As commodity prices stabilize and oil and gas companies exit bankruptcies, M&A activity should reach beyond the borders of the Permian Basin, according to a recent Deloitte report. (Source: Shutterstock.com)

Cataclysmic events ushered the 2020 oil and gas industry into an M&A Dark Ages as deals and values plummeted, particularly asset transactions. Recovery this year is possible—though tenuous, according to Deloitte, and will rely on stable oil prices.

The pandemic and last year’s commodity price war heightened an already frayed industry and stymied a market already populated by reluctant buyers, bankers and investors. As 2021 dawned, the oil and gas industry found itself even more propped up on debt as public and private investment fled.

Now the oil and gas industry will look to reset financially, continue to consolidate through M&A and contend with an expanding energy investor base attuned to renewables.

Across all oil and gas sectors, global year-over-year transactions fell by 40% to 258 deals with value declining to $218 billion last year compared to $347 billion in 2019, according to a February M&A report by Deloitte. Among global upstream transactions, values fell by 48% to $70 billion, compared with $134 billion in 2019.

The U.S. remained the largest source of upstream deals, accounting for 53% of transactions and 73% of deal value. Of the five largest deals in North America, four were in the U.S.

Since 2014, U.S. upstream transaction premiums have fallen by half, according to Deloitte. Still, shale was the driver for most U.S. activity, dominated by low-premium, all-stock deals.

“Following an unprecedented low first half of the year, upstream deal value returned to pre–COVID-19 levels even as deal count remained anemic,” Deloitte said in its report. “However, unlike previous years, much of the deal value was driven by corporate consolidation, despite the lack of megadeals.”

Only two upstream deal announcements eclipsed $10 billion: Chevron Corp.’s $13 billion acquisition of Noble Energy and ConocoPhillips Co.’s $13.3 billion purchase of Concho Resources.

“Both transactions represented a shift in M&A, with a focus on lower-premium, all-stock, corporate consolidations with an eye to the Permian, which remains the single largest region for drilling and M&A activity,” the Deloitte report said.

As oil prices stabilize and remain above $50/bbl, and as companies exit bankruptcies, all-stock consolidations should reach beyond the borders of the Permian Basin to the Bakken and Eagle Ford in the U.S. and the Montney and other unconventional plays in Canada.

Plays such as the Eagle Ford and Haynesville “continue to be fragmented, making them potentially ripe for renewed dealmaking in 2021.”

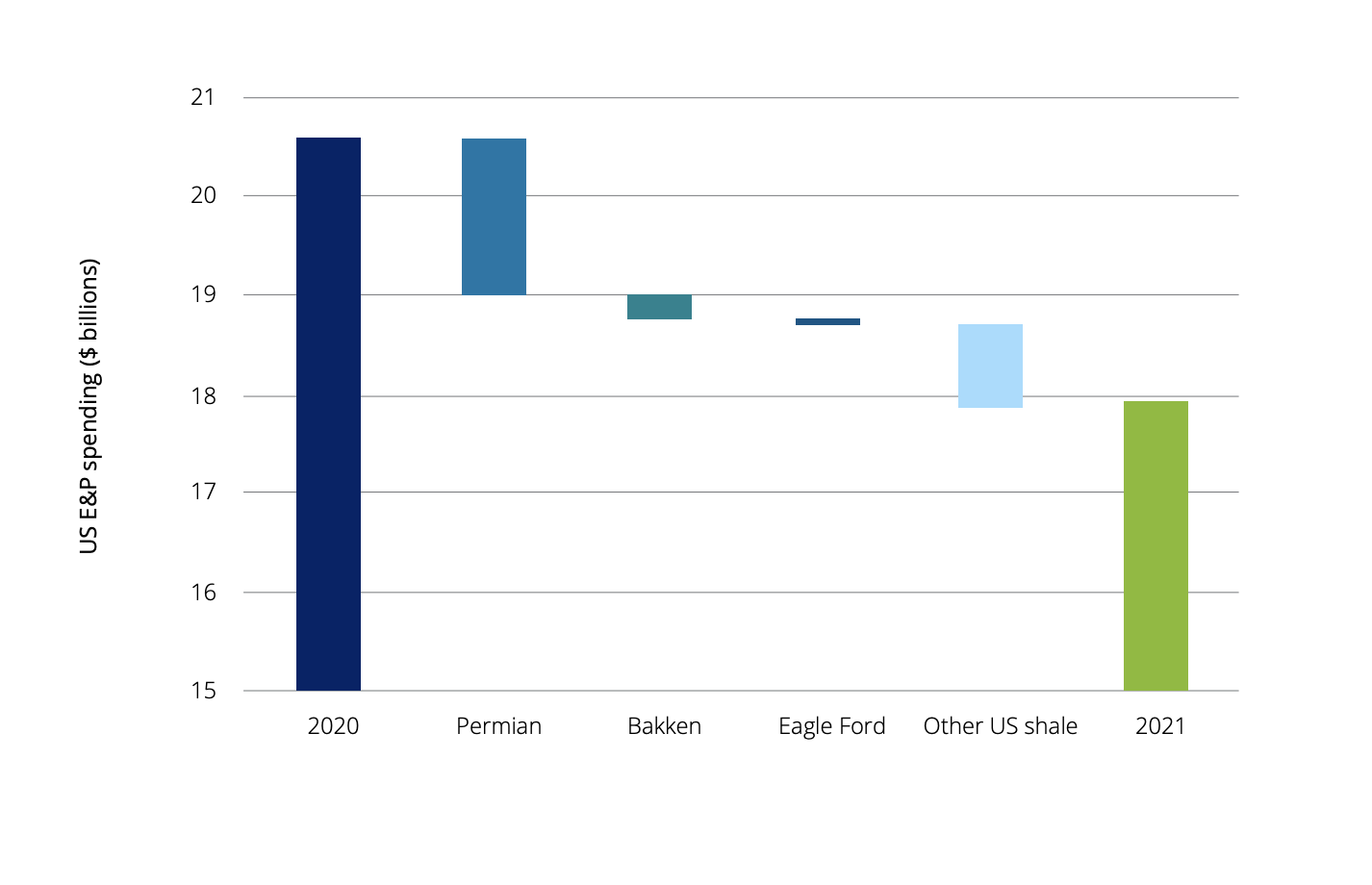

Note: Data includes 23 U.S. oil-focused operators accounting for 41% of 2020 U.S. tight oil output.

Indebtedness will remain a key theme for the oil and gas industry this year, particularly as other industries continue to generate more lucrative payoffs.

“The oil and gas industry has been one of the hardest hit by the pandemic, with energy industry revenues declining by 54%,” the Deloitte report said, “primarily because of increased remote work and lower industrial demand for energy and materials, including fossil fuels and petrochemicals.”

Last year, more than 100 upstream and oilfield services companies filled for bankruptcy, and impairments have risen across the oil and gas sector.

“While 2021 should be a period of recovery for the sector, debt levels have risen for multiple segments since 2015, most notably for integrated, midstream and downstream companies,” the Deloitte report said.

While oil prices have recovered from historic lows, Brent oil is expected to remain range-bound at about $50/bbl. With many companies looking to deleverage, further downward pressure could be brought to bear on the M&A market.

“The lack of financially strong buyers could delay large-scale divestitures by the majors and large upstream producers,” the Deloitte report said. “Similarly, higher debt levels may limit the attractiveness of further consolidation in midstream and downstream.”

Oil and gas companies constitute just 2% of the S&P 500, compared with more than 15% a decade ago. For many investors, Deloitte analysts said oil and gas has proven too volatile while not outperforming less risky sectors.

“More reliable sources of capital will likely return in the long term once companies restructure, commodity prices improve, and returns stabilize,” the firm’s report said. However, streamlining the debt of those companies may take years.

Stream Hart Energy’s virtual

A&D Strategies and Opportunities Conference

Since 2016, financing options have already been constrained, with limited equity issuance, IPOs, venture capital and private equity investments. Companies instead have relied on lenders, with debt issuance rising to $240 billion, including $98 billion in second-quarter 2020.

However, dealmaking in the oil and gas sector could return to pre-2020 levels this year, according to Deloitte. As oil and gas companies finalize impairments, bankruptcies reduce liabilities, and debt is restructured or discharged, more financially secure organizations could engage in a significant increase in transactions.

“Even though shale spending dropped dramatically over the course of the year, the United States remained the largest source for deals,” the report said. “That could open opportunities for countercyclical investment by those with stronger balance sheets, spurring further dealmaking.”

Recommended Reading

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.