[Editor's note: A version of this story appears in the October 2020 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

What’s the sentiment today of investors buying into the E&P space? Capital One Securities senior E&P analyst Phillips Johnston pulls no punches. “Pretty much zero,” he scoffed. “It’s the most hated sector on Wall Street.” It’s a reality U.S. oil and gas producers are finally facing: Public money is gone, and this time it’s not cyclical.

Energy accounts for less than 3% of the S&P 500 today, its lowest weighting in 20 years and a fall from a 13% peak earlier this decade. That number represents all of energy, with E&Ps a minor subset of the whole. Over the past 10 years, the S&P 500 returned 230% while the S&P Oil & Gas E&P index returned negative 70%.

The sector is a capital vortex. And Wall Street is angry at being duped.

“It’s a despised sector,” said Johnston, based in New Orleans. “I’ve been covering energy since 1998, and I’ve never seen anything like this.” While some energy-dedicated hedge funds and mutual funds remain invested given their sector mandate, long-only generalist investors began to steadily flee the E&P space following the late-2014 collapse in oil prices and have been virtually absent from it over the past three to four years.

“Investors want the sector to quit destroying capital,” he said.

As shale boomed, producers built their models on and their stocks were rewarded for fast production growth, which built net asset value (NAV). At the time, the world needed more gas and oil—it was an era of scarcity with growing demand. But that all changed. Now the world is awash in both commodities—largely due to the success of the shale innovators—at a time when the environmentally minded want to reduce or eliminate both. The return on investment never materialized.

“Let’s be frank,” Parsley Energy Inc. CEO Matt Gallagher said in the company’s second-quarter conference call. “North American E&Ps are in a battle for investment relevance, not a battle for global market share. Allocating growth capital into a global market with artificially constrained supply is a trap our industry is falling into time and time again.”

Since the oil price collapse in late 2014, the E&P sector has outspent cash flow by $41 billion and impaired “a staggering” $211 billion in assets, reported Devin McDermott, head of North America oil and gas research for Morgan Stanley. Prior to this 2020 down spike, the U.S. E&P business model was already in a state of transition, he said.

“Over the past decade the debate has shifted from peak supply to uncertainty around peak demand and ultimately what is the role of oil and gas broadly in our energy mix. This change necessitates a strategic shift away from growth. Investors have begun to emphasize returns and free cash flow.

“Much of the U.S. E&P industry has struggled to make this transition.”

And therein lies the crux of the problem.

The end of the growth model

Given the shale land grab that began over a decade ago and the heavy emphasis on growth, the U.S. independents have destroyed capital as far back as 2007, Johnston estimated, “and that’s a long track record of management teams doing the wrong things.” When generalist investors look at other sectors that have generated returns and free cash flow during the same time period, “it’s tough for them to look past that.”

E&Ps “for the most part haven’t refocused on total shareholder return,” said TCW Group portfolio manager Diane Jaffee, “and that’s why we have shied away.”

The aggressive growth rates pursued by E&Ps over recent years contributed to the global supply glut, and investors now are demanding that producers “really slow down” and not grow beyond a low- to mid-single-digit production growth rate, said Johnston.

“Historical metrics don’t really matter that much right now. It’s all about, can these companies generate a return on capital? All these companies are saying the right things right now, but there’s no real track record there.”

The call by the investment community to transition from growth to value began three years back, but Stifel managing director Michael Scialla said the absolute collapse in prices during the second quarter of 2020 spurred a lot of management teams to urgent action. “We’ve got to take drastic steps. We don’t need to grow at all, and some companies were growing at double digit rates. All of a sudden they’ve had to slam on the brakes.”

Compounding the problem of disastrous returns, another existential headwind facing the industry is that the investment community views hydrocarbons as a waning industry—rightly or wrongly—with peak demand occurring within the decade, said Mark Viviano, head of public equities at Kimmeridge Energy. He calls this “terminal value risk.”

Kimmeridge, a New York private-equity firm focused on upstream energy, is raising a fund to invest private capital in public equities, led by Viviano, with the intent to drive E&P transformation as an activist investor.

“If you polled most non-oil and gas investors, the general view would that be that oil demand peaks over the next 10 years. And, unfortunately, I think there is this association with peak demand and almost zero demand, not really understanding the time period to replace that magnitude of demand after it peaks. But, again, it’s an academic debate. It doesn’t matter if that fear is what’s driving valuations in the sector.

“The perception is real, and it’s being reflected in the valuation of these securities.”

Following the oil price collapse in early 2020, leading E&Ps are now urgently redefining their models, notable in their latest second-quarter earnings calls. How do E&Ps change their strategy to bring capital back into the space? “It’s a simple shift away from growth toward returns. Less production growth, more return of cash. That’s resonated well with investors,” McDermott said.

In a nutshell: total repentance.

SIDEBAR

Retreat to Megacaps

There was a time when upstream oil and gas companies were exciting places to be, said Diane Jaffee, a senior portfolio manager with Los Angeles-based TCW Group. “There was unbelievable growth in the U.S., different innovative techniques, which allow companies to find oil and gas faster and cheaper. And that was exciting. Then the world came crashing down in the summer of 2014.”

Jaffee, herself based in New York, oversees three funds: TCW Relative Value Large Cap, TCW Relative Value Dividend Appreciation, and TCW Relative Value Mid Cap. Those funds used to include independent E&Ps. Those are memories now.

The correlation between E&P valuations and commodity prices began to bifurcate in 2014, she noticed, with stocks underperforming commodities. “Upstream became a no man’s land for investors,” she said, finding favor only with “super nichey” hedge funds and specialty investors. “And that’s a shame. It used to be a staple in everybody’s portfolio, and now it’s not.”

TCW joined the exodus. The fund manager divested of all of her E&P holdings in two phases, the first in the fall of 2014, and again in 2018. “We eliminated all of our E&Ps.” Presently, its largest energy oil and gas holdings are Chevron, Baker Hughes and refiner Marathon Petroleum—and that’s all. “The super megacaps have wildly outperformed,” she said.

Chevron, of course, is a major with upstream, refining, marketing and services. She liked the company’s recent deal—still pending—to acquire Noble Energy Inc. and its strong assets, particularly those offshore Israel. “Noble was always regarded as a premier company, and Chevron didn’t seem to overpay.” In contrast, not pursuing Anadarko Petroleum in a bidding war with Occidental Petroleum was “super smart.”

Baker Hughes—one of the Big Three global service providers—is her second largest holding. When it merged with GE’s oil and gas business it became more international, less focused on the U.S. It’s even more intriguing to her now that it is formally separated from GE. Baker rates high on governance as well. “It’s incumbent on management to think about their shareholders. E&P companies have not done a good job of that.”

Investors want more diversified, bigger companies until E&Ps refocus on shareholder returns, she affirmed. Her own portfolios reflect that.

“Frankly, the stain from investing in E&Ps—because the old methodology of paying management teams for just growth, growth, growth—clearly isn’t working anymore.”

First and foremost, free cash flow

Delivering sustainable free cash flow is the first step in promoting investor interest, according to Scialla, based in Denver. Over the past five years, the U.S. E&P sector has spent some 120% of cash flow every year to drive growth, he said. The lead foot on the accelerator has to stop.

“There’s a perception out there that U.S. growth is not needed,” he said, “at least for now, and maybe for a long time.” With an eye to the Paris Climate Accord, investors anticipate global demand to peak in a few years.

“And if that’s the case, then why are these companies spending most of their cash flow to grow? They need to be thinking about how to best monetize the inventories they have as efficiently as possible.” And while oil and gas producers might argue the premise or at least the timing, “That’s the investor mindset right now.”

With this in mind, Scialla said the goal of every large-cap company should be to cap their spending at 75% or less of cash flow. He points Pioneer Natural Resources and Parsley Energy as larger E&Ps guiding that over the next couple of years they will put 60% or less of cash flow into the ground. “That’s pretty attractive free cash flow,” he asserted.

That number, however, is unrealistic for small and mid (SMID) caps, he believes, which should aim for 80% to 85% free cash flow spend. But, “It certainly can’t be close to 100%,” he said. “That’s not what investors want.”

Kimmeridge’s model puts a hard cap at 70% of cash flow reinvested, with the first 30% applied to either the balance sheet or shareholders, depending on the company’s leverage profile. No exceptions.

“After that, with the 70% of cash flow, some companies will be able to grow, some companies will remain flat, and some will shrink depending on their asset quality and cost structure,” said Viviano. “But this idea that everybody should be targeting a growth rate in a sector where demand is growing maybe one to one and a half percent in a good year doesn’t make sense.”

Viviano emphasized Kimmeridge is not anti-growth per se. “If you can spend 70% of your cash flow and still grow volumes, that’s fine. But growing volumes at the expense of shareholder returns is no longer acceptable in this industry.”

Contrary to the upstream sector as a whole, Cimarex Energy Co. has always been returns focused, said Karen Acierno, vice president of investor relations. “That’s always where we start. Growth is more of an outcome of that—although we’ve had some pretty decent growth over the years.” Cimarex avoids production targets.

Her advice to Cimarex’s producer peers: “You have to let go of growth. Free cash flow is a choice at the end of the day,” she said. “You have an idea of what your cash flow is going to be, and you choose how much you’re going to invest. So you just make the decision to invest less, and you know you’re going to grow less.”

NAV, once the featured metric to drive market cap, is less important, and growth is certainly less important, she said. “It’s time to generate cash flow. We’ve been working to buy acreage and delineate it, so now let’s develop it.”

Generating cash flow, however, is unpredictable in a volatile market. Coming into 2020, Cimarex guidance hinged on $50/bbl oil with an upward bias. “We were in a place where we could generate a significant amount of free cash flow,” she said. Then, “Everything fell apart. And shareholders started asking, ‘What do you do from here? Are you committed to generating free cash flow?’”

The message from investors—even at the bottom of the cycle—is, do you have the ability to generate positive cash flow?

For Cimarex, the answer is yes. Even in the wild ride of 2020, they anticipate generating free cash flow well in excess of their dividend by year-end. Going into 2021 and beyond, the Denver-based operator expects to limit capex to 70% to 80% of cash flow, resulting in free cash flow of 20% to 30%.

Free cash flow generation is easy when prices are at the top of the cycle, but generating dollars at the low point will make E&Ps more investable. Goaded by the oil price collapse this spring, companies are compelled more than ever to drive down corporate cost structures and breakevens to defend against low price cycles.

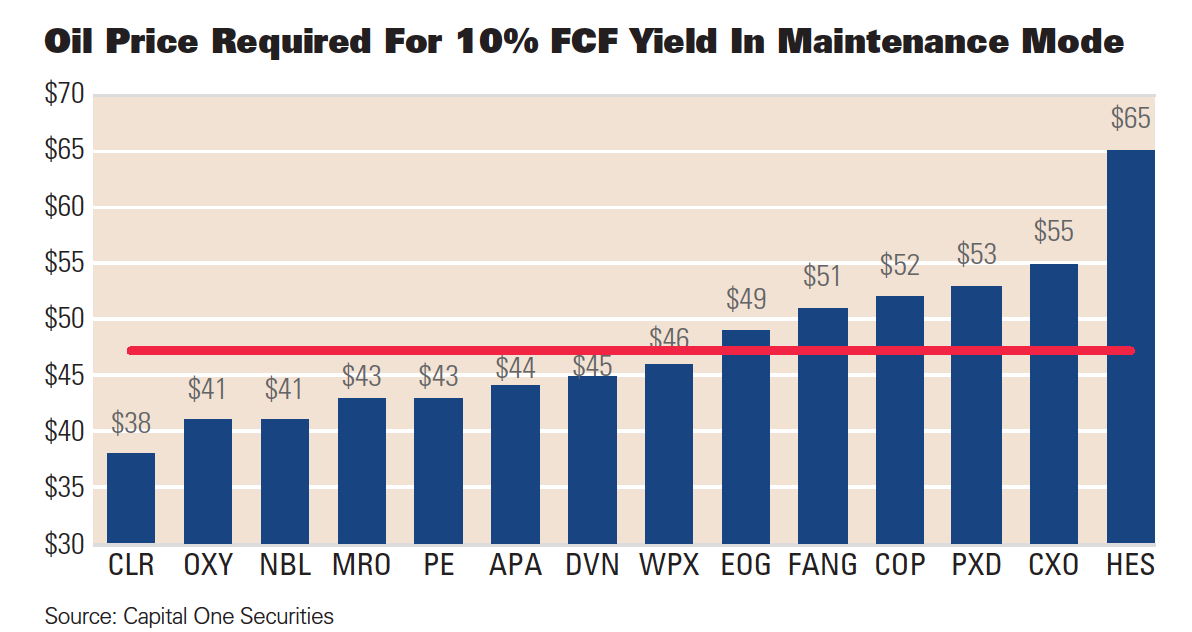

“We’ve seen companies make good progress on that so far this year,” Morgan Stanley’s McDermott said. “At the start of 2020, the average company that we cover required about $45 per barrel to fund all of its costs, including interest and any distributions or dividends that the company had and maintenance capex. That same number today across the same subset of companies is $38 per barrel.

“So you’ve driven efficiencies in response to the oil price collapse. Part of that is cost cuts, part of that is high grading, part of that is supply chain deflation, but managing for a lower-for-longer oil world to bring down your breakeven so you can generate outsized free cash flow in the recovery is important.”

The E&P sector remains bloated with G&A expenses as well, keeping cost structures too high, Johnston said. As much as 50% of G&A costs or more need to be chopped out.

“Although many companies have been cutting overhead over the past couple of years, there’s still way too much G&A cost embedded in the publicly traded sector right now. Privately held E&P companies tend to operate with significantly less G&A burdens than their public counterparts. The latter needs to exercise capital discipline and continue to squeeze costs out of the system. That self-help approach will help generate better returns and free cash flow.”

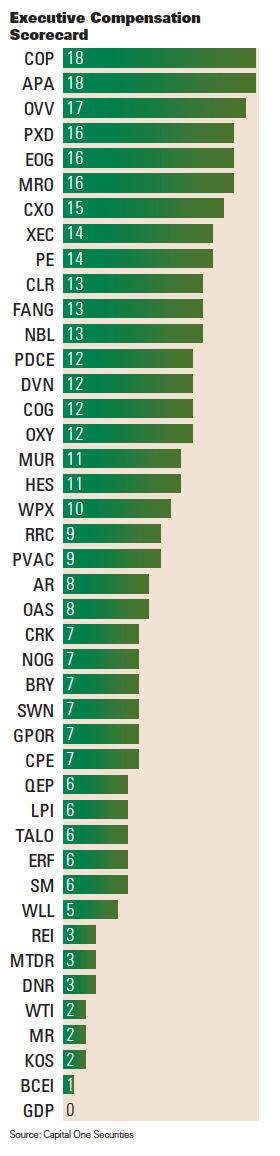

How? First, cut the head count. “These companies can definitely be run in a more nimble manner,” he said. Second, executives are still paid “way too much relative to what they do. That amount of compensation could be cut massively.”

As a case in point, of the 40-plus E&P companies that Capital One currently follows, the combined total compensation for the top five executives at each company was close to $20 million on average in 2019, with some companies reporting more than double that amount.

“This is especially egregious when you consider the terrible share price performance and the fact that over half these companies now have a market capitalization below $1 billion.”

Once achieved, the highest and best use of free cash flow comes into question. Although investors are eager to see a return of capital by E&Ps, following the shock of the severe price collapse earlier this year, debt reduction is a higher mandate for many E&Ps today. It’s a first screen for these same investors too.

“Companies with banged up balance sheets are pretty much uninvestable right now,” Johnston said. If net debt to EBITDA is 2.5x or greater, or if sizable debt maturities are looming, he said, “it’s usually a nonstarter—most investors will move on.”

Balance sheet strength is imperative, Scialla confirmed.

“That has shot to the top of the priority list, even before thinking about returning capital. Even companies with pretty solid balance sheets feel like oil prices could turn around quickly again and feel they need to be prepared to weather the storm if it’s coming again. They’re paying down debt with cash flow, which is the first step for a lot of companies to become a more attractive investment vehicle for value-oriented investors.”

Even “rock solid” companies are talking about paying down debt with free cash flow before they do anything else. “That just tells you how negative oil prices scared people. It took a pretty extraordinary event to trigger that. With more than 6 million barrels of spare capacity out there, if we have a second wave of the virus and it turns back down, they want to be prepared for the worst.”

Before March, leading companies were targeting debt ratios of 2x debt to EBITDA. Yet that metric can quickly jump to 4x without adding new debt if oil prices and thus EBITDA gets cut in half. That simple metric can trigger debt covenants, Scialla noted. As a result, “A lot of companies are targeting one and a half times now, or even lower than that.”

Few investors are willing to look at companies that have any financial risk, he said. “They feel like they’re already looking at a risky investment in this space, and they don’t want to double down. Some companies with good assets would be great investments if they could just get their debt levels down, but I don’t sense a lot of interest.”

The favored solution by Wall Street for overlevered names, he said, is use cash flow to pound on the debt. “A lot of companies are doing that. If you can hold your production flat or grow it slightly and generate a lot of free cash flow to improve the balance sheet, that’s the sweet spot.”

A number of companies with strong balance sheets are choosing this path. Among those: Parsley Energy, PDC Energy and Cimarex Energy. Those with above-average debt that are doing so: Apache Corp., Marathon Oil Corp. and Continental Resources Inc.

Cimarex’s $750 million issue comes due in 2024, plenty of time to refinance. Yet in its second-quarter conference call management announced it would use excess cash flow after paying the dividend to retire the 2024 notes with cash, with a target debt to EBITDA of less than 1.0x. “We think we can do that at $35 oil,” Acierno said, “just to illustrate the quality of our assets.”

Acierno emphasized that Cimarex’s balance sheet is strong and has been over the years, but with WTI falling into the teens in April then negative, the company now feels compelled to protect it further. In addition to paying investors a dividend, “Reducing debt has become an important part of our use of free cash flow after investment,” she said.

SM Energy is an exception, however, Scialla noted. The Midland Basin operator, with a market cap shy of $200 million, refinanced debt in the second quarter, albeit at a higher coupon, but extended maturities and lowered absolute debt—both good. The Denver-based producer exited the quarter with a 2.45x net debt to EBITDA. But instead of using cash flow to further pay down absolute debt, it instead chose a path of keeping EBITDA high and growing at a double-digit rate.

“The stock reaction to that was pretty negative on the quarter,” said Scialla.

The choice by smaller E&Ps is a double- edged sword, he acknowledged.

“If you hit the brakes too hard, the EBITDA dries up so fast that you’re still not going to delever the balance sheet.”

Echoing that, SM CEO Jay Ottoson explained on the second-quarter conference call, “In these downturns people have a misunderstanding about levered companies; we really don’t have an option to just stop activity and watch our leverage skyrocket. That’s just not what you should expect a fairly levered company to do.”

When prices drop as they did in March, Ottoson explained, the company cut activity very quickly. Then as costs bottomed, it once again increased activity to keep cash flows up and leverage down. “And that’s what you should expect levered companies to do in this part of the cycle.”

Kimmeridge’s Viviano takes exception.

“The mistake the industry has made historically is trying to delever through growth. They spend more money and grow production.” But when oil prices go down, they’re left with high absolute debt, and the leverage ratio blows out. “That’s why we’ve seen so many bankruptcies so far this year.”

The first 30% of free cash flow generation should go toward paying down absolute debt, he said, and as debt diminishes, they will have the ability to increase the return of capital to shareholders. “Not every company is going to be able to do this, and consolidation is the natural outcome for what we’re asking.”

Viviano agrees leverage ratios should be 1x at midcycle prices but notes that those midcycle prices likewise need reset to the mid $40s. “So if you move from $45 down to $35 in the cyclical downturns, your leverage ratio is still reasonable, not the 4x or 5x we’ve seen from some companies over the last six months.”

To get there, any free cash flow should be used to pay down absolute debt, he said, countering SM’s strategy.

If everybody was at 1x mid-cycle pricing before the COVID-19-induced demand destruction, “you wouldn’t be seeing the destruction we’ve seen on the capital side from bankruptcies this year. That’s a goal the industry should have.”

SIDEBAR

Seeing Red

Energy historically accounted for between 40% and 70% of investments within Van Eck’s Global Hard Asset Fund, launched in 1994 with a focus on natural resources. No more. “As we stand today, it’s the smallest it’s ever been,” said Shawn Reynolds, portfolio manager.

Reynolds is not a generalist investor. He’s an engineer and geologist, having worked at various E&Ps before becoming an upstream analyst and then resource fund investment manager. Even with that bias, he can’t risk the allocation.

“It’s a career risk to go barreling into the energy space right now, and that’s just from a performance standpoint. Unless I see two or three years of performance out of the E&P space, there’s just no way I could ever allocate to it.”

Reynolds sits on an investment committee for a large hospital with an $8 billion portfolio. The committee meets once a quarter, and each member receives a sheet that shows how the funds are invested. The investment categories are listed in a column, top to bottom, best to worst, about 50 lines, showing 1-year, 3-year, 5-year and 10-year performances.

“Every line is green except for the very last line, which is where energy sits. It’s red. And by a lot. So these people who have fiduciary responsibilities to these funds ask, ‘Why the heck do we have this allocation to energy, because they’ve been disastrous?’”

The silver lining is that the allocation is so small they’ll let it ride, he said, but the allocation is definitely not increasing. “As a fiduciary myself, it would be really hard to advocate raising the exposure to that space when everything’s red over the past 10 years. That’s what the industry is up against.”

In his role as a portfolio manager, Reynolds meets with E&P boards regularly. In early September, at one of their annual meetings, the board asked him, “What do we have to look like?”

“I said, ‘Make yourself look like a real company. Deliver returns on capital you invest that are higher than your cost of capital.’ I hate to be that blunt, but the industry clearly, clearly, clearly lost track of that. It’s what we all learned in any basic business class.”

During the early days of shale, investors did not expect that, as capital was testing a new phenomenon and new technologies, but after 10 years, “you have to start generating a return on that.”

“We’ve been really frustrated in the space for a couple of years because of the lack of ability to pivot their business model.” Compounding that, he said, “The decarbonization energy transition winds have started to blow quite hard” as well.

The sad part of this year is contrasted in fourth-quarter 2019 results, he lamented. “A number of them had really started to deliver.” Then OPEC-Russia wiped out one leg of the stool, and COVID-19 the second leg. “Now we’re balancing on just one, and it’s absolutely disheartening.”

Is there room for a growth E&P any longer? “There’s always room for one, but there’s no room for an industry that delivers that way.”

Investors will return only when the industry delivers a 2x performance compared with other sectors and it hurts investors to not be allocated to energy, he said. “That’s the only time you’ll get money flowing back into the space.”

Eventually he expects 10 to 12 E&Ps to succeed at growing their companies in the high single digits and be able to deliver high single digit returns of cash over a 10- to 15-year period. When that occurs, “that’s going to be special.”

Cash back to shareholders

Once a company commits to generating cash flow over growth and tames the balance sheet, the next wise move is to get those excess Benjamins to shareholders.

“As we move through the next few quarters, you’ll see more and more companies move in the direction of constraining capital investment and focusing on returning cash rather than reinvesting that cash as oil prices rise,” McDermott predicted. “That is a necessary step for the industry.”

This can be accomplished via three primary ways: a dividend, variable dividend or share buybacks. Overwhelmingly, everyone agrees that establishing a competitive dividend is imperative going forward.

“Debt pay down is currently the main priority for most E&P companies. Once financial leverage ratios are reduced to 1.5x or lower, investors want to see a lot of that free cash flow returned back to shareholders, mainly in the form of dividends,” Johnston said.

Paying dividends forces capital discipline, he believes, and for the last year and a half, he has been advocating for E&P companies to pay out most of their free cash flow in the form of regular base dividends plus variable dividends.

In early August, Pioneer Natural Resources and Devon Energy Corp. both announced that they will soon begin doing just that. Johnston believes that other E&P companies with solid balance sheets will eventually follow suit, a trend that could help attract generalist investors back to the sector.

For TCW’s Jaffee, dividends are a priority. As group managing director for the West Coast asset manager, Jaffee oversees investments for three funds. None of those include E&Ps at this time.

Jaffee tracks five valuation factors when choosing investments: price to cash flow; price to sales; price to book, and price to earnings ratios, but the fifth one is “super important”: dividend yield. “The company has to meet one of those five valuation factors, but having a dividend yield that is equal to or greater than the broader market … is very important to us.”

Over time, on average, 40% of total returns comes from dividends for the broad-based market, she said, “so dividend returns—and the sustainability and growth of that dividend—are very important.”

E&Ps, however, get anxiety attacks at committing to a dividend, as the uncertainty of commodity prices puts their ability to pay at risk in low price cycles. Nonetheless, generalist investors seek certainty of returns, and not meaningless returns either.

“You can’t have a token 1% dividend—that’s not going to do much for anybody,” Scialla said, but companies need to start somewhere. “Investors want to see something in the high single digits. That would get their attention in a market that is struggling to find yield in safe investments.”

“What is their interest in investing in an oil and gas company that’s not going to pay you back an above-average dividend?” questioned Shawn Reynolds, portfolio manager for New York investment house Van Eck’s Natural Resource Equities strategies.

“I mean, the universe of investors that are going to invest in the oil and gas space and betting on oil and gas prices has diminished to a very, very small number. So there’s got to be a different reason to bring them back in.”

Investors view dividends as high quality cash flows, McDermott said. Base dividends must be sustainable through the cycle, but being too aggressive in growing the dividend can have an opposite affect with investors, he warned. “Once you implement a dividend, you can always cut it, but there’s more negative reputational damage when you cut it” should prices collapse.

Cimarex initiated its dividend in 2006 at the dawn of the shale era, counterintuitive to most other fast-growth E&Ps of the day, and has maintained and grown it ever since. This past quarter it paid 22 cents per share, yielding some 3.4%.

Investors “do want cash returned to them,” affirmed Acierno. “They certainly haven’t seen it in share prices. E&P stocks have been underperformers for some time,” she said, but regular dividend levels need to be sustainable. “It’s fine to allocate a certain portion of your cash flow to a dividend, but you don’t want that to get out of hand, especially in the lower part of the cycle.”

Pioneer Natural Resources and Devon Energy, in second-quarter calls, floated the idea of a so-called variable—or special—dividend which would be in addition to their nonvariable base dividends. It would serve as an upside modality to return cash to shareholders when commodity prices are elevated—and retract if prices waned, leaving the base in place. Essentially, it’s an option on price.

“I think some investors are open to the idea,” Scialla said. “Rather than chase growth when prices are higher, give that money to us. If you keep your production flat, that’s doable for some of these companies.”

A Capital One survey of investors showed 60% of investors preferred a fixed-plus-variable dividend as the primary method of returning cash to shareholders, vs. 8% for fixed alone and 11% for share repurchases.

To Jaffee, however, the idea of a variable dividend, which was a new thought to her, was unappealing.

“That would be very hard for typical mom and pop endowments and pension plans to invest based on that strategy. A dividend payout strategy is a sign of good governance. So if you say ‘We can’t know what the commodity is going to do, so we’re going to pay a variable dividend,’ not a lot of people are going to sign up for that. At the end of the day it becomes a bet on the commodity.”

Share buybacks are a traditional and third way to return cash to shareholders, but opinions differ.

McDermott favors them, although admitting that share buybacks have not worked out well historically. This, he said, is because industry tends to buy back shares at the top of the cycle when valuations are high and cuts off buybacks when prices fall. Rather, a fixed, consistent buyback program through the cycles and over a multiyear period becomes a part of a total returns package that investors can count on.

ConocoPhillips did this as part of its 2016 remodeling. “It was a value proposition that investors like. You can count on it over every quarter. Investor feedback was positive. Consistency in the return metrics back to investors is important.”

Johnston takes an opposing view. “A proven way to destroy capital has been for companies to keep a stock buyback program on automatic pilot, regardless of what the share price is doing,” he said. “In an upcycle, in a strong market, share buybacks look good on paper. But in a bear market, a downcycle, they’ve proven to destroy value. If a company does buy back stock, I would rather management be opportunistic and price-sensitive rather than take the autopilot approach.”

Beating the market

It’s not enough for E&Ps simply to return a modest amount of cash to shareholders. It is imperative that the total return proposition be competitive with other cyclical sectors in the broader market, McDermott said. Particularly, the expected return for the S&P 500 is about 8% including dividends plus growth. “E&Ps should offer a cash return proposition that is at least comparable with that.”

But just matching the market in cash returns is not enough to be competitive, he contends. E&Ps must beat it.

“To be in line with the S&P 500 is not going to get investors excited. You have to be better than the broader market for investors to take capital out of other investments and put it in oil and gas.” That total return proposition can be a combo of free cash flow plus growth in that cash stream, he said.

Pioneer Natural Resources is strategically positioning itself to do this. It is downshifting its growth to 5% to 7%, down from 20% to 25% during the wide-open era with a 70% to 80% governor on spending. Adding a possible variable dividend together with its common dividend would yield another 5% approximately to direct investor returns.

With 10% total return vs. the S&P at 8%, Pioneer is beating that market threshold to lure investors back into the stock. Pioneer, said McDermott, is positioning “to survive and thrive in a lower-for-longer oil price environment while returning cash back to investors consistently over a period of time. That’s what investors want to see.”

Capital One’s Johnston measures free cash flow yield as a defining metric and, at $45 oil, the sector’s free-cash-flow yield is not high enough compared to industrial stocks to attract generalist investors, he said. “Either oil prices need to go up significantly without stock prices going up significantly, or some of these E&P stocks need to rerate lower, which is pretty depressing to think about considering how much they’ve underperformed.”

Scialla sees it similarly: “If you look at the free-cash-flow yields these companies need to be competitive with other industries, it probably needs to be in the double-digit range.”

Viviano takes the goal of returning cash to shareholders a step further. E&Ps should make it their mission to return 100% of enterprise value within 10 years, he said. The reason comes back to the perceived terminal value risk for investors.

“If investors think oil is going away in 10 years and you provide visibility into returning 100% of the capital, then you’re taking that risk off the table.” And if oil demand by some miracle continues to be around in 10 years, “now it’s all option value, right? You’re not asking the investor to pay for it. I think investors are willing to take that risk.”

That playbook is taken from the refining and tobacco industries, which each faced terminal value headwinds in the past. In response, both shifted from growth to value with a 10-year payback and were able to outperform the market.

The way we pay

The topic of executive compensation is a sore spot with investors who were burned while management reaped rewards. “The shale boom of the past decade has been a fantastic phenomenon for the U.S. as a whole and has helped keep a lid on global oil prices, but to many outside observers looking in, it seems like the only folks that made any money during the boom were management teams,” said Johnston.

Management compensation has remained high regardless of share price performance and incentive plans have been skewed, he said. “Investors lost money while management teams made money. There’s been a lot of frustration about management compensation, especially in the last five years.”

E&Ps suffer from a clear misalignment of management incentives, said Viviano. “Management teams seem to find a way to get paid no matter what the shareholder experience looks like. We’re a big believer that all long-term compensation should be tied to performance.”

Earlier this summer, Morgan Stanley conducted a survey on E&P executive compensation, which revealed that 80% of the industry still has a heavy weighting toward growth in their executive incentive plans. “In a world that doesn’t need more oil, having volume growth in management compensation is not something investors are looking for,” McDermott said.

Instead, investors want management incentives tied to shareholder return and capital efficiency metrics.

Investors are fed up with executive compensation untethered to total shareholder return, Scialla said. Executives receiving exorbitant bonuses in years where their stock gets cut by half, for example, puts a black eye on the industry. “That just can’t happen. That’s hard to overcome.”

Ultimately, it’s a trust factor. “Investors don’t have a problem with management teams making a lot of money. They should—they’re under tremendous pressure. But they should make money when investors make money, and that’s why management compensation has to be tied to total shareholder return.”

The fundamental problem is E&P executive performance is measured against a narrow band of peers that make up less than 5% of the global oil and gas market, said Viviano. “That just doesn’t provide the right incentive to radically evolve the business model. It creates this herd mentality where they all act in tandem.”

Peer groups instead should reflect the broader energy market. “The idea is you’re not just competing for capital against other E&Ps. You’re competing for relevance across the broader sector.”

Jaffee concurred. “They have to think about not just their total shareholder return among other energy peers, but among other choices investors can make, whether it’s technology, industrials or utilities. Investors don’t have to invest in energy.” Good governance is incumbent upon management to think about their shareholders, she said, and “the E&P companies just have not done a good job of that.”

Johnston noted that some companies are beginning to include total return metrics in their executive comp incentives, such as absolute share price performance.

“That’s obviously shareholder friendly, as it ties a component of executive compensation directly to share price.”

As compensation plans continue to shift away from growth-based metrics and toward share price performance and other metrics like free cash flow, cash-flow-per-debt-adjusted share and return on invested capital, the change could go a long way in terms of attracting institutional investors back to the sector.

The call to consolidate

To investors on the outside of the sector looking in, the industry remains very fragmented. Size matters, as does cost efficiency. Small companies unnecessarily burn capital through G&A and cost of capital.

For companies that fall below $1 billion in market capitalization, it is increasingly difficult to attract capital, said Morgan Stanley’s McDermott. “Liquidity is not there, and the stocks tend to be more volatile. Generally speaking, the smaller producers are taking overhead costs and spreading them over a smaller resource base. They tend to be higher cost structure companies.”

Jaffee’s interest starts at $1 billion, same as the Russell mid-cap index. “It would be rare to go outside that universe.”

Scialla puts the line of demarcation at $2 billion. “Bigger is better these days. Management teams are getting the message that you’ve got to be a couple of billion before you’re even going to be looked at. Even if you are high quality, these companies are feeling the pressure to get bigger as fast as they can to get on the radar screen of the generalist investors.”

Shale is now a scale industry, according to Reynolds. Economies of scale and large swaths of contiguous acreage define the winners. “It’s not about whether you’re going to find the oil; it’s about how much you can find and how cheaply you can get it out of the ground, and that demands scale. It’s a completely different mindset than the early days of shale.

“You have to be behemoths in this space to actually make money doing it.”

That’s bad news for SMID-cap public companies, which played a critical role in the acreage acquisition and delineation phase of shale.

“How do we get broad-scale investors back into the space? I don’t think it’s with a bunch of small guys scrambling around putting something creative together. It’s in the established players that have scale and the capability of squeezing value out of the acreage they own.”

And the way to compete for that capital is through consolidation.

“If you want to attract sizable, large institutional investors you need to have more liquidity and more market cap,” McDermott said. And if growth isn’t an option, consolidation is the alternative.

Consolidation doesn’t necessarily have to be a big company buying a small one, he noted, as mergers of equals work well. “If you have geographic overlap, two relatively small companies combining into one larger one can drive that scale, can increase market cap, can boost free cash flow, can boost returns and allow you to have a competitive value proposition.”

But even that tactic requires a low-premium merger of equals, which remains a stumbling block to executing these combinations. McDermott highlights the merger between D-J Basin neighbors PDC Energy and SRC Energy as a model for others. The $1.7 billion all-stock deal in 2019 reflected a 4% discount for SRC shareholders while creating the second- largest operator in the play. “Stocks traded up on the back of it, and we have a bigger, better scaled company now.”

G&A reduction is a compelling reason to combine, Johnston stated. “Investors definitely want to see consolidation take place in the oil and gas patch. Too many companies are sub-scale, and there is too much overhead in the space.”

In some cases, most G&A overhead costs of a company can be eliminated if it is acquired by another company, he claimed. Case in point: When Parsley Energy agreed to acquire Jagged Peak in late-2019, the targeted G&A savings that Parsley laid out to investors by 2021 amounted to roughly 85% of Jagged Peak’s standalone G&A cost. “Getting rid of that overhead would go a long ways in terms of improving returns and free cash flow.”

Although most everyone in the industry and investor-verse agree that no- to low-premium consolidation is necessary to drive value, yet the marriages simply aren’t happening to any degree. Why? Because management teams are incentivized not to.

Most E&P management compensation structures today involve little stock ownership and fairly modest change of control payouts relative to annual compensation. The result?

No-premium mergers simply mean the absorbed company walks away with no upside. And who wants to do that?

“That’s one of the challenges,” said McDermott. “Generally, compensation is not set up to incentivize those types of deals. While it might be in the best interest of shareholders, it's not necessarily in the best interest of management teams. And that disconnect between management incentives and what's best for shareholders is one of the investor frustrations with the industry today.”

Change of control premiums in management compensation are a driver of consolidation. Those companies with above average change of control premiums tend to transact; those below average don’t.

“All of them want to be the surviving entity, and nobody wants to relinquish the reins to let somebody else take over the company,” said Scialla. External pressures, though, will probably drive consolidation to fruition, he said, particularly if oil prices don’t surprise to the upside.

“It’s going to force difficult decisions. They should band together. The alternative is to continue to work for a company where the stock price is less than a dollar, so it’s the lesser of two evils.”

Should smallish companies just hang on for better days? Better days won’t change investors’ minds this time, he surmises.

“The guys that are kicking the tires [of the sector] are not asking to give me your smallest company that has the most upside, or a company with a lot of leverage to boost returns. They’re asking for the highest quality name that is not going to go bankrupt if things don’t turn out the way we think they might.”

Small publics have no choice but to consolidate, Reynolds believes. “There’s very, very little public capital available to them.” Yet egos and bloated compensation are keeping small companies from coming together, Reynolds stated. “Get your ego out of the way and don’t pay yourself $3- to $10 million a year for nothing. Come up with something creative that you can consolidate around.”

Taking emissions seriously

Environment, social and governance (ESG) was a big consideration among investors before E&Ps went into survival mode in March, and it remains so ongoing, said Johnston. “It’s another headwind facing the sector and will continue to be important.”

And traditional oil companies need to be particularly mindful of the “E” aspect, Van Eck’s Reynolds said. Particularly emissions.

Although U.S. independents are struggling to retrofit their business models to total shareholder returns, they can’t ignore ESG directives in the meantime, he said. “They’ve got to do both.”

A large cohort of investors will never invest in fossil fuels, he admitted, but “that’s OK. You’re never going to satisfy them.” The other 95% of investors, though, are going to want to invest and see commitments toward ESG principles. “We’re one of them.”

Foregoing ESG efforts by denying climate change science misses the point at the company’s risk, he said. “It doesn’t matter if climate change is true. The science doesn’t matter; it’s the perception. More and more people are demanding responsible investing, and you can’t hide from it. So you either have to do it or be left behind.”

Scialla said, “It’s definitely one of the major criteria for new investors looking at the space. ESG is even more important for this industry than for others because it’s a carbon emitting industry and they need to do everything they can to limit emissions as much as possible.”

“We don’t think investors should be totally void of energy names,” Jaffee clarified the investor viewpoint. “We really don’t. We do think that everything starts from the top, so if you have good governance, then other things like methane and carbon footprint will come to the forefront. So I really do believe that there is a place for energy in the portfolio, but I also think that smart companies are moving to a lower carbon footprint.”

Acierno does not believe the push for ESG investment principles is a temporary fad. “I don’t think it’s going away. More and more investors are interested in the environment and see fossil fuels in the rearview mirror. We do think there’s a place for us during whatever transition occurs. We just have to be good stewards of the environment.”

She noted Cimarex is “laser focused” on reducing emissions, particularly around flaring, and executive compensation is partially tied to that. “We are committed to and are getting improvements.”

Kimmeridge believes strongly E&Ps should be environmentally responsible and has published a white paper on its website spelling out just how that should look. With the world more and more focused on sustainability, oil and gas companies run the risk of seeing continued exodus from the space. But Viviano also thinks engaging with industry rather than divesting is a better strategy to address environmental deficiencies.

“The industry needs to align its environmental footprint with the Paris agreement,” he said, “which is to see dramatic reductions in greenhouse gas emissions over the next 20 to 30 years. Companies need to set long-term targets on environmental performance to align with that, because that’s the only way you’re going to bring investors back into the sector.”

Living for another day

Forced by black swan circumstances, many E&Ps are in the process of retooling their corporate structures to better align with shareholder interests, while many others have yet to pivot or are stranded without capital or scale. The unspoken variable is whether management teams will hold the line on capital discipline and the promise to return cash to shareholders once prices rebound, or will higher prices be like giving a drink to a drunk?

Scialla is understandably hesitant to say it’s different this time, as E&Ps have chased every upcycle in history with new growth, “but it really does feel like it’s different. I don’t think we’re going back to the old ways.”

Investors have been burned too many times and the cycles are shorter to where, if oil spikes to $60, investors won’t chase companies spending more than their cash flow to generate growth, he said. “These management teams have to take a look at how we survive in this new world. How do we attract the types of investors that should move into this space?”

Asked when investors might engage with E&Ps again and reflate the stocks, Jaffee balked. She wasn’t committal for five years as an outlier, but she acquiesced, “I don’t believe it’s never.” The investments, she said, have to be less commodity sensitive to investors. “They are less willing to play the commodity game through their stocks. If they want to do that, they can do it through a hedge fund or private equity.”

Rather, investors want disciplined management focused on total shareholder return measured against all sectors.

“We would need to see a longer track record on that. That’s why we shied away. We need at least a few quarters of them really thinking about constraining their growth and thinking about total shareholder return. Conoco did it; others have been lagging.”

And before Jaffee ponders E&Ps again, she’s waiting for the test. “It would be intriguing to see, when commodity prices go up again, whether they stick to the disciplines they embraced when commodity prices were down. We have to see management walk the walk. We would definitely be intrigued by that.”

SIDEBAR

The Insider Activist

Mark Viviano is on a mission to reform the E&P sector—from the inside out.

The upstream buyside analyst and portfolio manager left Wellington Management in February after 17 years to join New York private-equity house Kimmeridge. The strategy: invest private capital into public E&P equities—big enough to play the role of activist from within.

“Over the last few years at Wellington I had grown increasingly frustrated that the sector had become uninvestable. I either needed to abandon the sector and find something else to cover or completely redesign how we invest in it and play a role in reforming the sector.”

In May, Kimmeridge launched its Kimmeridge Energy Engagement Partners Fund with a target of $500 million. Fundraising has surpassed $150 million thus far, according to SEC filings. Viviano is managing the strategy.

“Traditional engagement with management teams and boards wasn’t bringing out the degree of change or urgency I thought was necessary,” he said. “And we don’t think you get these changes by asking nicely because they continue to get paid for the status quo. There’s no incentive for them to change.

“But activism does have that ability to serve as a catalyst because when you’re threatening the CEO’s and board of directors’ jobs through potential proxy battles, you tend to see an acceleration of change.”

Setting up the rules of battle, in a white paper titled “Preparing the E&P Sector for the Energy Transition: A New Business Model,” Kimmeridge in February posted its demands for E&Ps to attract investors back to the space:

• Provide visibility into returning 100% of the enterprise value to shareholders through dividends and buybacks within 10 years.

• Commit to reinvesting less than 70% of cash flow at strip pricing and place a cap on annual reinvestment rates at 80% in the case of better price environments.

• Reduce balance sheet leverage targets to 1.0x Net Debt/EBITDA or below.

• Align management compensation with the interests of shareholders through lower cash base salaries, higher equity ownership, pay for absolute share price performance and tiered change of control payments that reward selling and consolidation.

• Make capital allocation decisions with an understanding of the environmental impact, including the discontinuation of freshwater use for fracking, zero gas flaring and a commitment to carbon neutrality.

Viviano emphasized that Kimmeridge’s form of activism will be different than historical references. Those focused on selling assets or other portfolio management maneuverings to temporarily drive up share price by exploiting the sum of the parts. “They haven’t fundamentally changed anything in the business.

“We’re trying to address the root cause of the problem around capital allocation, governance and environmental performance rather than just putting a Band-Aid over the problem through portfolio management.”

Kimmeridge is unique in this role as the firm itself owns and manages E&P operations through its private-equity arm. “We haven’t seen dedicated energy activism before,” he said. “We’re doing this with the credibility of being an upstream operator ourselves. That’s very different than any other activist in the sector that are coming at it from a financial perspective and not an oil and gas perspective.”

And if he can effect change in a few, herd mentality will create a stampede of others doing the same. “If companies embrace the changes and are rewarded through either higher valuations or a better shareholder base, you will see other companies adopt these changes.”