The risks you take in the market should be reasonable, rational and let you sleep at night. Here’s what’s keeping MLP investors pacing their bedrooms at 2 a.m.—as well as how to get some rest:

1. Crude Contagion

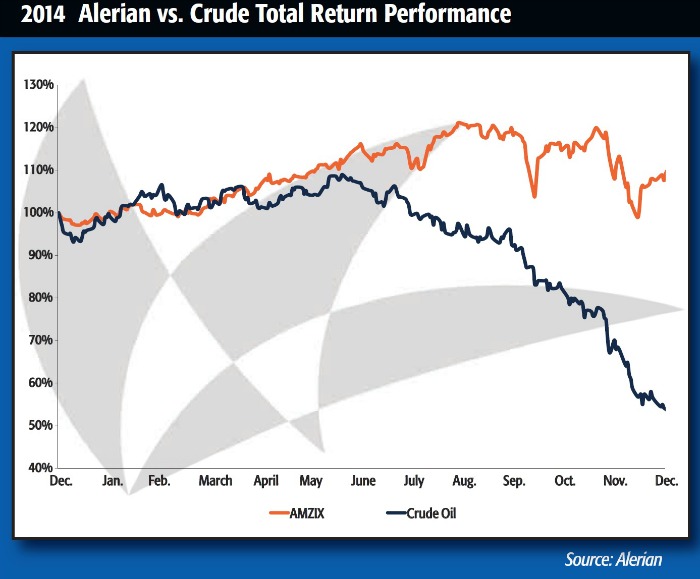

No one expected that crude prices would fall 50%in sixmonths. And because NGL and crude prices are correlated, the NGL complex of ethane, propane, butanes and pentanes took a dive as well. E&P MLPs, which profit directly from the price of commodities, have seen the largest impact, but midstream MLPs can be indirectly impacted when prices begin to affect volumes. Additionally, the profitability of processing and fractionation plants is generally dependent on natural gas being cheap relative to NGL.

Solution: If you choose to invest in supply-dependent energy businesses like gathering and processing, look for those companies with multiyear, fee-based contracts and/or minimum volume commitments. Those companies operating closer to demand centers will also have an advantage.

2. Rising Interest Rates

Investors stopped fearing the impact of rising rates on MLPs as the 10-Year Treasury yield fell below 2%. Some assume rates will rise in 2015 and that any effect is already priced in, while others believe a rise in rates is too far off to worry about right now. History has shown that an unexpected rise in interest rates usually has near-term adverse consequences for MLP unit prices, both because they are considered by some to be fixed-income substitutes and also because their growth is aided by cheap financing for acquisitions and organic growth projects.

Solution: MLPs with above-average distribution growth tend to do better in rising rate environments. MLPs with long-term, fixed-rate debt and/or the ability to finance a significant portion of their projects internally (via high distribution coverage ratios) are less likely to feel the consequences of more expensive credit. And in the event of a credit crunch, larger, investment grade MLPs will still have access to capital.

3. Black Swan

The events that have moved the MLP space the most have been unanticipated. Everyone talked about Peak Oil, right up until the day we talked about the Energy Renaissance. Midstream MLPs weren’t—and aren’t—strongly correlated to commodity prices over the long term, but that hasn’t stopped investors from panicking since June.

Other low-probability but potentially adverse developments could be: reduced capital markets access, dramatic fund flows away from energy infrastructure, heavy-handed environmental legislation or breakthroughs in renewable energy technology.

Solution: Your overall portfolio should be diversified, but so should your MLP/midstream energy portfolio. Remember that MLPs are still equity securities, and that long-term investors have generally been rewarded for riding out periods of volatility.

Investors care about 2015, but midstream MLPs are a long-term investment in the buildout of North American energy infrastructure. It is an investment measured in years, not months. Even if 2015 is the intermission, it’s not the end of the show.

Maria Halmo and Emily Hsieh, CPA, are directors for Alerian, an independent provider of MLP and energy infrastructure market intelligence. Over $20 billion is directly tied to the Alerian Index Series. For more information, please visit www.alerian.com/alerian-insights.

Recommended Reading

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.