For all businesses, there are clear and tangible advantages to consider climate change-related risks in their strategies including improving reputation in an increasingly skeptical society. (Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Rapid electrification of energy and growth in renewables will significantly reduce CO₂ emissions in the coming decades, but fossil fuels will still be needed to supply half of the world’s energy in 2050, according to DNV GL’s 2020 Energy Transition Outlook.

The technical adviser to the global oil and gas industry forecasts that the energy transition will not deliver on the COP21 Paris Agreement, predicting that the 1.5 C carbon budget will be exhausted in 2028 and the 2 C budget in 2051. Extrapolating the emission trends, the outlook points to a 2.3 C warming of the planet by 2100, compared with the pre-industrial level.

Our economies and societies globally have already been impacted by climate change, with extensive damage to infrastructure and loss of human lives. Without any action, there is the threat of irreversible breakdown of natural eco-systems and ensuing losses for investors.

Check out DNV GL – Oil & Gas CEO Liv Hovem’s recent discussion of the DNV GL 2020 Energy Transition Outlook with Hart Energy and what it means for U.S. shale.

Climate change and the ongoing transition to a lower carbon economy has sparked a fundamental re-shaping of finance. With significant capital reallocation, stakeholders are increasingly demanding transparency on ESG issues as part of the delivery of a ‘greener’ portfolio. We have recently seen a substantial rise in calls from major investors for boards and shareholders to address climate change and other ESG issues.

The financial community, therefore, needs to be able to develop a robust portfolio profile that incorporates an understanding of the potential energy transition risks as well as the physical risks during this transition.

Deciphering the decarbonization challenge

With regards to identifying energy transition risks, there should be a focus on policy measures, technology uptake and social changes that will disrupt existing businesses and their underlying models and revenue streams and provide opportunities for more rapid transition.

The physical risks, such as the impact of increasing temperatures and severe storms on physical infrastructure, productivity levels and global supply chains, also needs to be considered. Like the terrifying wildfires across Australia and unrelenting flooding in China this summer, we are already starting to see the structural and economic impact of climate turmoil.

With decades of experience of managing risk, as well as research and innovation work, DNV GL is well placed to present the risks and opportunities from the investment case, bolstered with a deep understanding of the engineering challenge.

In order to facilitate the transition to a cleaner, lower carbon future, we have developed a Climate Risk Management Framework (CRMF) which combines data and insight from various sources, including the annual Energy Transition Outlook, the Technology Outlook report, the Climate Geo-Enhanced Assessment of Risks (C-GEAR) tool and traditional risk management services.

The framework can be used by companies and investors to assess their exposure to climate change and to provide confidence to stakeholders that climate risks are reflected in their business and investment strategies.

To assess whether an organization is ‘future fit,’ the climate risk management process is highly flexible. Clients can access the complete suite of activities or choose modular outputs. Whether it is to inform investment strategies, to define climate-related risks to existing physical assets or potential targets, this strategy will assess the vulnerability of fixed-income or equity portfolios to climate risks or to set concise and workable targets.

The Task Force on Climate-related Financial Disclosures (TCFD) was established in 2015. In its 2019 report, it concluded that progress on climate-related disclosures was disappointing and as a result, is pushing for increased availability and quality of such disclosures. In order to maintain this social licence to operate, the DNV GL CRM framework allows companies and investors to demonstrate, through independent assessment, their compliance with the goals of ESG and TCFD.

Future fit

To help companies understand the changes that they would need to make to meet a 1.5 C or 2 C future, we use our trusted data and insight to define future scenarios which are compatible with their business. These models are used alongside the C-GEAR physical climate modelling tool, in order to examine the company’s portfolio of assets. A combination of downscaled climatic data spanning from 2015 to 2099, and additional catalogues containing several types of environmental variables, parameters and damage functions is also utilized. It would typically take a three to four-month period to run this process for a client.

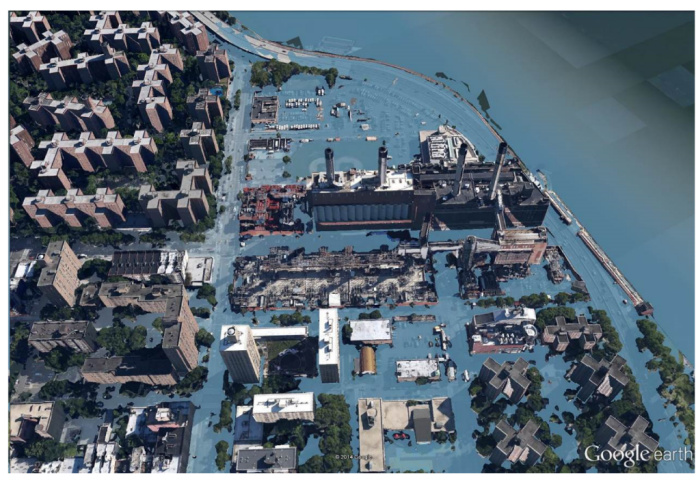

For example, the methodology can present an asset such as a power plant and the impact of a range of climate scenarios to show both short and long-term potential for change. This could include demonstrating the impact of flooding, for instance, how far the river would overflow the banks and the damage that is likely to have occurred in this period, as demonstrated in Figure 1. The model has been calibrated against a series of events and superstorms in the past, to be able to accurately demonstrate these potential scenarios.

Managing risks and identifying opportunities

The business case for integrating the energy transition with physical and environmental risk in investment decisions is strong, as it ensures an orderly, carefully thought through approach to realize the benefits of a low-carbon economy. It allows companies and investors to mitigate their exposure to climate-related risks and seize opportunities to invest in solutions, enhance their competitive advantage and assure long-term profitability.

In such a dynamic environment, these investment decisions will need to be reviewed regularly. The key to this process is continual improvement, leading to enhanced performance in terms of carbon intensity, economic efficiency, and business resilience. Feedback is critical to ensure that policy and strategy decisions remain valid and effective. The success of the CRM framework is therefore vitally dependent on the support from all parts of the organization and in particular, from the board.

With substantially more uncertainty in the investment community now than in previous years, there is also increasing precariousness on which direction to take with regards to investments.

We focus on helping companies to not only manage those risks but also to identify the opportunities that come from these transitions. This is a unique and pertinent approach, based on our data-rich scientific and mathematical models to align client specific input via DNV GL-facilitated workshops.

Developing climate-related goals with clear milestones and science-based targets that promote and accelerate the transition to a low-carbon economy will sustain the long-term value of companies and asset portfolios, and with 12 months to go until the milestone COP26 climate conference in Glasgow, time is of the essence.

For all businesses, there are clear and tangible advantages to consider climate change related risks in their strategies. Such considerations can ensure efficient use of resources, build adaptive capacity and resilience, open new markets and enhance reputation in an increasingly skeptical society.

Download a complimentary copy of DNV GL’s Energy Transition Outlook 2020 report here.

About the Author:

Graham Bennett is currently the head of the energy transition team at DNV GL for the U.K. and West Africa region. He has worked for DNV GL for the last 26 years.

A qualified mechanical engineer, Bennett left an industry environment 30 years ago to work in consultancy, where he has been developing and applying risk management techniques for clients mainly in the oil and gas sector. He is the author of a number of papers and training courses relating to risk management and the energy transition.

Currently, Bennett leads the DNV GL U.K. activities in hydrogen and CCUS, working with U.K. gas networks, industrial clusters, financial institutions and policy makers in examining the alternatives for deep decarbonization. In 2020, he was elected as a Fellow of the Energy Institute in recognition of his work in the energy transition area.

Recommended Reading

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.