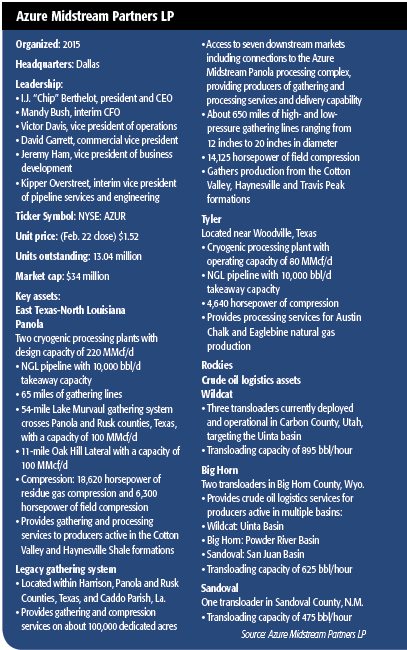

Privately held Azure Midstream Energy LLC acquired publicly traded Marlin Midstream Partners in early 2015 and changed its name to Azure Midstream Partners LP. Although the current situation in its core East Texas/Louisiana operations area, as well as transloading assets in the Rockies, may be challenging, Azure’s chief executive, Chip Berthelot, believes the enterprise is well positioned for continued growth when the turnaround comes.

MIDSTREAM You have held several executive positions with midstream firms before Azure. What attracted you to the midstream?

BERTHELOT You know, there are two major things that initially attracted me to the midstream business and continue to keep me really interested in it and focused on it. The first one is that it’s ever changing—between changes in technology and changes in commodity price cycles. That makes it extremely exciting and challenging. There never seems to be a dull moment, we never seem to be working on the same exact stuff.

And then the second thing is just the fact that energy, and specifically natural gas, is critical to our everyday life, to our society and to the future of our kids and grandkids. I’ve always enjoyed being able to contribute professionally to our country’s energy security.

MIDSTREAM A year ago you acquired Marlin Midstream, enhancing your Cotton Valley and Haynesville assets. How has that combination worked out?

BERTHELOT We were trying to accomplish two major things with the acquisition. One was, we were trying to gain access to the public markets and specifically to the MLP structure, which we did. We did not at that time foresee the challenges that the public market and the MLP vehicle—along with everybody else—would be enduring for the last year. But we do believe that, long term, it will be the right move.

The other thing that we were trying to accomplish is that we had a significant gathering footprint in East Texas and Louisiana, but we did not have processing assets. We weren’t specifically in the processing business and so we also wanted to be in that business. The good thing about the transaction is that it did both of those major items that we needed to accomplish as a company in one fell swoop.

We are glad we’re in the processing business in East Texas; that’s contributed to our revenue substantially. It is, as we all know, a very challenging business environment everywhere, but we’re excited both about access to the MLP structure and the processing business in East Texas. We think we’re well positioned for the future and we’re going keep working at it.

MIDSTREAM Overall, how is your business in East Texas doing?

BERTHELOT It is down a little bit, but healthy. The drilling activity is down significantly. It’s down to a little bit less than half of what it was at this time last year, but there’s still a little drilling activity, we still have molecules flowing through all of our pipe and our processing plants; we’re healthy. When you’re not growing so fast and adding facilities so fast, it’s a great time to optimize your expenses, operating efficiencies and tweak your customer service model. These focal points help you get better and make sure that you’re running as efficient a company as possible.

MIDSTREAM You have a fee-based business model but you have indirect exposure to commodity prices as production and drilling change. How do you manage those challenges?

BERTHELOT We do have very limited commodity exposure in the fees that we charge. We are predominantly fee based in how we charge our customers and make money but, like you said, the indirect commodity risk we do have is drilling exposure. We do our best to get minimum-volume commitments, and we have some substantial minimum-volume commitments in both our public business and our private company.

And then the other thing we do is to focus on what we can control absolutely. We can’t control either the commodity price or the amount of drilling that’s going on, but we can control our cost structure and we make sure that we’re as efficient as possible. We can control ways to differentiate ourselves from our competitors with customer service and then, of course, we can control how hard we work. In challenging times like this we make sure that we’re getting after the items that we control and remain healthy enough to take advantage of drilling growth when times turn around.

MIDSTREAM You recently announced that you suspended your fourth-quarter 2015 distribution. Can you share some of your thought process around this decision?

BERTHELOT Since our units were trading at a level where the yield is at 60% to 80%, we just aren’t getting credit for the dividend in today’s challenging environment. As a result, our board made the decision to suspend the distribution to preserve cash and liquidity to enhance our ability to fund some potential step-out projects that add gas supply, which we are currently working on, and/or debt reduction or potential dropdowns from our private company. It was a very difficult decision, but one we needed to make to ensure the company’s long-term health.

MIDSTREAM Does the MLP expect to see further dropdowns from the parent?

BERTHELOT We do. We have substantial assets sitting in our parent company that we would like to drop down into the public vehicle, and we’ll continue to evaluate those transactions. Those will not happen until valuations and public unit price volatility find some normalized level. Right now, we think our public-company units are significantly undervalued so it’s extremely difficult for us to drop assets in it at these valuations.

MIDSTREAM The start up of LNG exports from the Gulf Coast is expected in the first quarter, which will be a plus for the gas business. Do you have any projections for how it will impact demand in your operating area?

BERTHELOT You know, we do. I did see that the other day that Cheniere delayed the start-up of its first shipments due to instrumentation problems. We know they want to get it right. We’re excited about that LNG export business, and we’re excited about it being in the direct proximity of our assets.

We think the main impact is that LNG exports will support the market. It will make sure that East Texas and North Louisiana producers get a higher netback to the wellhead. That is directly a result of the geographic, close proximity and low transportation costs of those natural gas molecules for LNG export. We think that the major—the main—impact will be support of pricing against other parts of the country that may see more substantial basis differential discounts, thus lower wellhead netback pricing.

MIDSTREAM East Texas has been a major producing area for many years but recently there have been rumors of some sort of new, gigantic gas discovery there. Anything to that?

BERTHELOT East Texas is an interesting animal and, like you allude to in the question, it has always reinvented itself, and continues to reinvent itself. We’re seeing new producer customers. We’re seeing these guys continue to make good wells. That, of course, is in this very low-commodity price environment and they are challenged to make good returns. But they can make money even in this type of commodity environment.

We think East Texas is one of the greatest fields in the nation. There’s nothing specific that I’m aware of right now that’s a giant, new discovery. Of course, I’m not a geologist, but we do believe in the long-term viability of producing gas in East Texas. There’s a heck of a lot of gas underground in East Texas and Louisiana.

MIDSTREAM Do you continue to have public access to capital? How are the capital markets changing for midstream operators?

BERTHELOT The access to capital through our public vehicle is limited because of the market turmoil. The mammoth changes to the commodity prices and the resulting, significant changes in drilling activity result in changes to everybody’s MLP growth profiles. That’s got the capital markets in turmoil, which limits our ability to access capital.

We are now looking, and continue to look for, creative ways to access capital and to continue to be able to grow and transform our business. We are working on some near- to intermediate-term solutions both on our public company side and our private company side that we think will position us for future growth.

We think this downcycle is going to be an opportune time to add to business in terms of step-out and bolt-on acquisitions and diversification into other basins.

MIDSTREAM What about your private side?

BERTHELOT Same thing, same answer. It’s the price of growth. We’re working on some things on the private side that will put us in a great position. We happen to think that later in 2016, and going into 2017, is going to be a great time to be growing and building a larger gas company. Our intention is to grow through acquisition and greenfield project development, but first we need to fix the access to capital issue, and we will solve that over the next quarter or two.

MIDSTREAM How can fee-based midstream operators differentiate themselves to investors concerned about commodity prices and their impact on upstream producers?

BERTHELOT It is important to look at a couple of things. One is how much of a company’s revenue, or gross margin, comes from fee-based vs. commodity-sensitive activities, along with the kind, and terms, of contracts. These are a couple of important components. Then of course, two is what kind of minimum-volume commitments an MLP may, or may not have. We happen to enjoy a large percentage of fee-based business. It’s something north of 95% in our private company, and it’s something right around 95% in our public MLP. We like that. We do have minimum-volume commitments in both of those businesses that are substantial, and we think it’s important to communicate that to investors, to do our best to contract in that manner. But you can’t always take all the commodity risk off the table.

And I’ll say that most midstream operators do have that indirect commodity risk that is associated with drilling and finding new gas, so there is a difference. What we try to do is take commodity risk off the table and live with the drilling risk. To hack that away will give us no gathering and processing business. So we mitigate that by doing some of the things I mentioned earlier, by making sure we understand our costs. We’re optimizing those. We’re doing a good job of being aggressive in the field with customer service, and we also try to make sure that we’re competing for packages of gas that have already been drilled but might be coming off contracts with our competitors. That’s how we mitigate volume risk.

MIDSTREAM You also have sizeable transloading operations in the Rockies. How does that region differ from East Texas and Louisiana?

BERTHELOT That transloading business represents a little less than 20% of our MLP business and it is 100% backed by minimum-volume commitments. Those two factors make it a real consistent revenue stream.

There are many, many differences between the regions. One of the things I found in my career is that when you look at similar businesses, though,

in different geographic regions they are really very similar. We all tend to contract the same way and we tend to operate relatively the same way and a lot of times we’re dealing with the same customers. So they’re different—but they’re the same. But I’ll say that this is a business that we’re happy with because it’s just a coupon-clipping business with minimum-volume commitments that we have into the year 2020.

MIDSTREAM Crude-by-rail volumes have dropped off in the past year. Do you feel rail will continue to be a transportation option in the long term?

BERTHELOT Let me start by saying I’m not a recent rail expert. But historically, my experience has been that rail is swing transportation that ramps up very quickly and grows exponentially when you are in the growth part of the business cycle, but then tends to drop off first and slow down exponentially in a challenging part of the business cycle.

We’re glad that our logistics business is backed by the minimum-volume commitments so that we don’t necessarily have to experience those swings. But we do believe that rail will continue to be a transportation option in the long term. Primarily because we don’t think that these commodity price swings and the other down-business cycles in the gas businesses are going anywhere anytime soon, in our lifetime.

MIDSTREAM Do you have personal predictions on when commodity prices will rebound?

BERTHELOT I do not have strong personal predictions or opinions on where commodity prices will go or when they’ll rebound. The thing that I’ve found throughout my career is about the time we think we all know the answer, it turns out to be something different. That’s why for many years I’ve tried to design the businesses that I’ve run so that I don’t have to lose sleep over the commodity prices. That’s what we’re trying to do here.

These are challenging times. There’s no doubt about that, but some of the old guys like myself who have done this for many years through multiple companies and multiple business cycles have seen and survived these business cycles.

The main thing you’ve got to do is make sure that you have talented people around you. I’ve got a very talented operating team and a great group of investors, both the private equity investors and the public, and my investors have succeeded through many business cycles. So with the great operating team both in the field and the back office, we think we have a great footprint, great assets, in East Texas and we think East Texas is a great long-term oil and gas field that continues to reinvent itself.

We think that’s a recipe for success, and we’re confident that over the long term that that it will all work out and that we’ll survive this downturn. When this business cycle turns around and we start to grow again, we think we’ll be well positioned to substantially make some hay and grow our business. We’re excited about where we’re at.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.