(Source: Shutterstock.com)

A market flooded with cheap oil coupled with the demand-destroying coronavirus is forcing unprecedented headwinds on E&P companies and exposing those not protected by hedges on produced volumes. Hedging offers a degree of protection in volatile oil and gas markets, providing a source of reliable liquidity assisting operators, some of which are adrift in truly uncharted waters.

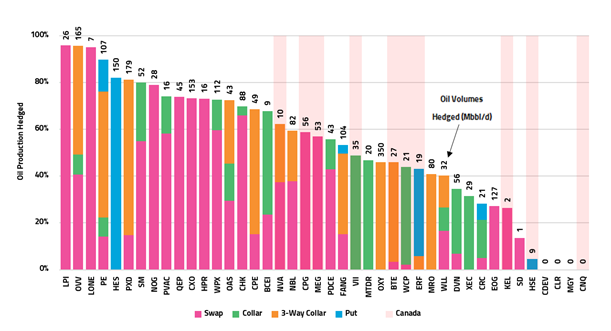

According to a joint report by the recently-united Enverus and RS Energy Group Intelligence teams, 2.5 million bbl/d of aggregate 2020 oil-hedge volume among publicly traded North American E&Ps is set at an effective hedge price above $50 WTI. Most oil-weighted E&Ps have hedged between 25% and 90% of anticipated oil production for the year. Enverus estimates the value of these financial-derivative assets (in conjunction with gas and NGL hedges) exceeds 10% of respective enterprise values for the majority of E&Ps.

“Most North American E&Ps have some sort of policy to hedge at least some of their volumes for a certain period, but each policy is unique,” explained Andrew McConn, an analyst with Enverus. “Some refrain from hedging altogether, opting for complete exposure to market prices. There is an argument for doing that. But most wish to mitigate at least some of their exposure to the main risk facing E&Ps—commodity prices. And those hedge programs are exactly for times like this—to insulate companies from big market shocks, which are always a possibility.”

For example, U.S. independent Devon Energy Corp. has hedged about 80% of its estimated 2020 crude production at an average floor price of nearly $45 WTI. Smaller, Permian-focused Laredo Petroleum Inc. currently has 100% of its estimated 2020 oil production hedged with 7.2 million barrels swapped at over $59 WTI and 2.4 million barrels swapped at about $63 Brent.

Apache Corp., which had no hedges in place for 2020, just in the past week added near-term oil hedges to protect 2020 cash flows from further price deterioration. Those deals were made at less favorable terms, mid-$20 WTI for fixed swaps through September on over 110,000 bbl/d in addition to three-way collars over the balance of the year covering over 40,000 bbl/d. A similar hedging strategy for Brent crude was also consummated, covering lower volumes.

“If you hedged two months ago you’re in a much better position than two weeks ago,” McConn said. “I think it is fair to say that the vast majority of companies are going to be very reluctant to hedge at today’s strip. But even with the strip reflecting $30 oil for the rest of the year, there is still downside risk. It can go lower.”

However, the Enverus/RS report also reveals hedged oil volumes decline by 85% after 2020. If oil prices fail to recover by year-end, 2021 could prove even more challenging for E&Ps than 2020.

“The oil market really needs to find the path to recovery by the end of the year because the whole sector is just more exposed to market prices going into next year,” said McConn. “There are a lot of E&P businesses that fundamentally do not work at $30, so most companies will be very reluctant to hedge at such prices.”

Recommended Reading

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Scotland Ditches 2030 Climate Target to Cut Emissions by 75%

2024-04-18 - Scotland was constrained by cuts to the capital funding it receives from the British government and an overall weakening of climate ambition by British Prime Minister Rishi Sunak, said Mairi McAllan, the net zero secretary for Scotland's devolved government.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

2024-04-18 - Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.