The Anadarko Petroleum Lucius Truss Spar, located in 7,100 ft of water offshore in Keathley Canyon 875, 236 miles offshore in the Gulf of Mexico on January 2015. (Source: Robert Seale/Anadarko Petroleum Corp.)

Japanese E&P Inpex Corp. entered a deal on July 26 to purchase U.S. Gulf of Mexico (GoM) assets from soon-to-be-acquired Anadarko Petroleum Corp.

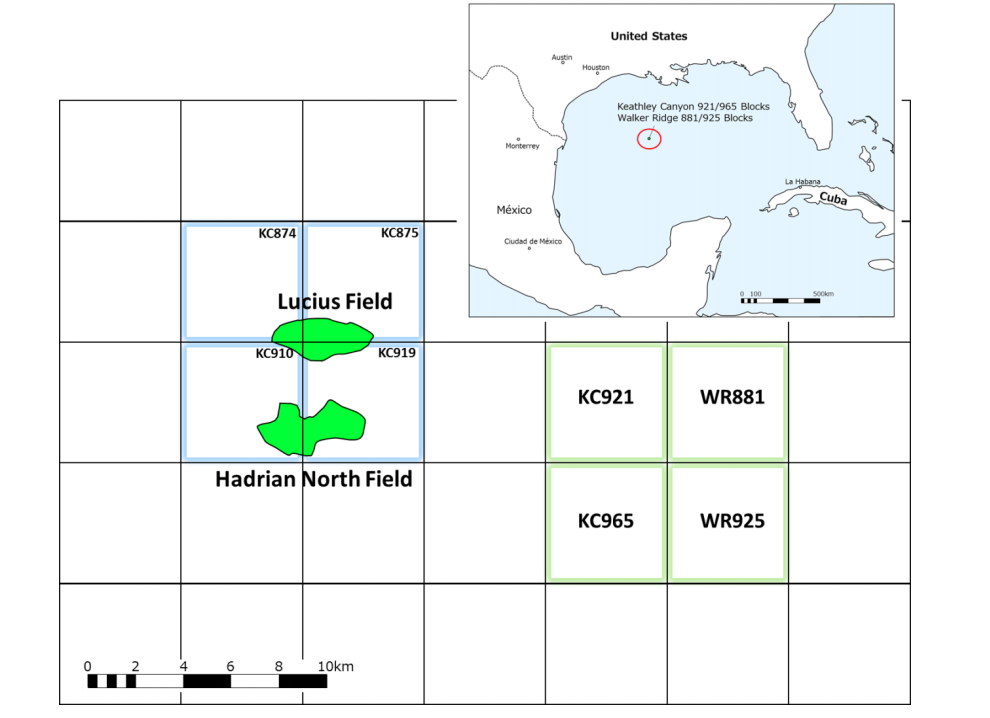

The Tokyo-based company said its U.S. subsidiary reached an agreement with Anadarko to acquire a participating interest in Keathley Canyon and Walker Ridge blocks located roughly 380 km (236 miles) off the coast of Louisiana. The terms of the transaction have not been disclosed.

According to the company press release, Inpex already has plans to drill an exploration well at an early stage in partnership with the operator, Anadarko, subject to management approvals and further evaluation work. Though, Anadarko, itself, is in the process of being acquired by rival Occidental Petroleum Corp.

The portfolio of The Woodlands, Texas-based independent oil company includes a range of global assets. However, what has largely believed key to Anadarko’s takeover is its position in the Permian’s Delaware Basin as Occidental already has agreed to divest the company’s Africa assets.

Occidental’s cash-and-stock bid for Anadarko, which including debt is for about $57 billion, has been approved by the U.S. Federal Trade Commission and is expected to close by the end of this year.

In the sale to Inpex, Anadarko is selling a 40% participating interest in Keathley Canyon blocks 921 and 965 and Walker Ridge blocks 881 and 925. As part of the agreement, Anadarko will retain operatorship with a 60% interest remaining in the blocks.

Inpex is Japan’s largest exploration and production company. The company said it ranks as a mid-tier E&P player, just behind the world’s oil majors.

Though Inpex is currently involved in about 70 projects across more than 20 countries, the company said it considers the GoM as one of its priority exploration areas.

The assets Inpex agreed to acquire from Anadarko are located near the Lucius and Hadrian North producing oil fields, in which the company has participating interest through its subsidiary. The blocks cover an area of 93.2 sq km where the water depth ranges between about 2,150 m and 2,700 m.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

TC Energy, Partner Sell Portland NatGas Transmission System for $1.14B

2024-03-04 - Analysts expect TC Energy to make more divestitures as the Canadian infrastructure company looks to divest roughly $2.21 billion in assets in 2024 and lower debt.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Tallgrass Energy Announces Latest Open Season for Pony Express Pipeline

2024-03-12 - Prospective shippers can review details of the open season, which began March 11, after signing a confidentiality agreement with Tallgrass.