In its annual outlook, the EIA says that a high uptake of IRA tax credits will bolster LNG exports. (Source: Shutterstock)

The U.S. will remain an exporter of oil and gas through 2050, the Energy Information Administration (EIA) forecasts, with extensive use of Inflation Reduction Act (IRA) tax credits benefitting LNG exports in particular.

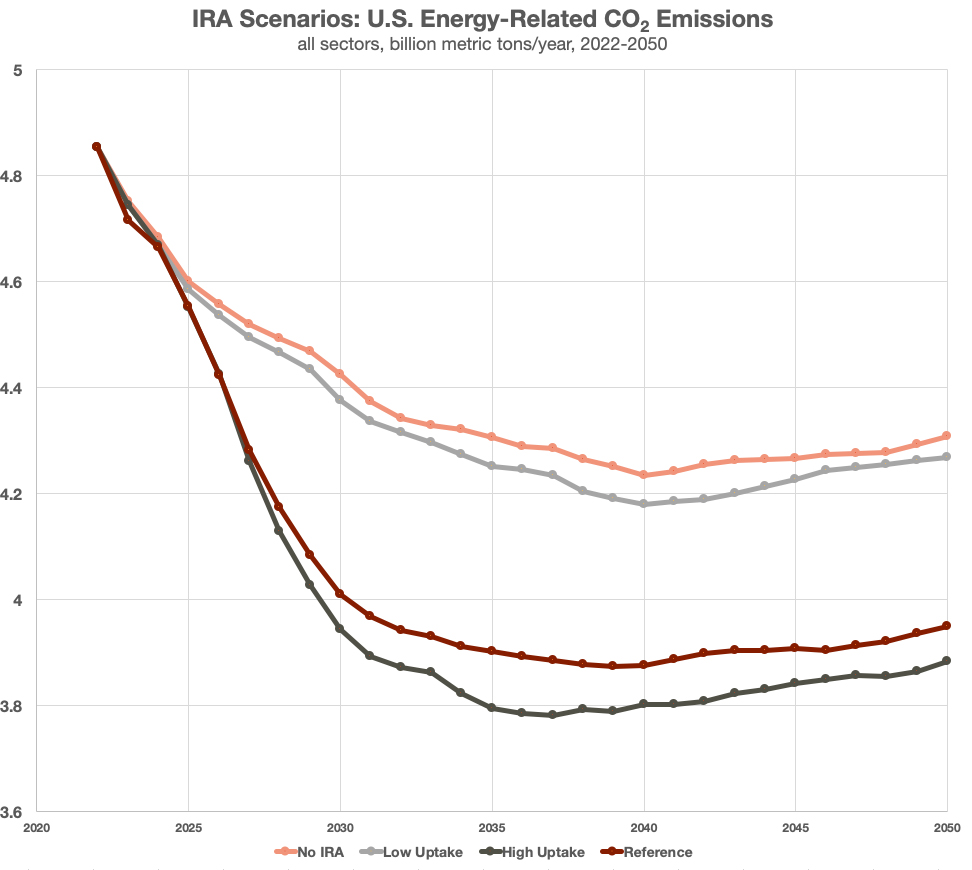

In its Annual Energy Outlook, the EIA also projects that energy-related CO2 emissions will drop by 25% to 38% by 2030 when compared to 2005 levels. Lower emissions are attributed to increased electrification, as well as higher equipment efficiency and an elevated deployment of renewables in the electric power sector. However, growth in the transportation and industrial sectors will limit the reduction in emissions.

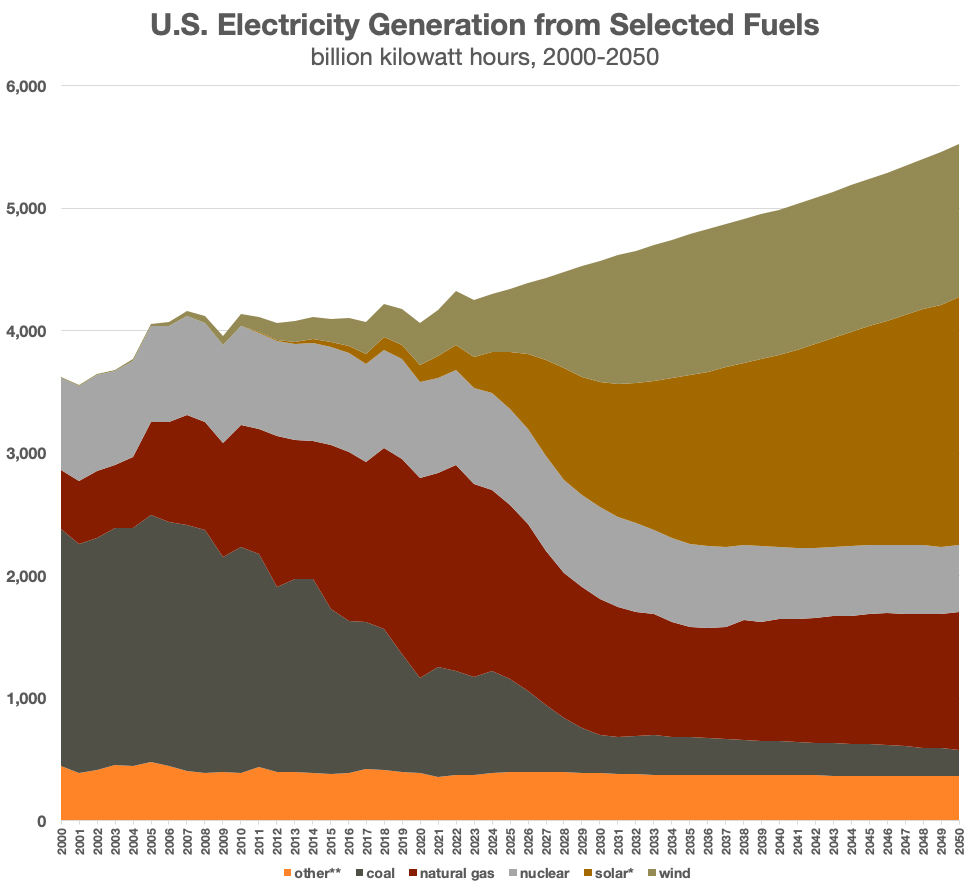

The thrust of the EIA’s forecast is that the increase in electrification will be driven by dramatic increases in the market share of renewables in power generation, combined with flat production from nuclear— but a substantial decrease in the share of natural gas and a steeper decline in the use of coal.

In EIA’s “high-uptake” scenario gauging the impact of IRA tax credits, the trends are more pronounced. Solar and wind combine to account for 72% of cumulative additions to new power generation capacity, which is estimated to range from 700 gigawatts (GW) to 1,124 GW. Wind and solar are projected to account for 56% of U.S. electricity generation in 2050, a figure that could reach 59% if bonus provisions of IRA tax credits are figured in.

The reduction in emissions is attributed to carbon-free resources providing more electricity in 2050 than coal and natural gas.

RELATED

Haynesville, Permian to Lead Natural Gas Production Growth in April

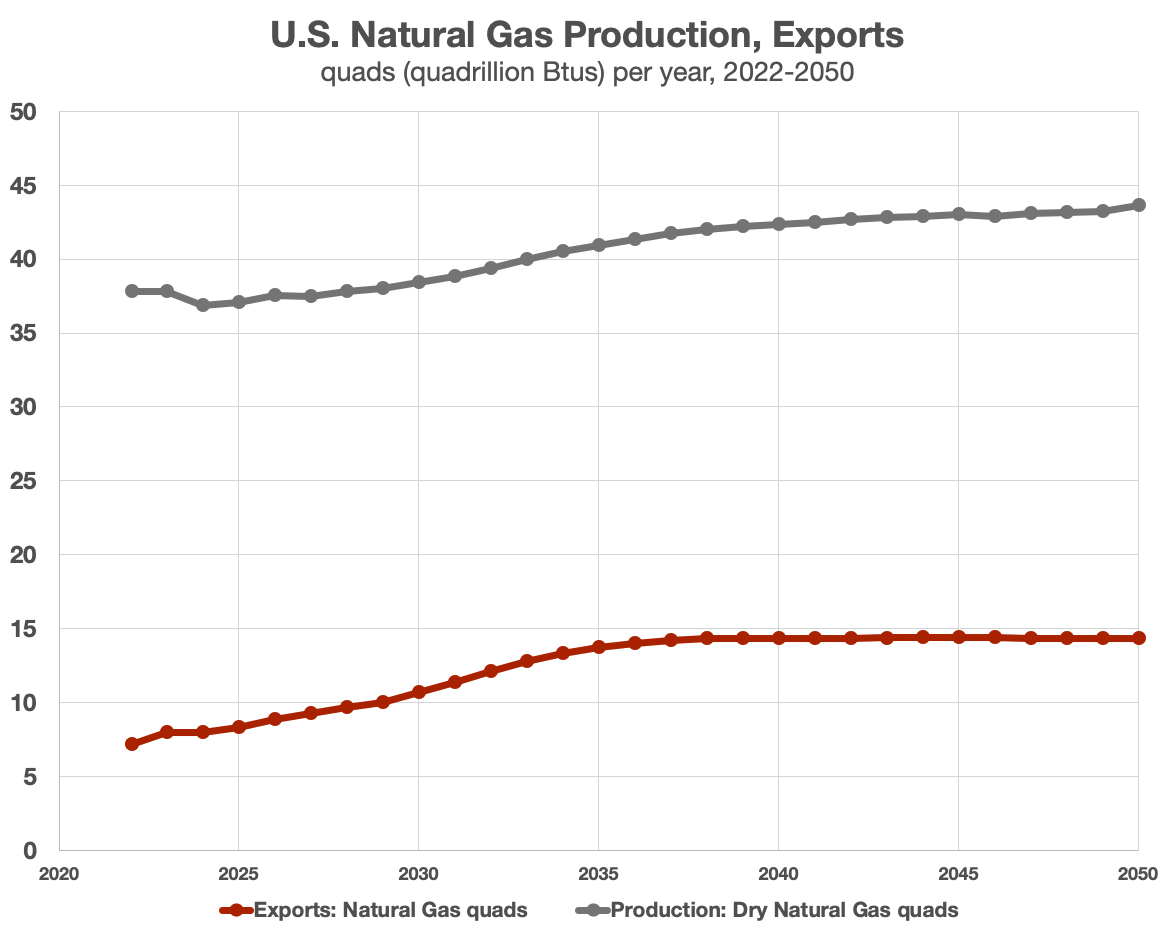

Global commitments to reduce emissions will cut demand for coal during this time period. At the same time, overall demand for energy will increase, leading countries to turn, in part, to an affordable, cleaner alternative to coal: natural gas.

The result will be growing exports of U.S. LNG to meet that demand, which in turn, will increase U.S. production, despite declining domestic natural gas demand.

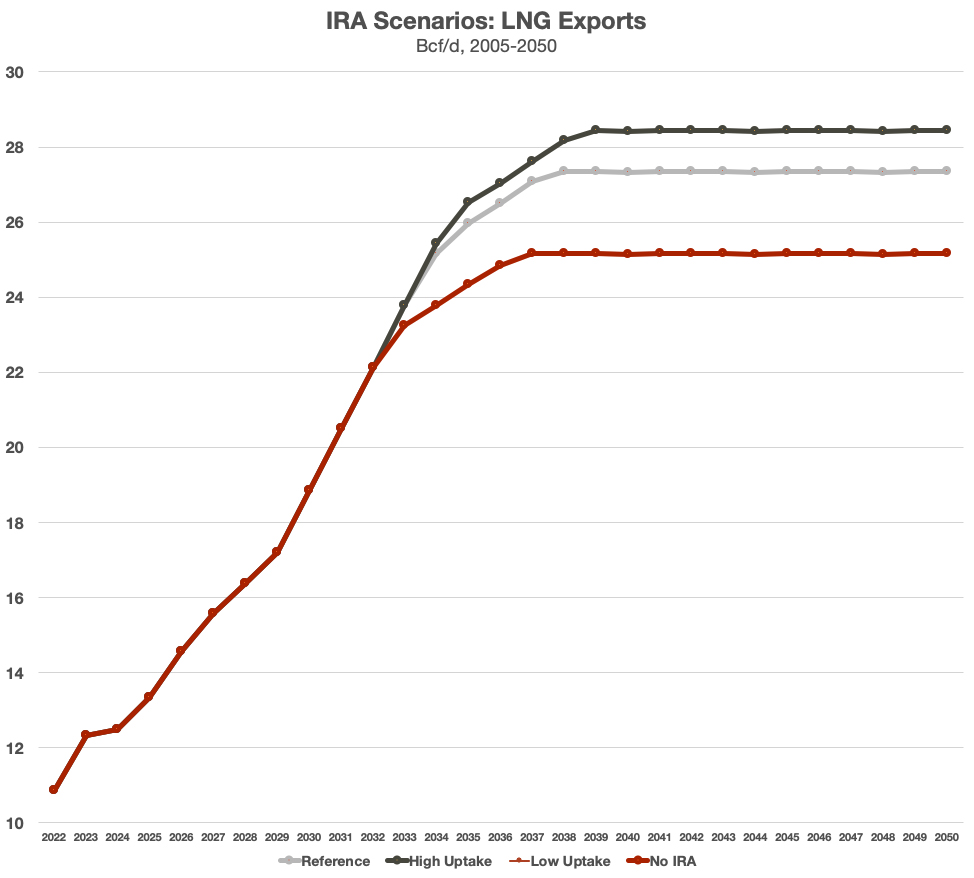

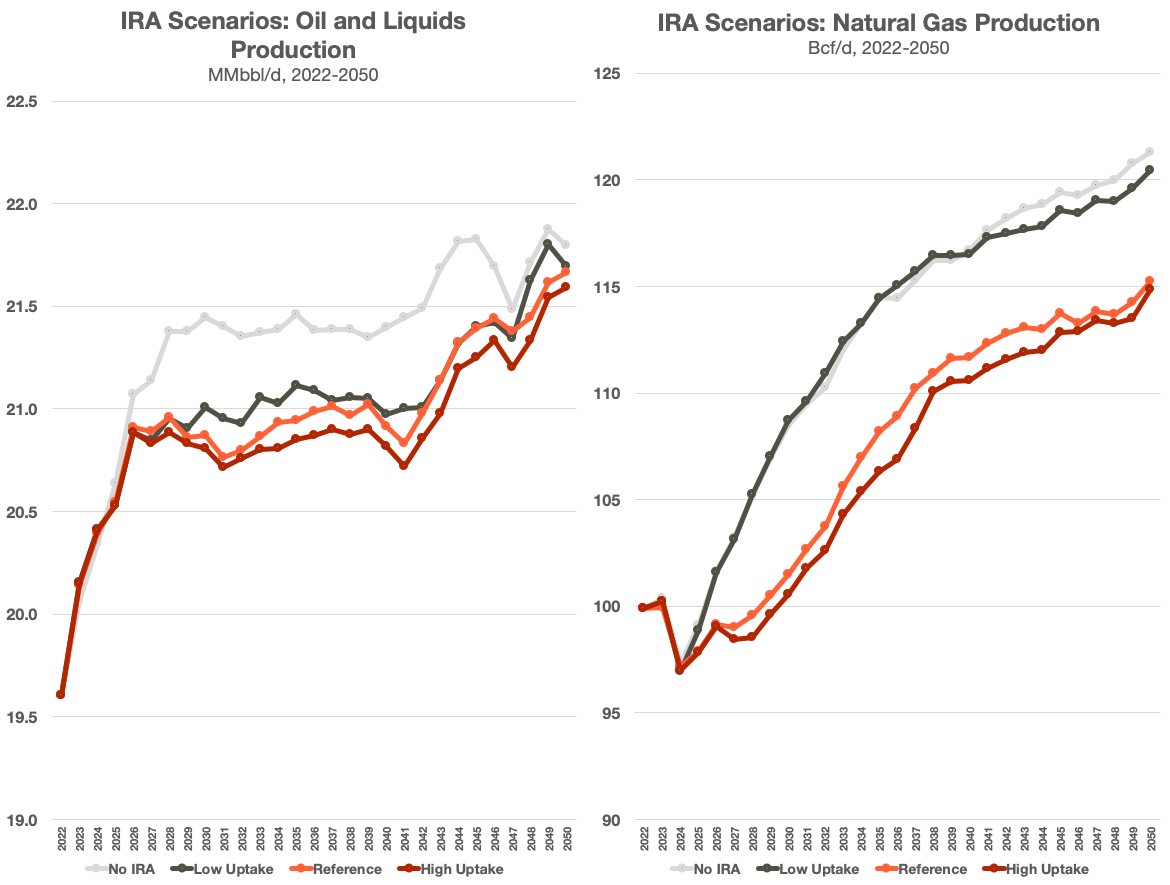

The EIA’s IRA-specific scenarios reflect that trend as well, but also the impact of the legislation’s tax credits. Without the IRA, LNG exports will grow 132% between 2022 and 2050. That growth is the same with the low-uptake model.

However, the high-uptake model has LNG exports growing 162%, and the reference model increasing 152%.

In modeling its reference scenario, the EIA assumed the use of base tax credits and certain bonus credits for eligible technologies. In the high-uptake scenario, the value of those credits would be the same or higher than the reference case. The low-impact scenario assumes the value would be the same or lower than the reference case.

In all of the IRA modeling, the no-IRA scenario and the low uptake scenario yield close results. The same is the case for the reference and high uptake scenarios.

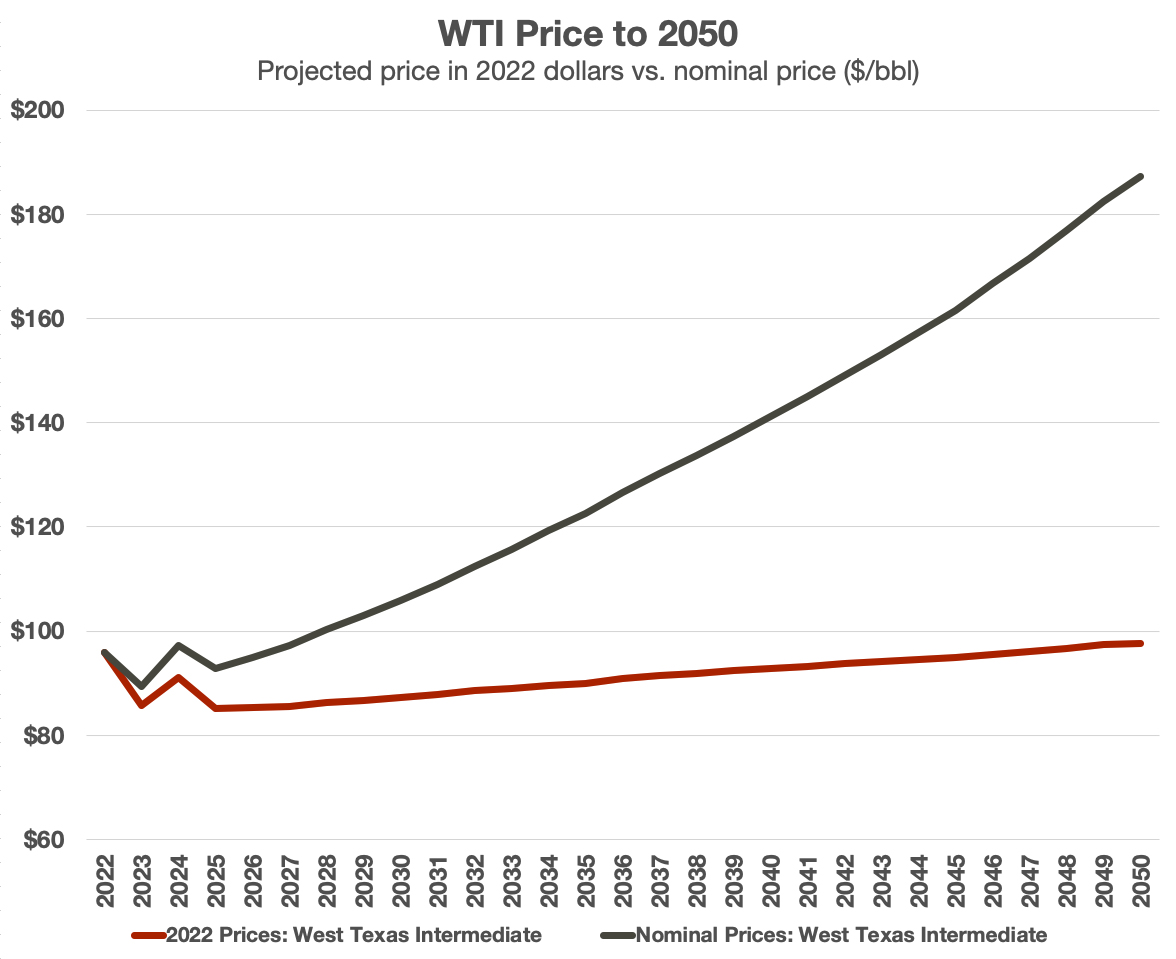

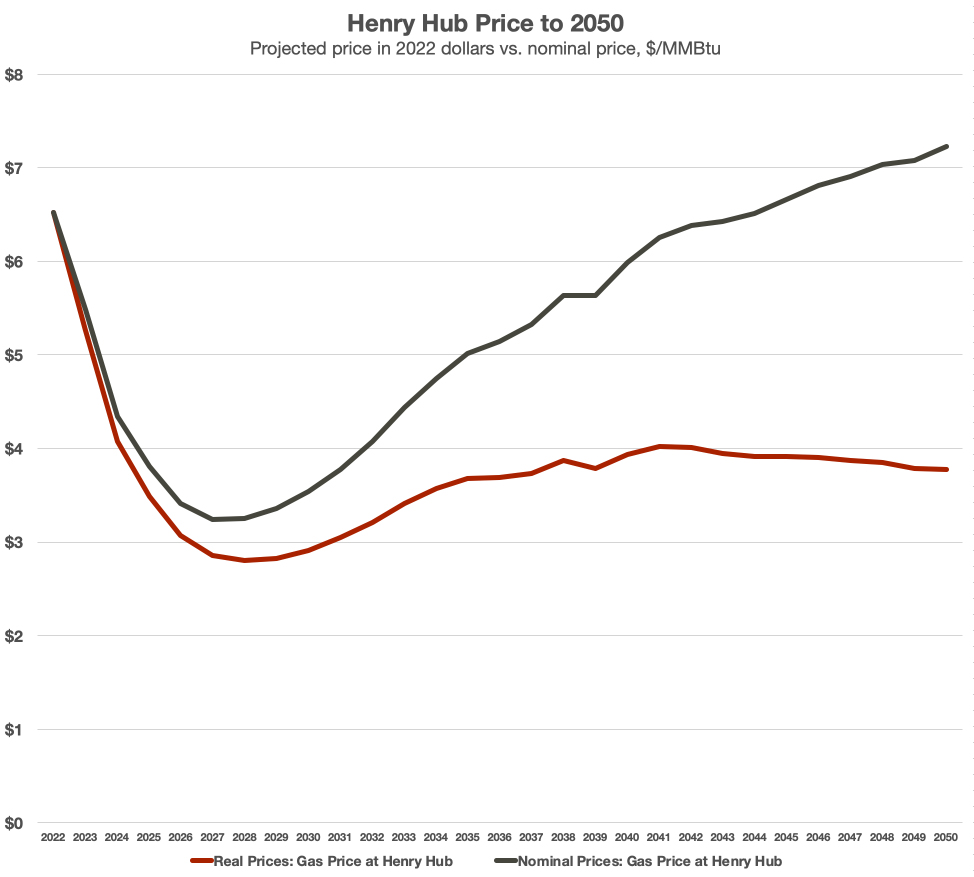

'Real’ prices increase

The “real” prices of oil and gas, based on 2022 dollars, will rise 14% in the case of WTI and sink by 28% in the case of natural gas. WTI, which the EIA estimates will average $85.78/bbl in 2023, will rise to $97.68/bbl (in 2022 dollars) by 2050. Customers will pay $187.28/bbl in 2050 dollars.

The price of natural gas, forecasted to average $5.26/MMBtu in 2023, will fall to $3.77/MMBtu in 2050 in 2022 dollars. Customers will pay $7.23/MMBtu in 2050 dollars.

Recommended Reading

US NatGas Futures Hit Over 2-week Low on Lower Demand View

2024-04-15 - U.S. natural gas futures fell about 2% to a more than two-week low on April 15, weighed down by lower demand forecasts for this week than previously expected.

Darbonne: Brownsville, We Have LNG Liftoff

2024-04-02 - The world’s attention is on the far south Texas Gulf Coast, watching Starship liftoffs while waiting for new and secure LNG supply.

US Natgas Prices Hit 5-week High on Rising Feedgas to Freeport LNG, Output Drop

2024-04-10 - U.S. natural gas futures climbed to a five-week high on April 10 on an increase in feedgas to the Freeport LNG export plant and a drop in output as pipeline maintenance trapped gas in Texas.

US NatGas Flows to Freeport LNG Export Plant Drop Near Zero

2024-04-11 - The startup and shutdown of Freeport has in the past had a major impact on U.S. and European gas prices.

Enterprise Increasing Permian NatGas Production

2024-04-03 - Enterprise Products Partners began service on two natural gas plants: the Leonidas in the Midland Basin and the Mentone 3 in the Delaware Basin, each with a capacity to process 300 MMcf/d of natural gas and 40,000 bbl/d of NGLs.