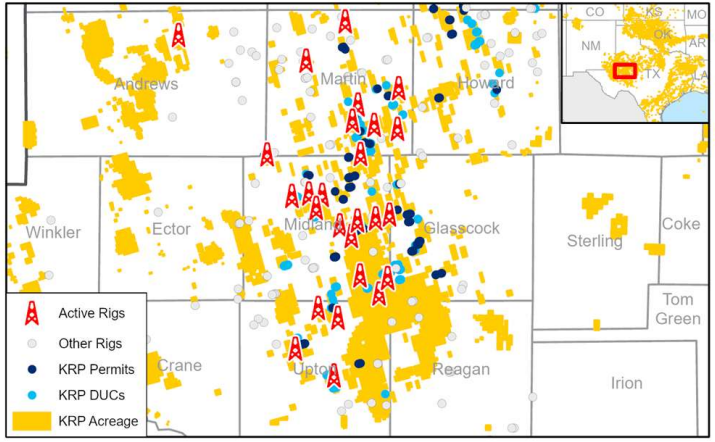

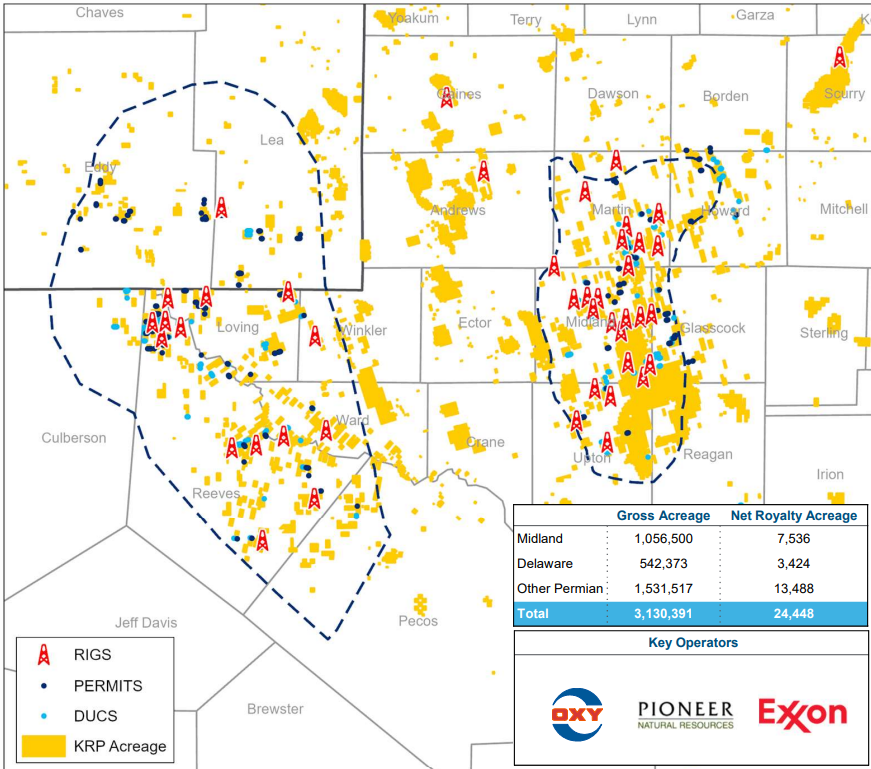

Kimbell, based in Fort Worth, Texas, is acquiring about 806 net royalty acres in the Permian’s Northern Midland Basin from MB Minerals, a subsidiary of Sabalo Holdings LLC, according to an April 11 regulatory filing.

The assets are located in northern Howard County, Texas, and southern Borden County, Texas.

Kimbell will pay approximately $143.1 million to acquire the royalty interests in a cash-and-stock transaction, including $48.8 million (34%) in cash.

The company will also issue around 5.37 million common units of Kimbell Royalty Operating LLC valued at $85.4 million, and approximately 557,000 newly issued KRP common units, valued at $8.9 million, for the acquisition.

The deal is expected to close during the second quarter.

RELATED

Kimbell Royalty Partners Closes $270 Permian Basin Acquisition

Kimbell forecasts that the acquired Midland Basin assets will produce an average 1,459 barrels per day (bbl/d) of crude oil, 219 bbl/d of NGL and 1,338 cubic feet per day of natural gas (1,901 boe/d) over the next twelve months.

The liquids-weighted assets are expected to move the oil weighting of Kimbell’s portfolio up from 29% to 34% of daily production.

The assets include more than 300 producing wells, and three active rigs were deployed on the acreage as of March 31, the company said.

Following the acquisition, Kimbell expects to have more than 16 million gross acres, 125,000 gross wells and 97 active rigs on its properties.

Kimbell bolstered its presence in the prolific Permian Basin through a $270 million acquisition last year. Kimbell acquired 889 net royalty acres in the Delaware and Midland basins from Austin-based Hatch Royalty.

The deal represented Kimbell’s largest transaction since 2018, when it acquired Haymaker Minerals & Royalties LLC and Haymaker Resources LP for about $404 million in cash and stock.

The MB Minerals deal is expected to close during second-quarter 2023.

White & Case LLP and Kelly Hart & Hallman LLP served as legal counsel to Kimbell on the deal. MB Minerals LP was represented by TenOaks Energy Advisors as financial adviser and Bracewell LLP as legal counsel.

Recommended Reading

RWE Boosts US Battery Storage with Three Projects

2024-02-14 - The three projects—two in Texas and one in Arizona—will lift RWE’s total U.S. battery storage capacity to about 512 megawatts.

Energy Transition in Motion (Week of April 12, 2024)

2024-04-12 - Here is a look at some of this week’s renewable energy news, including a renewable energy milestone for the U.S.

Equinor, Ørsted Bid for Better Contract in NY Offshore Wind Auction

2024-01-26 - New York State has received bids to supply power from three offshore wind projects in its expedited fourth solicitation that allowed developers to exit old contracts and re-offer projects at higher prices.

Equinor, Ørsted/Eversource Land New York Offshore Wind Awards

2024-02-29 - RWE Renewables and National Grid’s Community Offshore Wind 2 project was waitlisted and may be considered for award and contract negotiations later, NYSERDA says.

Dominion Energy Receives Final Approvals for 2.6-GW Offshore Wind Project

2024-01-30 - Dominion Energy’s Coastal Virginia Offshore Wind project will feature 176 turbines and three offshore substations on a nearly 113,000-acre lease area off Virginia Beach.