The goal of the energy transition seems simple enough: substitute fuels that emit greenhouse gases with those that do not. Achieving that goal is not simple at all.

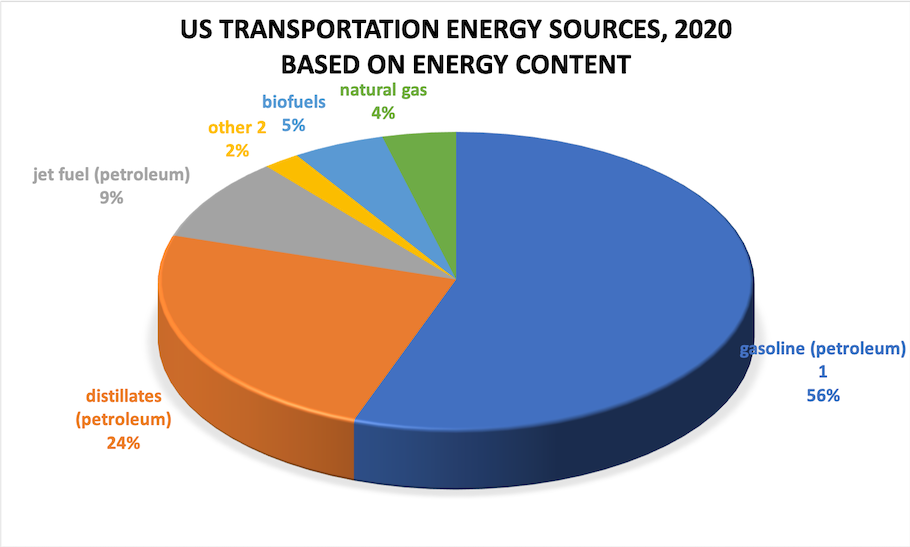

As we read in Best of the Energy Mix, the U.S. requires an enormous amount of energy on a daily basis. Specifically, transportation accounts for about 26% of all energy consumption in this country, the U.S. Energy Information Administration (EIA) has calculated. The transportation sector is dominated by fossil fuels, which account for about 93% of usage.

2 Other includes residual fuel oil, lubricants, hydrocarbon gas liquids (mostly propane), and electricity (includes electrical system energy losses).

(Source: U.S. Energy Information Administration)

We know that burning fossil fuels to generate energy releases greenhouse gases, particularly carbon dioxide (CO2) into the atmosphere. Those greenhouse gases contribute to warming of the planet. So, switching from gasoline-powered automobiles to electric vehicles (EV) appears to be a sensible solution.

Indeed, automakers are designing lines of electric vehicles. General Motors Corp. has developed the GMC Hummer EV and unveiled its Ultium platform for a range of EV models. The company expects 30 EV models in showrooms by 2025. Ford Motor Co.’s F-150 Lightning has garnered plenty of attention and the automaker’s Blue Oval Charge Network will have about 20,000 charging stations across North America.

But electricity, in and of itself, is not an energy source.

It must be produced by fuel and the main fuel source for electricity in the U.S. is natural gas. In recent years, gas has surpassed coal as the leader in the power generation energy mix, and with good reason.

“Just from a molecule-to-molecule basis, a natural gas combined cycle power plant is about twice as efficient as a coal-based power plant,” said Ramanan Krishnamoorti, chief energy officer of the University of Houston. “So, for the same kilowatt hours to be delivered, the natural gas combined cycle produces twice the power than a coal-fired power unit would.”

But efficiency is only part of the story. Every molecule of natural gas burned produces about half the amount of greenhouse gases as a molecule of coal.

“So, effectively, because of improvements in efficiency and because of less greenhouse gases being produced, every kilowatt hour of natural gas-based electricity produces one-fourth the greenhouse gases of an hour of coal-based electricity,” Krishnamoorti said. “That is, actually, fundamentally where natural gas can be transformational with regards to electricity generation and the issue of climate (as long as there are no direct emissions of methane).”

The electricity energy mix

So, natural gas beats coal on the basis of emissions. Do renewable sources of energy beat natural gas on emissions? That depends on the source.

Wind, solar and hydropower are emission-free. Biomass is not. Although it accounts for only 1.4% of power generation in the U.S., it is a major fuel source in many countries around the world. Those countries are looking to change to gas.

“In places like India and China, natural gas displaces not coal, but biomass,” Krishnamoorti said. “That will be transformational because biomass has a whole lot more greenhouse gas emissions than coal-based electricity generation or heat generation using coal. Coal in itself is not that clean a fuel. You’ve got SOX [sulfur oxides, or potentially harmful compounds of sulfur and oxygen molecules] and NOX [nitrogen oxides, which are poisonous gases] and heavy metals, but that’s much less than what you get out of biomass. Those contribute a significant amount of greenhouse gases.”

A study by researchers at the Lodz University of Technology in Poland and published in the Journal of the Energy Institute compared biomass combustion to that of hard coal and found that emissions from various biomass fuels (oak bark, willow and others) was often higher than that of coal.

Other sources of power generation, like nuclear and hydroelectric power, have limited growth potential. There are about 50 nuclear power reactors under construction around the world, mostly in China and India. In the U.S., there are only two. There is little enthusiasm to invest in nuclear power in the U.S. due to high costs and safety concerns over radioactive waste. Hydropower is limited geographically to areas where there is enough moving water to generate electricity. It is also vulnerable to droughts, an issue that has affected the giant Itaipu hydroelectric dam on the Brazil-Paraguay border.

Wind and solar, however, have been growing steadily in the U.S. and cutting deeply into coal’s market share. Wind power grew 14% in 2020 from 2019, the EIA said in a July 2021 report. Utility-scale solar generation (from projects greater than 1 megawatt) increased 26% in 2020 and small-scale solar, such as grid-connected rooftop solar panels, increased 19%, the report said.

However, solar power has its drawbacks. Sunlight hits the earth’s surface in variable amounts. It can change depending on location, time of day, season of the year and weather conditions. It also requires a large surface area to absorb or collect a useful amount of energy.

Those solar issues impact wind power, as well. The earth consists of different types of land and water that absorb the sun’s heat at different rates. Air over land heats and expands faster than over water. During the day, that warmer air rises, allowing heavier, cooler air to move in and take its place, resulting in wind.

The conditions of any given day—darkness, calm weather—are enough to limit the generation of electricity from wind and solar. And while the number of large-scale battery storage systems is growing, natural gas maintains its advantage because of its ability to deliver on-demand power.

“Natural gas power plants (and the availability of cheap fuel) have been very helpful to grid operators in balancing the intermittent output from renewables like wind and solar,” said Seth Blumsack, professor of energy policy and economics and international affairs at Penn State. “I think a big reason for the success of grid operators in being able to absorb very large amounts of wind and solar without causing more problems on the grid is because of the flexibility of natural gas generation to ramp output up or down quickly in response to wind/solar fluctuations. (There are other reasons for this success, too, but we’d be lying to ourselves if we didn’t acknowledge that cheap natural gas has played a big part.)”

The role of carbon capture

Of course, natural gas, the largest source of fuel for electricity generation and the cleanest-burning fossil fuel, emits CO2 into the atmosphere when it is burned. That is where carbon capture, utilization and storage (CCUS) comes into play.

In the carbon capture process known as oxy-combustion, pure or enriched oxygen is used instead of air for combustion. In this process, the volume of flue gas, which is produced when natural gas is burned, is 75% less than what is produced when air is used for combustion. That simplifies the process of removing CO2 as well as pollutants like sulfur oxide, nitrogen oxide, mercury and other particulates.

Federal energy policy is supporting the acceleration of CCUS deployment. One way is with research at Department of Energy (DOE) national laboratories like the National Energy Technology Laboratory, which is working on ways to improve process efficiency and reduce the capital cost.

Another is with funding. DOE’s Regional Initiatives to Accelerate CCUS Deployment identifies and addresses regional storage and transportation challenges facing the commercial deployment of CCUS.

Among its funding, DOE pledged $45 million to fund 12 projects that pursue ways to capture at least 95% of CO2 emissions generated from natural gas power plants and industrial facilities that produce cement and steel. The department also announced $24 million to support nine research projects developing new methods to capture and store carbon from the air, also known as direct air capture.

DOE has also made $20 million available to organizations focused on regional deployment of CCUS. Those entities include Battelle Memorial Institute, the New Mexico Institute of Mining and Technology, the Southern States Energy Board, and the University of North Dakota Energy and Environmental Research Center.

What is the potential for carbon capture to remove CO2 from natural gas?

“Potential? 100%,” Krishnamoorti said. “Potentially all of that can be captured. It is a cost to society, it is a cost to energy, it is a cost to producers, but it can be done.”

Within the next 10-15 years, it is possible for carbon capture for natural gas to be deployed globally, he said, gathering CO2 emitted at the source and shielding the atmosphere from the greenhouse gas.

By contrast, another carbon capture process, demonstrated for coal based power-plants, uses a less effective technology known as post-combustion that scrubs the CO2 out of the flue gas. However, while this process can scrub 85% to 90% of CO2 out of the coal flue gas, sulfur oxide needs to be removed in a separate, expensive process performed prior to removal of CO2. Sulfur is not a component of natural gas as it used in power plants (gas produced from the earth often contains sulfur), so the process of making it emission-free is cheaper and easier than the process for coal.

Natural gas and hydrogen

The energy transition cannot be discussed without including hydrogen. The most common element in the universe, hydrogen can be combusted with oxygen to produce a fuel (H2) with virtually no greenhouse gases. A hydrogen fuel cell powering a car is two to three times more efficient than an internal combustion engine fueled by gasoline.

“Hydrogen has the potential to solve two huge problems in decarbonizing our economy,” Blumsack said. “The first is finding a substitute for coal/gas/oil for some types of industrial processes that aren’t easily electrified. The second is in giving utilities an option for zero-carbon dispatchable electricity beyond nuclear. Hydrogen may also contribute to decarbonizing transportation but the world really looks like it’s going electric in that sense, at least right now.”

For hydrogen to solve those problems will require not just major commitments of capital, but a regulatory environment that can help to de-risk those commitments, he said.

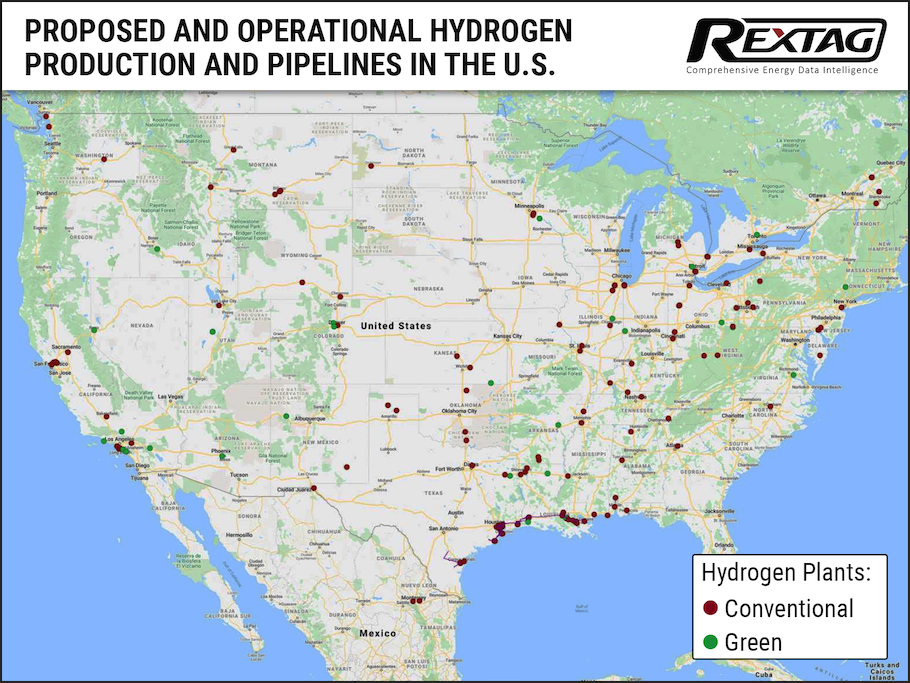

Today, virtually all hydrogen is produced from natural gas. In a process called natural gas reforming, high-temperature steam reacts with natural gas to create synthesis gas, a mixture of hydrogen, carbon monoxide (CO) and a small amount of CO2. CO reacts with water (H2O) to make additional hydrogen.

“This method is the cheapest, most efficient, and most common,” the U.S. Department of Energy said on its website. “Natural gas reforming using steam accounts for the majority of hydrogen produced in the United States annually.”

Hydrogen is used in petroleum refining to lower the sulfur content of fuels; in the treatment of metals; production of fertilizer; and processing of foods, the EIA said on its website. But until the cost issue is overcome, hydrogen’s uses will be limited.

“From a calorie basis or a kilowatt basis, natural gas is obviously cheaper than hydrogen,” Krishnamoorti said. The promise of incorporating hydrogen into the energy mix on a large scale is the development of “blue hydrogen,” or hydrogen produced from natural gas during the carbon capture process.

Then there is “green hydrogen,” produced with solar or wind power in which water is split into its hydrogen and oxygen parts.

“Fundamentally, until the price of solar- or wind-based electricity drops below 1 cent per kilowatt hour, you’re not going to get cost-competitive with natural gas burned to produce electricity,” Krishnamoorti said.

And even blue hydrogen is not necessarily the best choice.

“Blue hydrogen is exciting right now because natural gas is so cheap,” Blumsack said. “But if we can’t manage the climate impact on the natural gas side through better methane management and CCUS, then it’s not clear why you would invest in hydrogen rather than just using natural gas directly.”

The latest transition

Energy transitions are nothing new. The industrial revolution in the early 1800s made coal the new fuel of choice. Automobiles around the turn of the 20th century made petroleum the leader. Natural gas entered the mix in the 1930s and nuclear power in the 1960s. The transition to solar and wind began around 20 years ago.

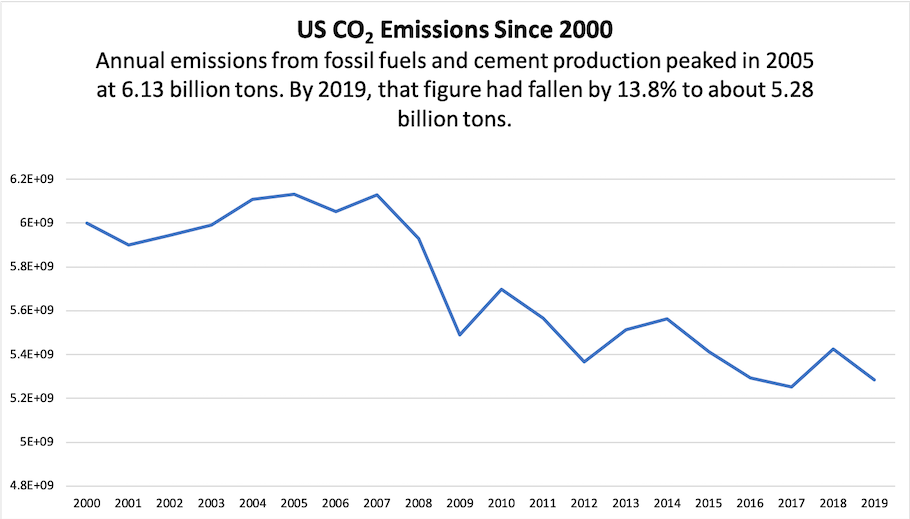

The effects of the most recent transition can already be seen. The growth of emissions-free renewables and natural gas in the electricity energy mix, and subsequent decline of coal, have contributed to sharply reduced CO2 emissions in the U.S. since 2000. So far, so good, but we may be at the point at which the low-hanging fruit has been picked.

Decarbonizing transportation necessitates the decarbonization of electricity generation. That means a continued reduction in the use of coal. Nuclear power capacity is at a relative standstill. Hydrogen is far from ready for large-scale use. Wind and solar will continue to grow but storage limitations keep those renewables from providing on-demand power, at least for some time.

Natural gas is not hindered by inherent limitations to providing on-demand power, and carbon capture technologies enable it to provide electricity without greenhouse gas emissions. That is why it is a must-have fuel for the energy transition.

The upshot

- Energy transitions, such as this one to renewable sources, are inherently difficult and take time to achieve.

- Electrification requires choices to be made on the best fuels to generate electricity.

- Nuclear power and renewable fuels like wind and solar emit very little CO2 but have limited potential to grow in capacity (in the case of nuclear) or are not ready because of storage limitations to scale up to the volumes necessary to meet demand (in the case of wind and solar).

- Natural gas is in a dominant position in the electricity generation market now; it is not burdened by the hurdles faced by renewables, has the ability to expand capacity and, while it does emit CO2 during combustion, that drawback can be resolved by development and deployment of CCUS.

Click here to continue reading the "America's Natural Gas" report.

Recommended Reading

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Evolution Petroleum Sees Progress on SCOOP/STACK, Chaveroo Operations

2024-03-11 - Evolution expects to participate in future development blocks, holding in aggregate over 70 additional horizontal well locations.