(Source: Blue Planet Studio/Shutterstock.com)

As the world transitions to cleaner forms of energy, the companies behind innovative oil and gas technologies are using their technical knowledge to help sustainably power the world.

The journey, however, is not without some risks and success requires collaboration and cost-effective solutions, according to panelists speaking during a recent virtual OTC Live.

“Trends towards a low carbon economy and energy transition are shaping our innovation,” said Pablo Reali, managing director of oil and gas projects for Suez Water Technology & Solutions.

The company, which specializes in delivering water and environmental technologies for the energy sector, aims to reduce its carbon footprint by 45% within 10 years through energy efficiency and emissions-reduction initiatives such as carbon capture. Reali said Suez is taking a collaborative approach to accelerate development and deployment of cost-effective technologies.

One project underway, for example, is the BP-operated Net Zero Teesside project, the first carbon capture usage and storage project in Britain. It aims to decarbonize a cluster of industrial businesses by 2030, delivering the U.K.’s first zero-carbon industrial cluster. Suez said in November it signed an agreement with BP that paves the way for development of a way to capture CO₂ emissions from an energy-from-waste facility and transport it for permanent storage under the North Sea.

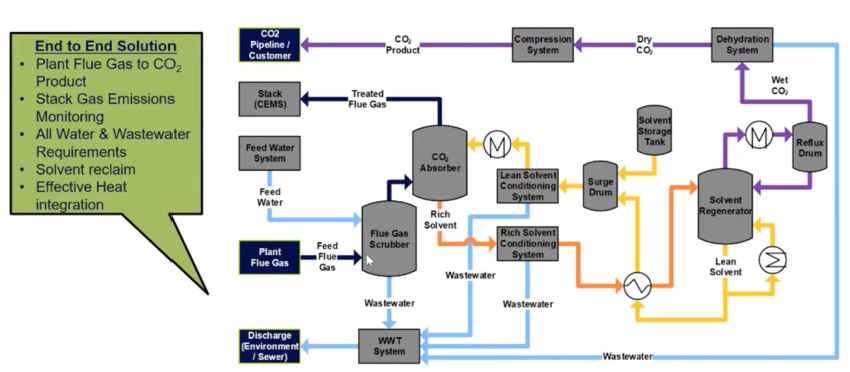

Teesside would capture up to 10 million tonnes of CO₂ emissions from the mid-2020s, according to Suez, which would use its expertise in energy-from-waste and CO₂ separation systems to create a solvent-based modular system to capture CO₂ from energy-from-waste flue gas emissions.

“The interesting thing from this project and collaboration is we are shifting technologies from oil and gas into other sectors,” Reali said. “This is built upon our industry knowledge in gas sweetening and gas treatment.”

The process, he explained, uses new solvents and application of electrodialysis water treatment. Added offerings include remote monitoring and chemical conditioning of systems. “We believe we are going to be able to deliver a comprehensive solution in an economical way,” Reali said.

Plans are for the commercial scale demonstration carbon capture facility to be developed at Suez’s Tees Valley (Lines 1 and 2) facility at Haverton Hill on Teeside, Suez said. The company aims to remove 90% of fossil and biogenic CO₂ emissions from the facility.

Other projects include partnering with a U.S. operator on an automated cyclonic wellhead desander, which he said cuts down the amount of gas vented during operations at shale or tight oil and gas sites, and offshore water injection recycling toward zero discharge technology.

“Innovation towards sustainability has to be collaborative based on shared targets,” Reali said.

“Trends toward the energy transition are happening,” he added, noting there will be no going back. However, “solutions have to make economic sense.”

For Spain’s Repsol, which envisions becoming a net-zero carbon company by 2050, the evolution of R&D has involved a cultural change toward a product mindset, according to Federico Giannangeli, the company’s technology director of E&P projects.

“Innovation is not only the way that we apply it to product development, but it’s also the way that we are doing things, changing the way that we are doing things,” he said.

The key is having a short time cycle for technology and product ownership with a strong business-to-consumer link.

“That was the best way to ensure that we have a technology that is not only developed, but is also adopted in the company,” he said.

One of Repsol’s technology production applications in the North Sea aimed to capture more data without expensive coring. One core could run higher than $7 million in the North Sea, he said.

Products developed and applied included using high-resolution image analysis for full digital petrophysical modeling along with digital and experimental hybrid workflows for quicker reservoir property estimation using artificial intelligence (AI), according to his presentation.

AlphaX Decision Sciences COO Aruna Viswanathan called AI “the creatively destructive breakthrough innovation that will allow oil and gas to maintain profitability while managing the energy transition and transformation in the decade ahead.”

She explained how AI models can learn from millions of other models in real-time instantaneously.

“AI can give you more information at your fingertips to ensure that you make the right decision,” Viswanathan said. “In this new world, every workflow is an invitation for disruption. And we believe based on what we have seen in market, that that is true for software in upstream.”

AlphaX is a Houston- and Silicon Valley-based software company offering AI technology for energy companies. In particular, the company has taken on the challenge of using AI to predict produced water at the well level, she said, highlighting the importance of water planning in production economics in shale plays such as those in the Anadarko Basin.

“Today, forecasting has typically been done with type curve analysis, application of water to oil ratios and using a lot of aggregation. But that doesn’t really speak to the dynamic nature of the industry and the ability or need to do a better economic modeling as water becomes a larger part of the equation,” Viswanathan said.

With AI, “processing occurs in just a few seconds for over 10,000 wells enabled via the cloud and helps provide engineering and economic tools that can be updated as new data becomes available,” she said.

The industry needs more AI solutions at scale capable of lowering nonproductive time and optimizing production, according to Viswanathan. She also believes AI has a role to play in making business models more sustainable and economically viable with improved forecasting as traditional oil and gas companies diversify into alternative energy.

Such diversification “will need significantly different business models requiring tighter controls on budgets and much better forecast capability,” she said, speaking on some risks facing the industry.

Also crucial will be overcoming familiar issues such as the amount of time for prototyping and developing technologies, stifling innovation with lengthy sales cycle times and getting technology to the marketplace faster among other issues.

Repsol’s Giannangeli suggested allowing more time for innovation.

“Innovate in your process as well as in your product. … Innovate with your product owners and your users and do not underestimate all the accomplishments that you can get with strategic alliances,” he said. “And last but not least, never lose sight of generating impact. R&D needs to generate impact.”

Recommended Reading

US Drillers Add Most Oil, Gas Rigs in a Week Since September

2024-03-15 - The oil and gas rig count, an early indicator of future output, rose by seven to 629 in the week to March 15.

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-04-05 - The oil and gas rig count, an early indicator of future output, fell by one to 620 in the week to April 5, the lowest since early February.

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.