Hydrogen producer Linde sees $50 billion-plus worth of global investment opportunities in hydrogen over the next decade as focus increasingly turns to the low-carbon energy source as a route to decarbonization. (Source: Shutterstock.com)

Hydrogen producer Linde sees $50 billion-plus worth of global investment opportunities in hydrogen over the next decade as focus increasingly turns to the low-carbon energy source as a route to decarbonization.

Speaking on April 27 during the company’s first-quarter earnings call, CEO Sanjiv Lamba said opportunities fall into three key categories: mobility; industrial applications to help existing customers decarbonize; and energy and power where hydrogen or its carrier—ammonia—will play a role.

The anticipated opportunities, which include about $30 billion in potential investments in the U.S., represent one of the best long-term growth environments Lamba said he has seen in some time.

“Of course, time will tell how many we ultimately sign and announce, but you can see we are making meaningful progress,” Lamba said.

Hydrogen is known as a fuel for space exploration; a component of ammonia, which is a key ingredient in fertilizers; and as a way to lower the sulfur content of diesel fuel. The shift to a low-carbon economy has positioned hydrogen as a game-changer for hard-to-abate sectors where it could be put to use as a fuel and feedstock — but also for energy storage and load balancing.

Adding hydrogen projects

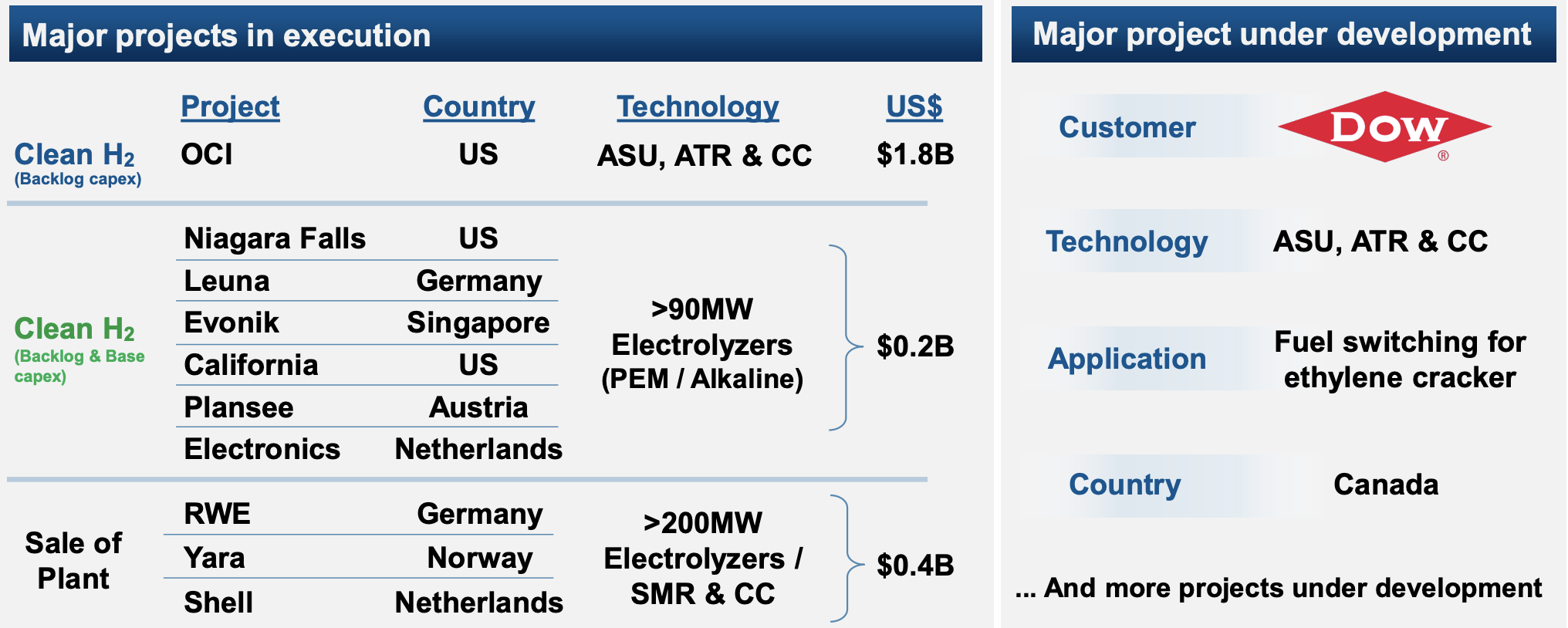

Chemical company Dow said on April 25 it had selected Linde as its industrial gas partner to supply clean hydrogen and nitrogen for its proposed net-zero carbon emissions integrated ethylene cracker and derivatives site in Alberta, Canada.

Earlier this year, Linde said it plans to invest $1.8 billion to supply OCI, a global producer and distributor of ammonia, fertilizers and methanol. Linde would provide clean hydrogen and other industrial gases for OCI’s new 1.1 million ton per annum blue ammonia plant in Beaumont, Texas. The hydrogen producer said earlier this month it signed a long agreement with Exxon Mobil Corp. for the offtake of CO2 associated with Linde’s new hydrogen production in Beaumont.

Linde’s backlog also includes more than 90 megawatts in PEM and alkaline electrolyzer technology investments that include deals signed with chemicals specialist Evonik and others. The company said it is currently developing more than 200 projects.

“Despite the many differences across these projects, a full suite of offerings coupled with a strong balance sheet will enable us to win more than our fair share,” Lamba said. “But rest assured, our participation will consistently follow our strategy and proven investment criteria.”

Currently, Linde has about a $2 billion backlog associated with decarbonization projects.

“Our expectation is that in the next two to three years, we will be making investment decisions anywhere between $9 [billion] to $10 billion worth. This is based on the projects we're developing, which are further advanced than others,” Lamba said.

IRA incentives provide boost

At about 60%, most of the investment opportunities are expected to come from decarbonization within the industrial sector, Lamba told analysts. Regions that could see the most growth include the Middle East, Europe and the U.S. Domestically, he expects momentum to be the greatest due to the Inflation Reduction Act (IRA).

This year, clean hydrogen plants can receive a production tax credit of up to $3 per kg for the first 10 years of operation. The credit expires in 2032.

The IRA’s 45Q tax credit makes hydrogen more attractive from a pricing perspective. Hydrogen can be used as an input into crackers, chemical systems downstream and the refining system, he said.

Linde CFO Matt White added that the hydrocarbon market for transportation and energy is somewhere around $6 trillion; however, the industrial gas business—of which Linde is a part—is only a fraction of that market.

“In my view, a lot of that $6 trillion market is what is being addressed and potentially converted to things like hydrogen,” White said. “If that happens, I think that actually creates opportunities in areas that we had a very, very small participation in in the past. But time will ultimately tell.”

Linde’s competitive advantage is its existing infrastructure along the U.S. Gulf Coast, where its hydrogen pipeline system spans more than 370 miles from Freeport, Texas, to Lake Charles, Louisiana.

‘Record highs’

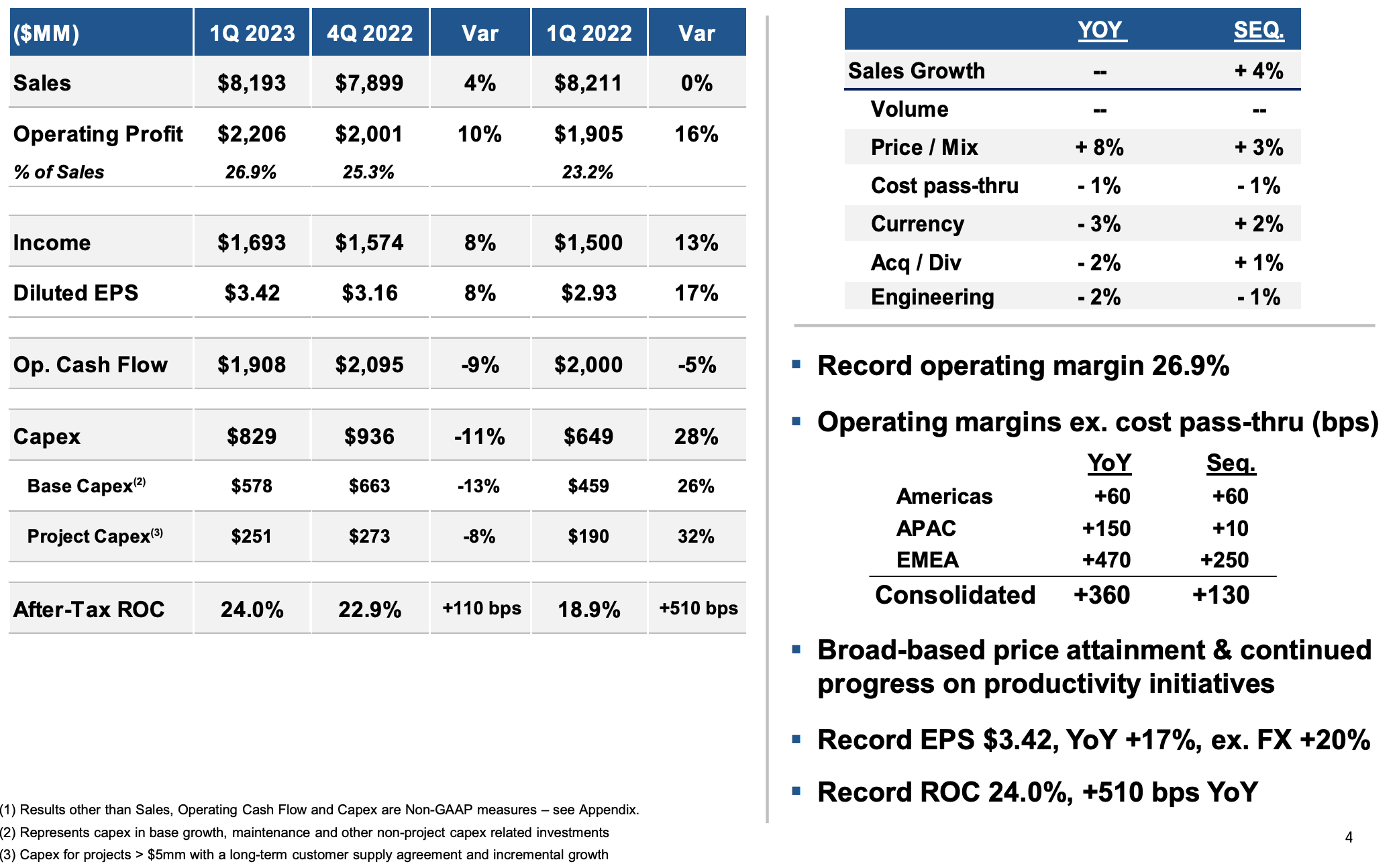

Linde’s sales held steady at $8.2 billion in the first quarter with earnings per share rising 17% year-on-year to $3.42. For second-quarter 2023, Linde expects adjusted diluted earnings per share in the range of $3.40 to $3.50, up 10% to 13% versus prior-year quarter.

“Earnings per share, operating margin and return on capital all reached new record highs. Robust pricing coupled with dependable return on capital have more than compensated or a weaker economy,” Lamba said. “Just like the last four years, Linde's ability to consistently deliver earnings growth in any environment is a testament to the resilient portfolio, operating excellence and capital discipline. And when global economies recover, which they always do, there's an opportunity to further leverage a base volume growth.”

Recommended Reading

Matador Bolts On Additional Interest from Advance Energy Partners

2024-02-27 - Matador Resources carved out additional mineral and royalty interests on the acreage it acquired from Advance Energy Partners for $1.6 billion last year.

Is Grayson Mill the Next Bakken Domino to Fall After Chevron-Hess?

2024-01-31 - As E&Ps look to bulk up outside of the Permian Basin, EnCap-backed Bakken player Grayson Mill Energy is reportedly exploring a sale valued around $5 billion.

Benchmark Buys Revolution Resources’ Anadarko Assets in $145MM Deal

2024-02-20 - Benchmark Energy II is acquiring Revolution Resources just over four years after Revolution bought out Jones Energy Inc.’s Midcontinent portfolio.

Marketed: DRII 642 Well Package in Louisiana, Oklahoma, Texas, Wyoming

2024-04-02 - DRII LLC retained EnergyNet for the sale of a 642 well package across various counties and parishes in Louisiana, Oklahoma, Texas and Wyoming.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.