Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

This story will appear in the upcoming Hydraulic Fracturing special report presented by:

The U.S. hydraulic fracturing sector has undergone significant change in the last year as companies alter their initiatives and business strategies in response to market tightness, rising costs and a push for cleaner oilfield solutions.

In the U.S. onshore region, operators are seeking innovative ways for improving customer value by boosting efficiencies or shifting away from diesel to reduce well costs. An uptick in demand for natural gas-capable fleets in 2022 has been a leading innovation, reshaping the landscape of frac fleets traditionally made up of Tier 2 diesel equipment.

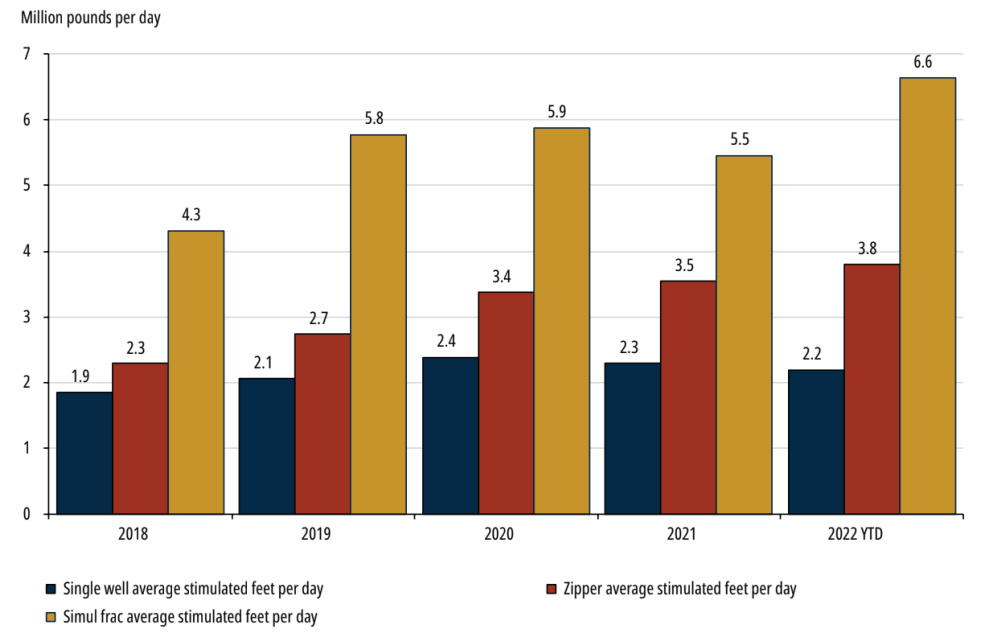

Alongside this, advancements in completion techniques, such as simul-fracturing or dual frac, continue to push completion efficiencies to new levels, achieving superior rates over traditional zipper fracturing operations. Leveraging Rystad Energy’s well level database and research, we have explored the U.S. hydraulic fracturing landscape to identify and compare historical techniques to current trends.

What’s next for fluid systems and proppant intensities?

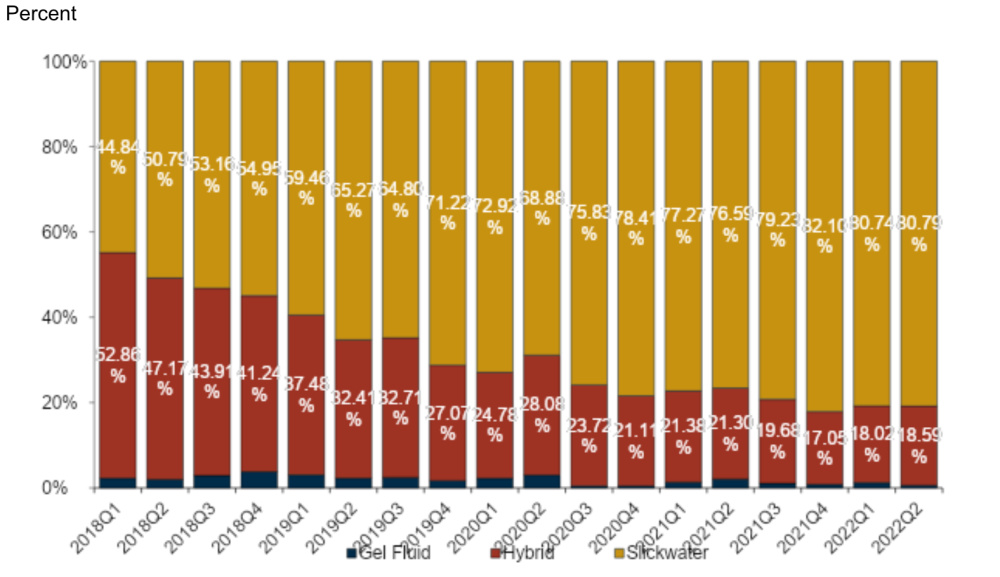

In terms of the material composition of frac jobs, hydraulic fracturing methods have remained systematically the same for years. The process involves injecting high-pressure proppant-laden fluid into a reservoir to increase surface area for hydrocarbon extraction. Fluid systems have trended in one direction in recent years with a strong shift between crosslink and hybrid fluid systems to pure slickwater. Ultimately, over 80% of well completions now use pure slickwater fluid systems (Figure 1).

Rystad Energy analysis shows that the use of hybrid fluid systems (slickwater systems with a tail end of gel or crosslink during higher proppant concentrations) has fallen by 6% in 2022 compared with 2020. With treatment rates in some cases well above 100 barrels per minute (bbl/m), the need for crosslink fluid systems for proppant transport is typically not required. Ultimately, it comes back to cost savings as a friction reducer is traditionally a lower-cost chemical additive compared to crosslink and guar gel.

So far in 2022, approximately 90% of completions in the Permian Basin, Bakken Shale and Appalachia have used slickwater fluid designs. Other basins, such as the Haynesville, Denver-Julesburg (D-J) and Midcontinent also heavily use pure slickwater designs but have also increased their use of hybrid designs.

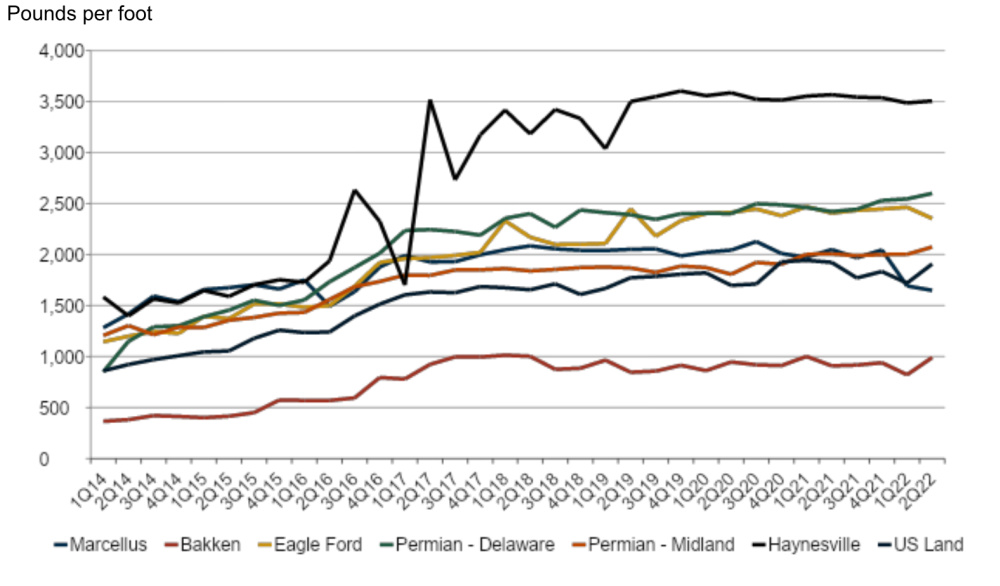

Proppant selection has also shifted predominantly to 100 mesh and, on a basin level, proppant intensities per well have stabilized (Figure 2). Since 2018, levels have only slightly increased compared to 2022 levels. However, the means of acquiring proppant continues to evolve. This year has been one typified by inflation and rising costs, particularly for diesel, which has led to an increase in last-mile trucking for proppant deliveries to frac locations. Because of this, mobile mini-mines have started to become popular within basins such as the Permian.

These mobile mines are estimated to have nameplate capacity of approximately 750,000 short tonnes compared to a traditional in-basin sand mine, which typically has nameplate capacities of 3 million to 4 million short tonnes. What makes these mobile mini-mines interesting is their wet sand application over traditionally dried processes. Wet sand currently has not shown any immediate impact on the overall performance of hydraulic fracturing operations and again, it comes back to cost. Using wet sand removes the drying process, which reduces the overall cost of proppant material.

New stimulation methods

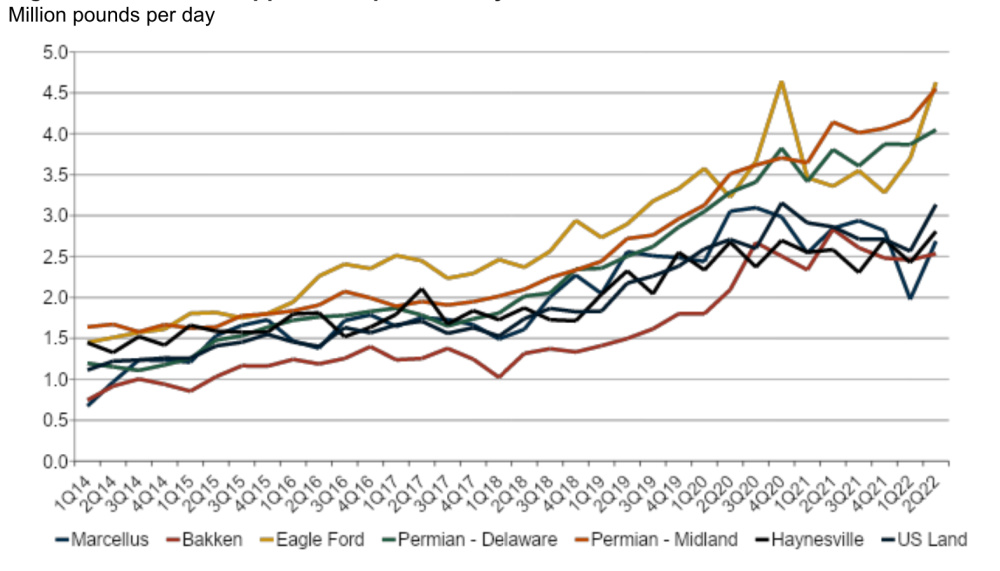

While fluid and proppant selections have slowly shifted, completion speeds continue to steadily increase, with an average 8% increase in proppant pumped per day for U.S. land in 2022 compared to 2021. Figure 3 breaks down by basin the amount of proppant pumped per day, which has continued to increase since 2018. The largest gains are in the Permian where proppant pumped per day has increased 11% so far in 2022 compared to 2021 and by 24% compared to 2020. This is partly due to the increased use of simul-frac or dual frac within the Permian Basin compared with others.

So far in 2022, Rystad Energy estimates that 84% of all simul-frac operations are in the Permian, with a smaller percentage in the Eagle Ford Shale and D-J Basin. Simul-fracturing involves using a single frac spread to stimulate two wells while dual frac is essentially a simul-fracturing operation but with two frac spreads. In 2022, approximately 9% of all horizontal wells completed with either technique, the largest adoption rate to date. Essentially by completing two wells at once, operators can decrease cycle times and realize first oil at a quicker rate. Figure 4 compares single-well, zipper frac and simul-frac operations to give an insight on the superior speeds that simul-fracs allow. Despite simul-fracturing not currently having a significant influence on other basins, completion speeds continue to increase as crews and equipment become more efficient.

Next-generation fleets impact

As ESG initiatives rise up the corporate agenda, the equipment landscape has begun to evolve as the race to a cleaner oil field solution in hydraulic fracturing continues. Cutting carbon emissions by displacing diesel as a primary fuel source continues to be used by many E&Ps. Pressure pumpers have responded in recent years by transitioning legacy diesel pumps to upgraded dual fuel (DF), dynamic gas blending (DGB) or electric solutions. DF or DGB pumps both use natural gas to offer partial diesel displacements of between 50% and 85%.

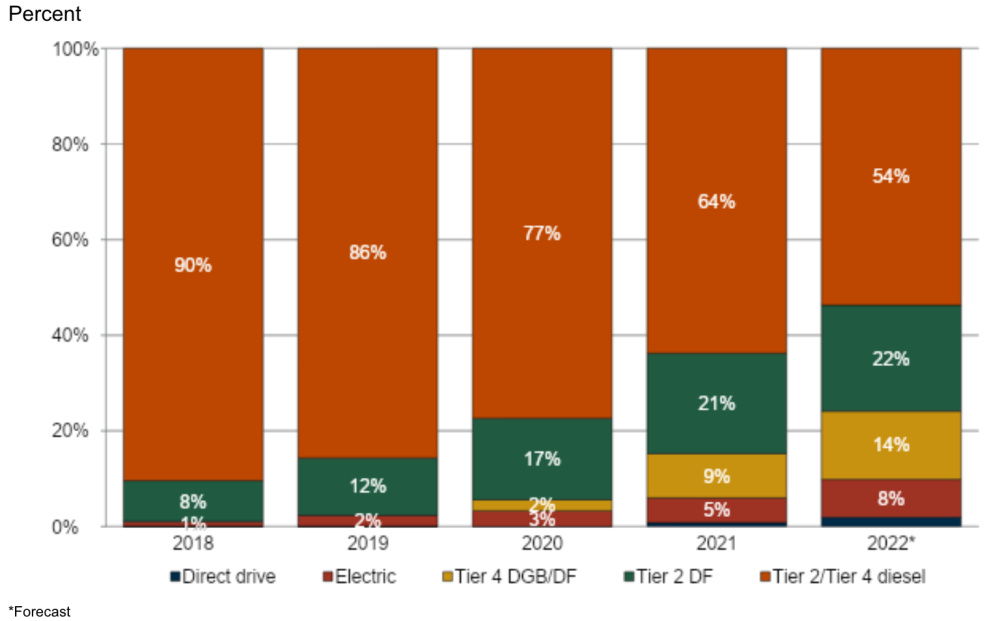

This transition to natural gas-capable fleets continues to be prioritized as diesel prices top $5 to $7 a gallon, pushing out well costs by $500,000 in some cases. Rystad Energy estimates that DF or DGB currently make up 30% of total inventory, representing a 12% growth since 2020. By end-2022, this is expected to grow to 36% as shown in Figure 5. These fleet types continue to be in high demand and remain sold out for the year to date. The bulk of these fleets reside in the Permian, Appalachia and Eagle Ford, but as more operators focus on cost-saving measures, this trend is expected to continue to grow.

Like DF and DGB, demand for electric frac (e-frac) is also soaring due in part to their 100% substitution rate. While e-frac has existed since 2016, the push toward a greener oilfield solution did not properly start until 2020, which caused a domino effect leading to nearly every major pressure pumper having or building an electric offering. These fleets typically leverage a large 35 megawatts (MW) turbine or multiple natural gas-reciprocal engines as a power source, allowing the operator to save by completely switching off diesel.

Despite the high demand, Rystad Energy estimates that e-frac currently holds a 5% share of the total fleet inventory, with expectation that it will rise to 8% by end-2022. Both e-frac and DF/DGB fleets can use field gas, which provides additional benefits for E&Ps. With the use of gas processing skid systems, operators can transfer well gas directly to fuel their operations, cutting fuel costs by an estimated 70% to 80%.

The driver for these changes is a focus on cutting the costs of services and wells. This has been the name of the game in recent years as many E&Ps look to boost cash flows without increasing in scale.

While the industry has been traditionally slow to change, this year and last have shown how dynamically and rapidly the hydraulic fracturing sector can respond to client initiatives by transforming completion speeds using new techniques, a trend which will ultimately change the landscape of hydraulic fracturing equipment.

Recommended Reading

For Sale, Again: Oily Northern Midland’s HighPeak Energy

2024-03-08 - The E&P is looking to hitch a ride on heated, renewed Permian Basin M&A.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Gibson, SOGDC to Develop Oil, Gas Facilities at Industrial Park in Malaysia

2024-02-14 - Sabah Oil & Gas Development Corp. says its collaboration with Gibson Shipbrokers will unlock energy availability for domestic and international markets.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.