The industrywide imperative is to become “predatory and opportunistic” in response to an environment of severe price depression and capital unavailability, says Seth Bullock, managing director for Alvarez & Marsal. (Source: Shutterstock.com)

As 2020 closes, bankruptcy has become a widespread reality of the oil and gas landscape, and for as many companies that have begun the process, there are plenty of others for which it remains an imminent possibility, according to Seth Bullock, managing director for Alvarez & Marsal and leader of the firm’s oil and gas restructuring practice.

Speaking during a recent Houston Energy Finance Group webinar, Bullock called for a rapid mindset and methodological shift. Overall, he said the industrywide imperative is to become “predatory and opportunistic” in response to an environment of severe price depression and capital unavailability.

Bullock began the discussion with a sober reminder that, despite the extraordinary events of this year—namely the COVID-19 pandemic—low commodity prices are representative of historical norms over the long-term. As a result, low prices should form part of an oil and gas company’s standard operating premise.

“You can’t plan on a price increase to bail you out,” he said. “I would actually plan on lower prices to stress test your business plan. If you’re wrong and prices increase, then your downside in that scenario is, you make more money. But conversely, if you’re wrong and assuming you’ve got an upward bias and prices decline, you may be putting your company at risk.”

Complicating the situation further, “Nothing has happened since the fourth quarter of 2018 to make this area more attractive for investors,” so capital infusions to offset low prices cannot rely upon either. Add accelerating ESG concerns to the mix, and companies have one clear option: cost reductions.

“Companies in this industry needed to get to the point where they can self-fund their business plan,” Bullock said. “You can’t rely upon external capital to bail you out, and self-funding needs to be at today’s commodity prices, if not a discount. The question is, how do you do that? The major delineating factor we see between companies that are thriving in this environment and those that are hurting is their cost structure.”

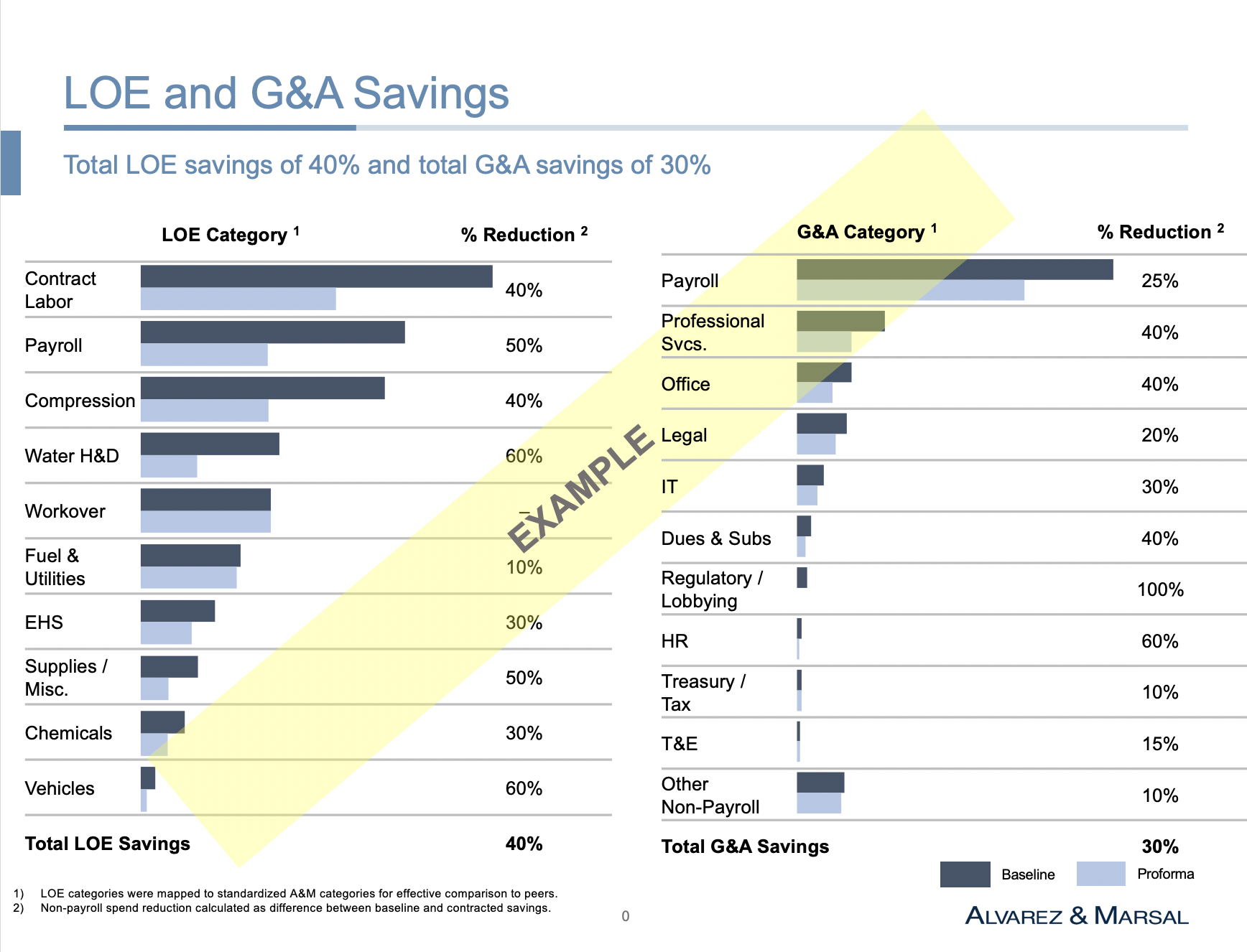

Bullock cited an unnamed client that recently worked with Alvarez & Marsal to reduce its cost structure, noting that, after the reductions, the company “had the best quarter they’ve ever had in their company’s history.” To achieve this, Bullock’s team benchmarked the client’s costs against best-in-class metrics and worked to close the gaps, a practice that is unfamiliar for many oil and gas companies, he noted.

“The industry got a lot of muscle tissue on learning how to grow. There’s less knowledge and expertise on being efficient,” but practicing financial “self-help” will be critical in the world of continued low commodity prices,” he said.

For some companies, cost reductions will not suffice, and restructuring will prove necessary. Though it involves pain, the process need not be cause for despair, Bullock said, because if initiated, followed through and exited from carefully, it presents a significant opportunity to revitalize an overlevered, inefficient organization.

When advising during a restructuring, he said, “We often ask our clients: What would you do if you were starting over, if you had a blank sheet of paper, what would this company look like? Many times, we end up with an answer from the clients that’s different from what the company looks like today.”

Reconceiving a company is difficult work, especially amid a crisis, and companies faced with bankruptcy are often tempted to do an out-of-court or pre-packaged bankruptcy to achieve a faster result. However, “You may actually want a little more difficult process, a little longer process, if it gets you a better answer on the end,” Bullock said, pointing in particular to companies with a larger number of contracts, which are difficult to reject in “pre-pack” agreements.

Bullock went on to describe several critical considerations throughout the long weeks of a restructuring. These included maintaining liquidity, establishing a retention plan for key employees and identifying large spending areas. It is key that management remains “honest about the challenges that are being faced, what it means for employees, even if it’s not great news, and the steps that you’re taking to fix it,” he said.

Make no mistake, Bullock said, “You want to do this quickly, and you want to do it once.”

“You want to avoid the Chapter 22, which is the Chapter 11 you had to file twice because you didn’t get it right the first time,” he continued.

In a final note of optimism, he pointed to the positive results of Southwest Airline’s operating model, which the Wall Street Journal described as enabling the company to become “predatory and opportunistic,” a visual Bullock said oil and gas companies should keep in mind.

“Should you go through a restructuring? How can you get to the point where you can be predatory and opportunistic?” he speculated. In conclusion, he said these are the questions that should be all oil and gas operators’ minds, regardless of whether they’ve entered a restructuring arrangement or are cutting costs to avoid it.

Recommended Reading

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

Equinor Brings Solar Plant Online in Brazil

2024-03-08 - Equinor says the Mendubim solar plant will produce 1.2 terawatt hours of power annually.

Select Water Solutions Bolts On Haynesville, Rockies Assets for $90MM

2024-01-31 - Select Water Solutions Inc. added disposal and recycling capacity in the Haynesville Shale and the Rockies across three acquisitions in January.

SCF Acquires Flowchem, Val-Tex and Sealweld

2024-03-04 - Flowchem, Val-Tex and Sealweld were formerly part of Entegris Inc.

Weyerhaeuser, Lapis Energy Enter Carbon Sequestration Exploration Pact

2024-02-29 - The exploration agreement covers 187,500 acres across three states with five potential carbon sequestration sites.