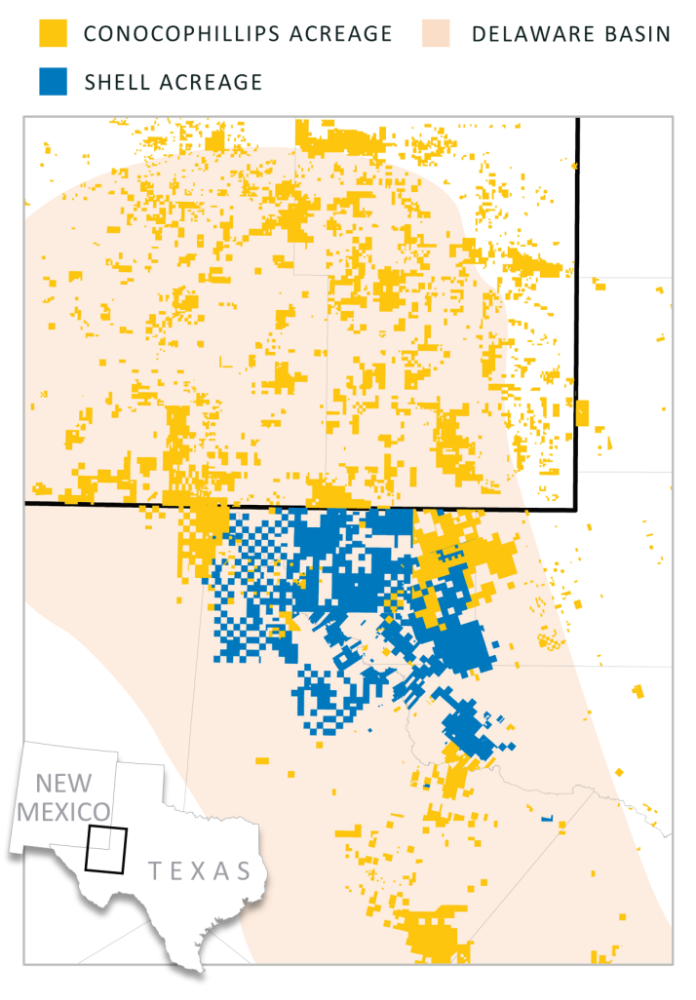

The $9.5 billion cash acquisition of Shell’s Permian business includes ownership in approximately 225,000 net acres located entirely within the Delaware Basin in West Texas. (Source: ConocoPhillips Co.)

Royal Dutch Shell Plc grabbed headlines on Sept. 20 with the European supermajor’s exit from U.S. shale through the divestiture of its Permian Basin business.

However, despite the significance of the deal for Shell’s energy transition strategy, the true winner of the $9.5 billion cash transaction, according to Enverus’ Andrew Dittmar, was the patience of the buyer—Houston-based ConocoPhillips Co.

“After waiting patiently on M&A opportunities through the land-rush years of the shale boom, Conoco has been able to pick up prime Permian real estate at what looks to be attractive price points,” said Andrew Dittmar, senior M&A analyst at the firm.

The acquisition of Shell’s Permian business includes ownership in approximately 225,000 net acres located entirely within the Delaware Basin in West Texas. The assets are expected to produce 200,000 boe/d in 2022, around half of which is operated. Further, ConocoPhillips noted in a company release on Sept. 20 it will also pick up over 600 miles of operated crude, gas and water pipelines and infrastructure as part of the acquisition agreement.

Overall, Dittmar ranks the acquisition as the largest all-cash U.S. upstream deal in over three years.

“Conoco is making a major commitment to shale in this deal and in particular the Permian Basin,” he said. “That is an area that lagged in Conoco’s portfolio for years but has recently lept to the forefront of its long-term plans.”

In addition to its latest purchase, ConocoPhillips also scored the largest U.S. upstream deal last year with its acquisition of Concho Resources, which was one of the largest unconventional shale producers in the Permian Basin with positions in both the Delaware and Midland sub-basins. The all-stock Concho acquisition, valued at around $13.3 billion, closed in January 2021.

Dittmar notes that the acreage prices for both ConocoPhillips acquisitions within the past year were only a fraction of the nearly $60,000/acre Occidental Petroleum paid for overlapping land in its purchase of Anadarko Petroleum in 2019

ConocoPhillips reported paying about $15,000/acre for Shell’s Permian position and Dittmar said ConocoPhillips’ purchase of Concho also priced attractively at $10,000/acre per analysis by Enverus.

“The shift in focus among the industry’s largest players seems to be creating opportunities for Conoco, which remains more aligned with traditional oil and gas production,” he said.

New investment in U.S. shale has slowed in recent years as companies prioritize shareholder returns and, in the case of the majors, shift focus to energy transition projects. This is occurring even though shale is currently generating record cash flow for what Dittmar described as “well-run E&Ps.”

“Besides a general cooling in the market for shale acreage, Conoco’s ability to pay cash in a deal of this size likely contributed to nabbing the assets at an attractive price point,” he added.

Since the emergence of COVID, most of the large E&P deals, and even smaller-sized corporate transactions, have been largely or entirely for stock.

“That is fine in a corporate merger or acquisition of a private company from a private equity investment firm,” Dittmar said.

From Shell’s perspective, however, cash was likely vastly preferable, he said. For example, the company announced plans alongside plans of the divestiture to distribute $7 billion of the total $9.5 billion sales price to shareholders. The balance of the proceeds from the sale is slated for debt reduction.

For ConocoPhillips, the addition of Shell’s Permian asset to its portfolio, which includes operations and activities in 15 countries, should further bolster profitability, Dittmar said.

Pro forma for the Shell deal, ConocoPhillips held approximately 750,000 net acres in the Permian Basin. Its position in the basin includes 88,000 unconventional net acres in the Delaware Basin, 58,000 unconventional net acres in the Midland Basin and an additional 21,000 unconventional net acres in various other plays in the Northwest Shelf, according to a company fact sheet.

ConocoPhillips projects to generate $10 billion in free cash flow over the next 10 years as a result of the Shell acquisition including $1.9 billion in 2022 at current strip and estimated production. The company said it also expects the acquisition to improve its greenhouse-gas intensity reduction target for 2030 by 5%.

“For a large company committed to oil and gas production, the deal should meet all investor expectations,” Dittmar concluded.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.