Helmerich & Payne Inc. (H&P) averaged 183 contracted rigs in the second fiscal quarter, exiting at less than guidance expectations with 179 contracted rigs, H&P CFO Mark Smith said in the company’s first quarter earnings call on April 27. (Source: Shutterstock.com)

Helmerich & Payne Inc. (H&P) averaged 183 contracted rigs in the second fiscal quarter, exiting at less than guidance expectations with 179 contracted rigs, H&P CFO Mark Smith said in the company’s first quarter earnings call on April 27.

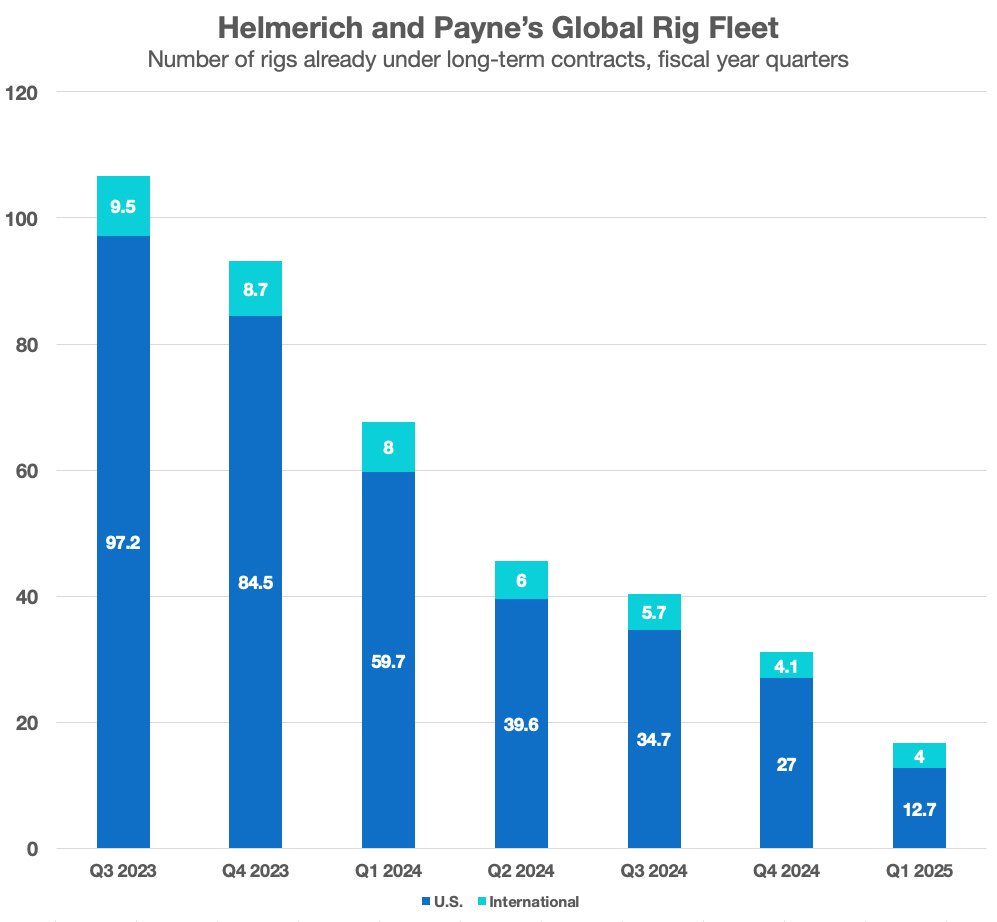

The company estimates running between 155 and 160 contracted rigs by the end of its fiscal third quarter, which Benchmark analyst Kurt Hallead said suggests fourth-quarter 2023 will dip below activity in the third quarter.

H&P President and CEO John Lindsay disagreed.

“My experience over the past two decades indicates that it isn’t unusual to see rig count volatility within an upcycle,” he said. “I don’t ever recall an upcycle that was straight up [and to] the right.”

Lindsay said the current softening of rig activity can be attributed to low U.S. natural gas prices, which had a dampening effect on the company’s rig activity. That contributed to “an increased level of contractual churn in the market, not only in terms of number of rigs but also in the increased idle time between contracts.”

Customers are also being more fiscally prudent with budgets and the return focus they are pursuing, he said.

Much of the recent turbulence in rig activity stems from natural gas, but Lindsay said that H&P is optimistic about the longer-term fundamentals of crude oil and its ability to drive rig demand.

“With current prices above the $70 per barrel range, our expectation is there should be strength in the oil drilling market,” he said. “We expect an improving rig count in the second half of the calendar year and, like the last three years, we expect a buying season in calendar Q4.”

As for the company’s international operations, H&P ended the fiscal second quarter with 14 rigs running in Australia. H&P added a rig in Bahrain, bringing the working rig count to two out of three in that country. Looking ahead to the third fiscal quarter, H&P anticipates idling one rig in Argentina that completed its term contract. Another, in Columbia, will be released as a customer assesses a recently drilled well and determines next steps.

Offshore, four of seven platform rigs were contracted, and H&P has active management contracts on three customer-owned rigs. Looking forward to third fiscal quarter, one offshore platform rig will be demobilized as the customer has reached the end of its multi-year drilling program.

Asked during the earnings call if lower U.S. activity would free up equipment for international operations, Lindsay said that wasn’t likely. He said he expects a buying season in the second half of the year, particularly in the fourth quarter.

He predicted that the estimated 155 to 160 rig count in the U.S. at the end of calendar second quarter would be the lowest number of the year.

“We are having conversations with some customers about some June opportunities,” he said. “You’ve probably heard me say [this] before: It’s difficult to see out much past a quarter, but we are having some conversations. And so that leads us to believe that we will start picking some rigs back up. And again, hopefully that is the bottom at that point.”

Lindsay reiterated that rig count volatility is to be expected in the cycle.

“Occasionally we’ll have an investor visit with us and say something along the lines of the current downturn,” he said. “It’s like – well, this is not a downturn. This is a very normal part of the cycle within a longer-term upcycle. You can look back at different periods over the last 20 years and you can see that for yourself. There’s a lot of volatility in rig activity. So again, we feel good about the position. But that’s our focus. It’s focused on the returns over market share.”

Double-digit returns, stock downturn

H&P realized annualized mid-teens return on invested capital for the fiscal year, Lindsay said during the earnings call. This marks the first time the company achieved a double-digit return since the 2014 cycle.

Despite better than expected fiscal second quarter adjusted earnings, H&P shares dropped 4.8% after issuing what Hallead called an implied 19% cut to third-quarter EBITDA. The share price dipped as low as $32.22 before recovering slightly. It ended the volatile trading day at $33.34, a 3.73% drop since the morning earnings report.