(Source: Hart Energy)

Six months after exiting bankruptcy, Jones Energy II Inc. said it agreed Dec. 6 to sell its assets and merge with Revolution Resources, an affiliate of Mountain Capital Partners LP, for $201.5 million cash.

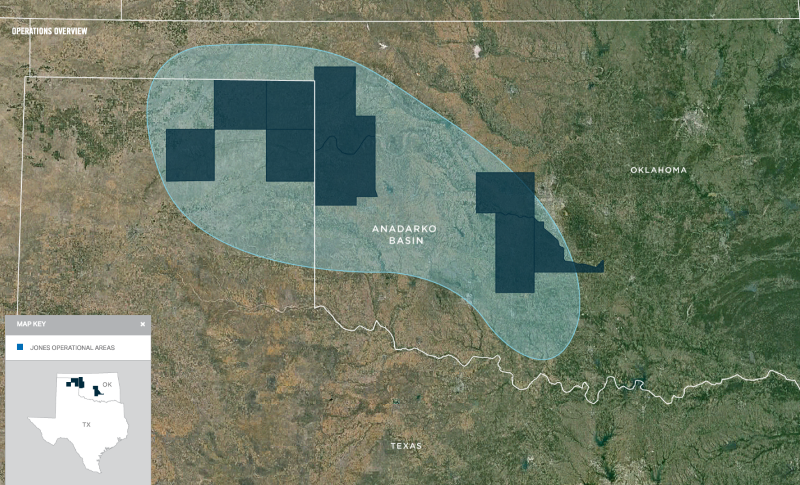

Jones Energy entered bankruptcy protection in April with secured and unsecured liabilities of more than $1 billion. The company, with assets in the Anadarko Basin in Oklahoma and Texas, emerged from reorganization 33 days later with a $225 million borrowing base agreement.

Jim Addison, Jones Energy’s chairman of the board, said the agreement marks the successful completion of its strategic alternatives process underway since earlier this year.

“Throughout the course of our exhaustive review, we engaged in meaningful strategic dialog with a significant number of potential counterparties,” he said. “Ultimately, the board unanimously determined that an all-cash transaction with Revolution is in the best interests of our shareholders and the company and will deliver the strongest economic value relative to the comprehensive range of alternatives we examined.”

Prior to bankruptcy, Jones Energy targeted the Eastern Anadarko Basin’s liquids-rich Woodford Shale and Meramec formation in the Merge area of the Stack/Scoop. In the Western Anadarko, the company targeted the Cleveland, Marmaton, Granite Wash and Tonkawa formations.

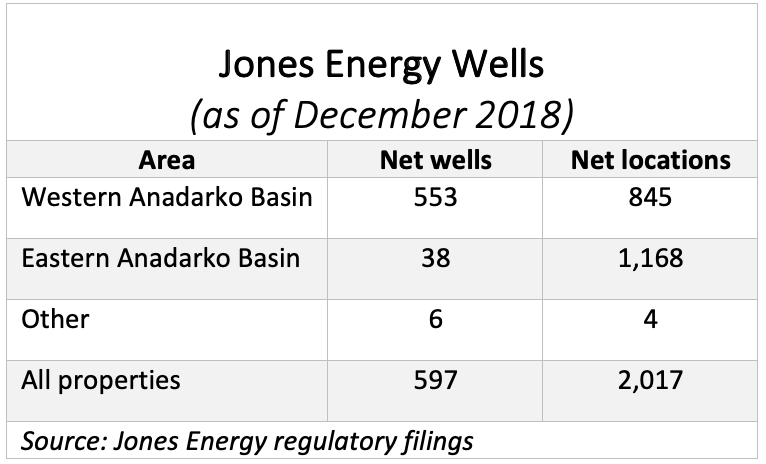

In the Midcontinent and other areas, Jones Energy held about 185,000 net acres as of year-end 2018, including 10,708 undeveloped acres. About 94% of its leasehold was HBP. Additionally, the company’s inventory included 597 net wells and 2,017 net locations.

Revolution Resources has previously taken advantage of distressed Midcontinent companies to make acquisitions. In January 2018, the company agreed to buy Gastar Exploration Inc.’s West Edmund Hunton Lime Unit (WEHLU) for $107.5 million.

Revolution II WI Holding Co. LLC is backed by Houston-based Mountain Capital private-equity fund, which has about $1 billion of assets under management.

Evercore and TD Securities (USA) LLC are serving as financial advisors to Jones Energy, and Baker Botts LLP is serving as its legal counsel. Kirkland & Ellis LLP is Revolution Resources’ legal counsel.

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.