NOAA, or the National Oceanic and Atmospheric Administration, “is predicting a near-normal 2023 Atlantic hurricane season. Specifically, there is a 40% chance of a near-normal season, a 30% chance of an above-normal season and a 30% chance of a below-normal season,” NOAA Administrator Rick Spinrad told media members during NOAA’s 2023 Hurricane season outlook news conference on May 25. (Source: Shutterstock.com)

After busy hurricane seasons in back-to-back-to-back years, it appears that NOAA won’t need its ark after all with forecasters predicting 2023 will be a milder year for hurricane activity in the Atlantic.

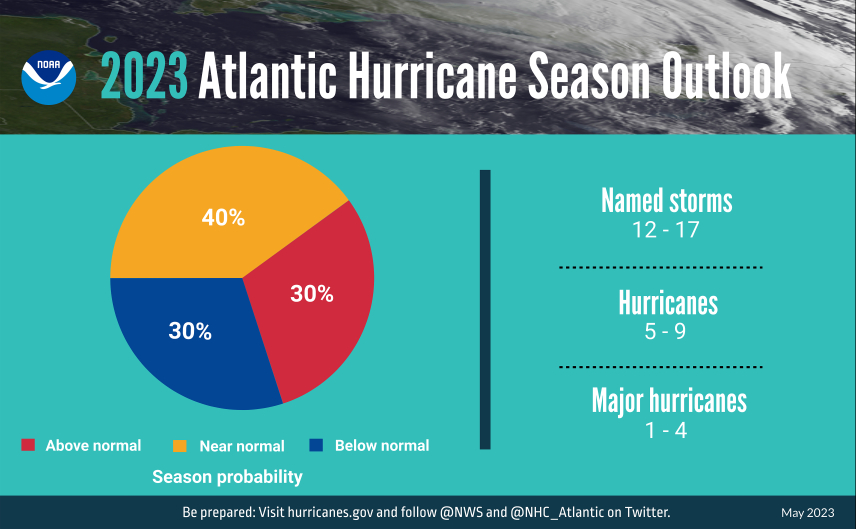

NOAA, or the National Oceanic and Atmospheric Administration, “is predicting a near-normal 2023 Atlantic hurricane season. Specifically, there is a 40% chance of a near-normal season, a 30% chance of an above-normal season and a 30% chance of a below-normal season,” NOAA Administrator Rick Spinrad told media members during NOAA’s 2023 Hurricane season outlook news conference on May 25.

This hurricane season, which lasts from June 1 to November 30, NOAA is forecasting a range of 12 to 17 named storms with winds of 39 mph or higher. Of those, between five and nine could become hurricanes—storms with winds of 74 mph or higher. And of these projected hurricanes, one to four of them are expected to reach Category 3 or higher, meaning they’d have winds of 111 mph or higher.

IBM’s The Weather Co. and Atmospheric G2 released a near identical hurricane season forecast earlier in May. Their scientists predicted 15 named storms in their initial 2023 outlook, seven of which will become hurricanes and three of which will reach Category 3 status or stronger.

This signifies a welcome change from the last three years, as the Atlantic has been plagued by tropical storms and hurricanes caused by La Niña conditions. In 2022 alone, 14 named storms accumulated, with three of them upgraded to hurricane status. That same year, approximately 11% of oil production and 8.56% of natural gas production in the Gulf of Mexico was shut-in due to Hurricane Ian. Storms in 2022 caused a collective $117 billion in damages to the U.S.

“But we are in an active era, and having a strong El Niño with an active era and such warm SSTs (sea surface temperatures)...it's definitely kind of a rare setup for this year.”—Matthew Rosecrans, NOAA’s lead hurricane outlook forecaster.

According to NOAA, this relatively lackluster hurricane season will be the result of El Niño, which is likely to develop this summer. El Niño oftentimes suppresses Atlantic hurricane activity as it tends to increase atmospheric stability.

However, the projected number of storms is higher than normally expected during an El Niño and could represent climate change’s effect on the environment.

“When I look back on the historical data we have, we've had anywhere from six name storms to 18 name storms during El Niños. The stronger an El Niño event, the less amount of storms you have,” Matthew Rosecrans, NOAA’s lead hurricane outlook forecaster, told media members during the news conference. “But we are in an active era, and having a strong El Nino with an active era and such warm SSTs (sea surface temperatures)...I've only seen it one other time in historical records… It's definitely kind of a rare setup for this year.”

Climate change might also contribute to storms with higher intensity, said Spinrad. Hurricane Harvey was an example of this, he said, attributing the storm’s stronger winds and greater rainfall to the increased energy that warmer climates and sea surface temperatures brought to the area.

Despite the effects of climate change on the Atlantic Basin, NOAA is incredibly confident in their forecast, due to recent investments aimed at innovation in their forecast technologies.

“Re-analysis of forecasts for storms from 2020 to 2022 has shown that the accuracy of our forecast track has improved by 40% since 2017. And the accuracy of our forecast intensity has improved by 46% since 2017,” Deputy Secretary of Commerce Don Graves told media members. “We’ve also improved the lead time for hurricane forecast by two days, and the seven-day track forecast now has the same accuracy as the five-day track forecast.”

NOAA is also rolling out a new hurricane model later this year called the Hurricane Analysis and Forecast System (HAFS). Developed using hurricane disaster supplemental funding in 2018, 2019 and 2022, the model provides up to 15% improvement in track and intensity forecasts over existing models. This season, the HAFS will run in tandem with the currently operational Hurricane Weather Research and Forecast Model System (HWRF) and Hurricanes in a Multi-scale Ocean-coupled Non-hydrostatic (HMON) model, but eventually will become NOAA’s primary hurricane model.

“The [HAFS] aims to improve forecasts for rapid intensification. All of our forecast models run on NOAA's operational supercomputing system. In July, we'll be expanding our supercomputing capacity by 20%,” Spinrad said. “This upgrade will allow us to run more complex forecast models and provide faster and more efficient computing power for operational prediction, research and development.”

Recommended Reading

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.