Bruin E&P Partners LLC emerged from bankruptcy following a comprehensive balance sheet restructuring that equalized a substantial majority of Bruin’s funded debt, according to a recent company release.

The Houston-based E&P company focused in the Williston Basin’s Bakken Shale play filed for Chapter 11 bankruptcy on July 17.

In an Aug. 31 company release, Bruin said it emerged from bankruptcy with $230 million in revolver capacity. The company also emerged from Chapter 11 with a newly constituted board of directors comprised of Kevin Asarnow, Mark Bisso, Richard J. Doleshek and Mike Wichterich as well as Bruin CEO Matt Steele.

Steele described Bruin’s Chapter 11 proceeding in a statement on Aug. 31 as “extremely efficient and uncontentious,” which he attributed to the support of the company’s stakeholders.

“We would like to thank each of our advisers for their guidance and tireless work and we look forward to continue to operate in the Williston Basin through our premier acreage position and operational excellence,” he added in the statement.

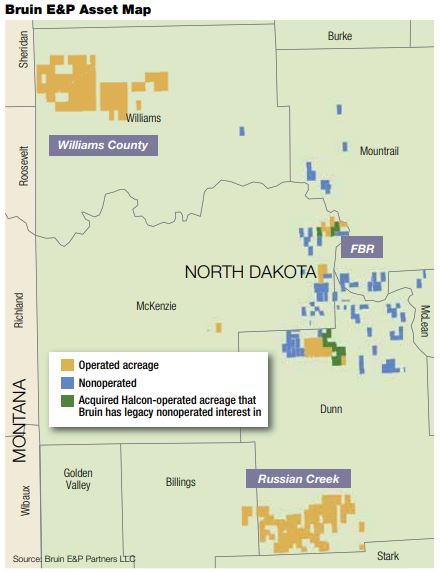

Bruin E&P Partners formed in 2015 with backing from Boston-based, private-equity-firm ArcLight Capital Partners LLC. Following two smallish acquisitions in 2016, Bruin bolstered its Bakken position in 2017 with a deal for Halcón Resources’ (now known as Battalion Oil Corp.) Williston Basin assets located in the heart of the play. The $1.4 billion cash transaction was backed by Arclight.

In a 2018 interview, Steele told Hart Energy’s Oil and Gas Investor that Bruin’s position in the Williston Basin covered 160,000 net acres, all Bakken and Three Forks. The core of the position, 30,000 net acres, was located in North Dakota’s Mackenzie, Mountrail and Dunn counties on the Fort Berthold Indian Reservation. The company operated 400 gross wells and had two rigs running as of late 2018.

Kirkland & Ellis LLP served as legal counsel to Bruin for its restructuring. PJT Partners LLP was the company’s financial adviser and AlixPartners LLP was its restructuring adviser. Jackson Walker LLP served as local legal counsel.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.