EQT Corp. operates about 95% of the assets in southwestern Pennsylvania, which it assumed following its acquisition in 2020 of Chevron’s position in the Appalachian Basin. (Source: EQT Corp.)

In a drive to becoming a “national nonoperated franchise,” Northern Oil and Gas Inc. said it will acquire the Marcellus Shale assets of India’s Reliance Industries Ltd. in a cash-and-stock deal worth about $250 million.

Based in Minnetonka, Minn., Northern invests in nonoperated minority working and mineral interests in oil and gas properties. The company branched from the Williston Basin, where the bulk of its portfolio is focused, with acquisitions last year in the Permian Basin.

Now with Northern’s expansion into the Appalachian Basin, the company furthers its goal of becoming a “national nonoperated franchise with low leverage, strong free cash flow and a path towards returning capital to shareholders,” CEO Nick O’Grady said in a statement on Feb. 3.

“With this transaction, we expect increased opportunities to efficiently allocate capital and diversify risk, our commodity mix and geographic footprint,” O’Grady said.

Reliance, led by billionaire Mukesh Ambani, has been diversifying away from its mainstay energy arm to consumer-facing businesses in recent years. In 2017, the company sold a chunk of its Marcellus assets located in northeastern and central Pennsylvania for $126 million to Kalnin Ventures LLC.

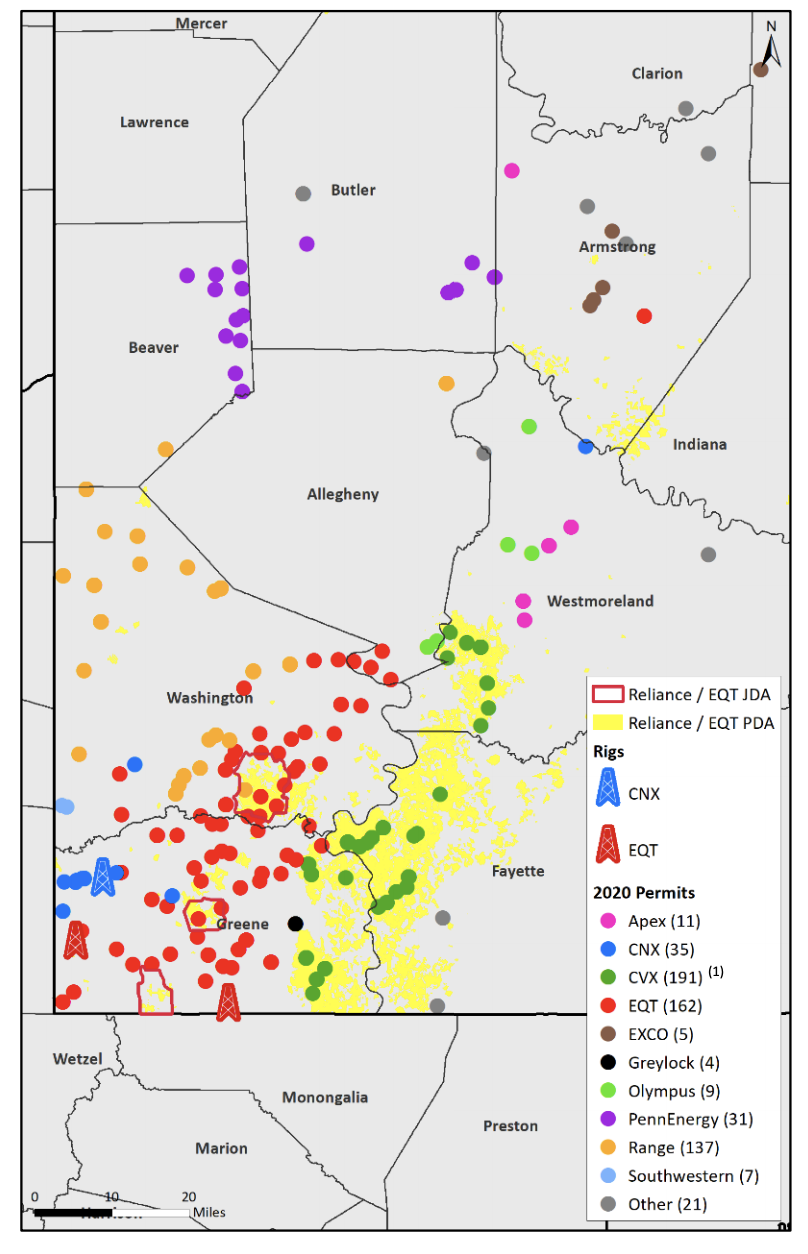

In a Feb. 3 company release, Northern said it agreed to the deal with a subsidiary of Reliance for a 27% blended working interest and 64,000 net acres in southwestern Pennsylvania. The acquisition also includes approximately 102.2 net producing wells, 22.6 net wells in process and 231.1 net undrilled locations in the core of the Marcellus and Utica shale plays.

At the effective date of July 1, 2020, the assets were producing approximately 120 MMcfe/d of natural gas, net to Northern’s ownership. EQT Corp. operates about 95% of the assets, which it assumed following its acquisition in 2020 of Chevron Corp.’s position in the Appalachian Basin.

Northern expects to generate between $55 million and $60 million in unhedged cash flow from the assets in 2021. The company said it has electing to hedge 75% of expected PDP volumes for about three years, including basis differentials, according to its release.

Additionally, Northern will become a joint venture partner in the development of the assets as part of the purchase agreement. Northern expects a capex budget of between $25 million and 30 million net to the company for 2021.

“The joint venture structure allows Northern significant input and clarity on the development plans for these assets on a multiyear basis,” Northern COO Adam Dirlam added in a statement in the company’s release.

Dirlam also noted that the cash purchase price of the assets only ascribes value for producing wells and the wells-in-process, which gave significant upside value to the undeveloped properties.

Simultaneous with the execution of the acquisition agreement, Northern entered into a cooperation agreement with Arch Energy Partners which acquired an undivided 30% interest in the assets for a cash purchase price of $75 million, according to a company presentation.

Northern will fund its purchase, comprised of $175 million in cash and approximately 3.25 million warrants, through a combination of equity and debt financings that were launched concurrently with the announcement of the transaction. The warrants will allow for the purchase over the next seven years of 3.25 million common shares of Northern at an exercise price of $14 per common share, which according to Enverus analysts is a 24% premium over the company’s closing price on Feb. 3.

Chad Allen, CFO of Northern, said the combination of equity and debt financings are projected to be leverage neutral on a trailing basis and leverage accretive on a forward basis.

“With these transactions, our debt metrics improve immediately on a pro forma basis and we expect them to continue to improve over the coming years,” Allen said in a statement noting the financings are also expected to “improve liquidity, remove all near-term maturities and significantly improve free cash flow on a multiyear period.”

Any remaining proceeds from the financings will primarily be slated toward repurchasing Northern’s 2023 second-lien notes and reducing debt.

Pro-forma for the Marcellus transaction, Northern expects 2021 production to be 58,000 boe/d with 55% liquids including NGL, which Enverus noted is “significantly drier” than its 29,000 boe/d last quarter at 77% oil. Enverus also noted in a Feb. 3 research note that Northern had reduced standalone capex expectations for next year by 6% to about $200 million, at a marginally higher production of 40,300 boe/d.

BofA Securities is lead financial adviser to Northern for the Marcellus transaction. Kirkland & Ellis LLP serves as Northern’s legal adviser. Wells Fargo Securities is a co-adviser on the transaction.

Reliance was represented by a Gibson, Dunn & Crutcher LLP team led by Houston Oil and Gas Partner Michael P. Darden and Oil and Gas Of Counsel James Robertson.

This story was updated at 10:32 a.m. CST Feb. 10. Reuters contributed to this article.

Recommended Reading

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

WoodMac: Market Likely to Absorb Aramco’s Downshift in Oil Production

2024-02-02 - Saudi Aramco’s move from a targeted 13 MMbbl/d capacity by 2027 is not expected to tighten the supply and demand balance this decade, Wood Mackenzie analysts said.