Considering its vast size, Atlantic Canada has seen relatively little E&P activity, but seismic programs now underway could considerably increase the pace of development.

State-owned Nalcor Energy Oil and Gas, based in St. John’s, Newfoundland and Labrador, is working to attract investment to the province’s offshore by using seismic data to evaluate the region’s frontier basin prospectivity.

Jim Keating, executive vice president of corporate services and offshore development, explained the company’s perspective. “We could sit back and wait for the private sector to create opportunities, or we could use expertise being developed and revenue being generated to fund seismic research to address gaps in the data.”

The goals were to establish a structured bid program and support it with better data. The first of these objectives was achieved in 2013, when the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) introduced a Scheduled Land Tenure System to organize bid rounds based on the level of activity in the bid areas.

Stephanie Johnson, acting director of exploration and information resources on the C-NLOPB, explained the program. “Low activity license rounds operate under a four-year timing cycle, while annual bid rounds held for mature regions operate under a one-year timing cycle.”

The C-NLOPB announces a region, and a call for nominations goes out for areas of interest. “This allows companies to suggest a particular area be included in the call for bids,” she said.

Next, sectors are identified, and following a time frame based on activity level, a call for nominations is issued over the sector. The round opens with an official call for bids by the C-NLOPB. Companies can submit bids, which are evaluated on a time line that allows the bids to be accepted in November and exploration licenses to be awarded in January.

The Scheduled Land Tenure System solved one of the issues, Keating said, but there was still a need to improve the quality and scope of the seismic data. The way Nalcor is achieving that goal is by employing the best technologies available. “We reached into the geoscience toolkit and selected the right applications of the right technologies with the right service providers,” Keating said.

Managing the program

The province has more than 1.8 MM sq km (~ 695,000 sq miles) under its jurisdiction, an area larger than the Gulf of Mexico, which makes seismic program planning challenging.

“We have to look long-term and be methodical,” said Dr. Richard Wright, exploration manager at Nalcor. “It’s an iterative program. What we find in previous years determines what we do in subsequent years.”

The first phase, Wright said, was “basin-finding work,” part of which included a survey in 2011 offshore Northern Labrador and southwest to Nova Scotia. “As prospectivity indicators are identified, infill efforts begin on a 20-km by 20-km [154.4-sq-mile] area, narrowing eventually to 5 km by 5 km [9.7 sq miles],” he said. “Where prospectivity is demonstrated but uncertainty can’t be reduced to industry investment grade level with 2-D data, we acquire a 3-D survey in advance of the license round.”

This year’s seismic program includes a 2-D survey south of the Carson Basin to be acquired this summer as well as a 5-km by 5-km survey in the Laurentian Basin to understand key source rock risk in advance of the 2022 license round. A 3-D survey targeting a key part of the Churchill River Delta offshore Labrador, which began in July, will help define the nature and extent of existing structures as well as hydrocarbon indications in the area.

“We also are investing in extending the Tablelands 3-D survey to the north, working with PGS and TGS, for extensive 3-D coverage for the upcoming 2020 bidding round,” Wright said.

Nalcor is incorporating coring in areas like the Orphan Basin, a frontier region with estimated oil reserves of 6 Bbbl to 8 Bbbl.

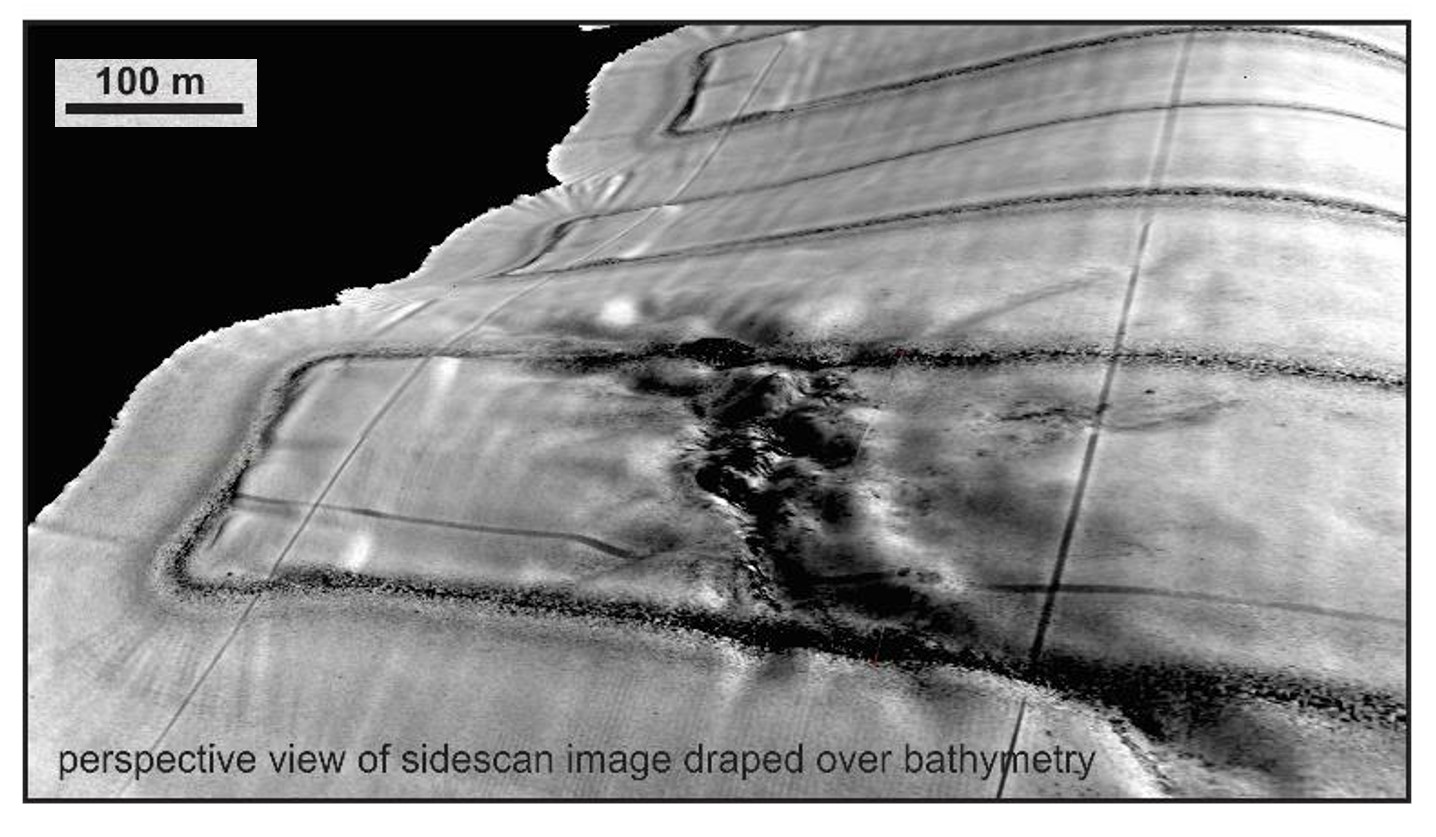

“Seabed cores from summer 2017 revealed thermogenic hydrocarbons. Many of these expressions were directly above areas identified as prospective using 3-D,” he said. “We also worked with Fugro and AGI to conduct a backscatter multibeam study to look for anomalies in the water column that could indicate seeps coming out of the seafloor.”

While results have been encouraging, more work remains to be done before it is possible to say what kinds of hydrocarbons could be present and whether they are commercial grade. Additional data will come from the first full waveform inversion (FWI) program in the region, which Wright said will yield enhanced velocity models. If successful, the FWI pilot project with PGS this summer will be extended to a broader area.

“Our exploration strategy was initiated when prices were high, so most of the outputs occurred after the oil price dropped,” Keating said. “Despite that, while most companies were reducing exploration expenditure, we captured disproportionate levels of interest. What shone through was the geologic potential.”

Nalcor has an ambitious program for the region. In less than 7% of the province’s offshore region, independent resource assessments estimate there is a combined resource potential of 49.2 Bbbl of oil and 5.4 Tcm (193.8 Tcf) of gas. There have been eight new entrants in the past three years and $3.9 billion in exploration work commitments made throughout the last four years. If results continue along the established trend, there will be significantly more data and many more reasons for taking a second look at Newfoundland and Labrador’s offshore region.

The province next door

Nova Scotia also is investing in its offshore through a program that Sandy MacMullin, executive director of petroleum resources at the Nova Scotia Department of Energy and Mines, described as “one of a kind.” The province is working with Morocco to create a clearer picture of its offshore oil and gas resource potential.

“We are reconstructing seismic images on both sides of the Atlantic to help us better understand the geological setting 200 million years ago when a tectonic rift separated Morocco and Nova Scotia,” MacMullin said. “We believe we have a world-scale petroleum system, but we need to establish a factual basis for this claim.”

The program began with speculation that the two regions shared early Jurassic source rock. The plan was to gather data offshore Morocco. “You can’t have a onehanded clap,” MacMullin said. “We had to share that initial rift basin and therefore the same source rock.”

Results so far are promising. “What we’ve learned to date is that while there are differences with Morocco, the early Jurassic history is very similar,” he said.

A peer review of data gathered and analyzed to date was held in June, with deepwater experts discussing what has been learned, validating priority areas and providing input for focus areas going forward. “It was a fertile atmosphere that encouraged an exchange of ideas that will help direct our next steps,” MacMullin said.

One of those steps is to continue an ongoing program of deepwater piston coring using robotics and mapping seeps using AUVs. “We also are collaborating with university researchers who are looking to find relationships between bacteria and proximity to seeps,” MacMullin said, noting that the data being gathered will be used to help unlock the age of the source rock.

The hope is that Nova Scotia will get to that point faster by working jointly with Morocco.

Recommended Reading

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Marathon Chasing 20%+ IRRs with Los Angeles, Galveston Refinery Upgrades

2024-02-01 - Marathon Petroleum Corp. is pursuing improvements at its Los Angeles refinery and a hydrotreater project at its Galveston Bay refinery that are each boasting internal rate returns (IRRs) of 20% or more.